Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 5.

There are no changes recommended for any of our Portfolios.

It may just be that my toddler currently likes watching a “Five Little Ducks” video while brushing his teeth (conveniently, it’s two minutes long), but the stock market this year resembles a duck to me—calm on the surface, but lots of action under the water.

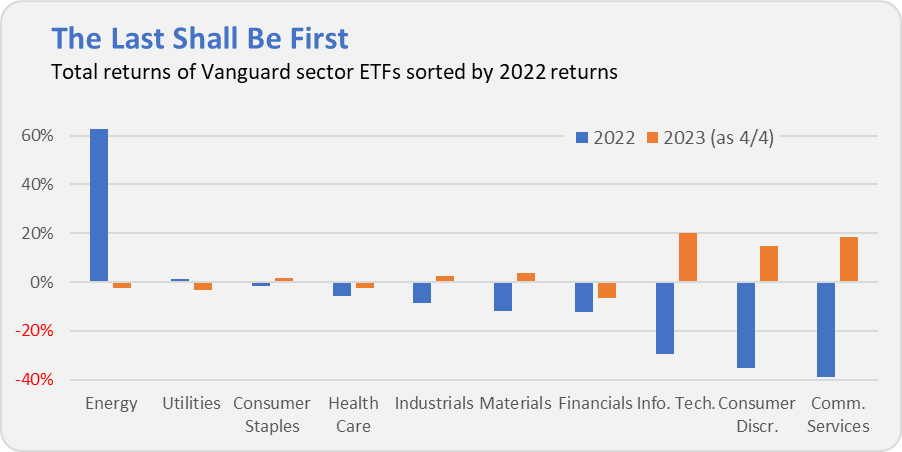

Total Stock Market Index (VTSAX) has gained a cool 6.7% for the year through Tuesday, despite bank failures and the Fed hiking interest rates on two occasions. But under the surface there has been a big rotation, as last year’s losers are this year’s winners and vice versa.

Information Technology ETF (VGT), Consumer Discretionary ETF (VCR) and Communication Services ETF (VOX) were Vanguard’s three worst-performing sector funds last year, notching declines between 30% and 40%. This year, those three sector ETFs are leading the way, with gains ranging from 15% to 20%.

Financials ETF (VFH) has been the worst performer this year, down 7%. Given what we know now, that’s no surprise, but I don’t recall any warnings of bank failures coming into the year. Putting banks aside, you can see in the chart below that the only two sector ETFs to notch positive returns last year, Energy ETF (VDE) and Utilities ETF (VPU), are down so far this year.

Will this trend continue? That’s the logical question, but unless you saw this reversal coming (and acted on it), what makes you think you can correctly time where the market winds will blow next?

I’ve yet to find any investor who can consistently time short-term market movements. Many try. A few get lucky … for a while. Almost all give up with smaller account balances than they started with.

Beware Point-in-Time Returns

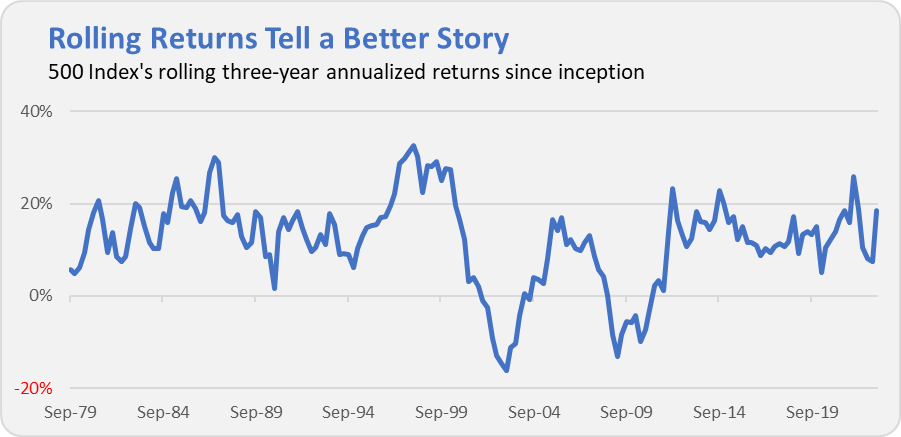

500 Index’s (VFINX) three-year (annualized) return jumped from 7.5% at the start of the year all the way to 18.4% at the end of March.

The index fund’s 7.5% return in the first quarter helped, but the biggest factor improving that three-year number is that the returns from the pandemic panic fell out of the calculation. 500 Index fell 8.2% in February 2020 and another 12.4% in March 2020. Remove those poor returns and start the clock at the market’s low point, and of course your returns are going to look a lot better.

Let’s put both those 7.5% and 18.4% annual return figures into context. The chart below shows 500 Index’s three-year annualized returns through time (using quarterly data). Over rolling three-year periods, the index fund has returned 12.0% per year on average since its 1976 inception.

That 7.5% pace at the start of the year was below average … but nowhere near as bad as the worst three-year runs in the market. And today’s 18.4% annual return is good … but not even close to the best we’ve seen.

Let this serve as reminder that point-in-time returns can be misleading. As I’ve said before, in investing, you can change the story simply by changing the start and end dates.

Our Portfolios

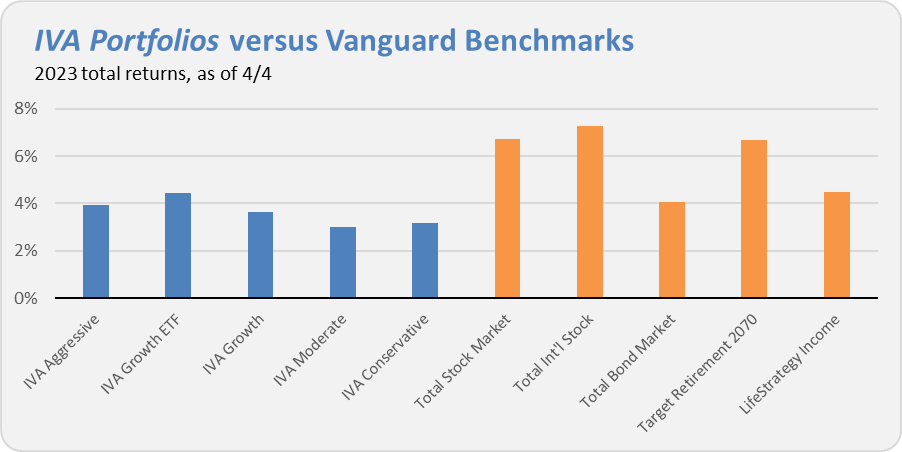

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.9%, the Growth ETF Portfolio is up 4.4%, the Growth Portfolio has returned 3.7%, the Moderate Portfolio is up 3.0% and finally the Conservative Portfolio has gained 3.2%.

This compares to a 6.7% gain for Total Stock Market Index (VTSAX), a 7.3% return for Total International Stock Index (VTIAX), and a 4.0% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.7% for the year, and its most conservative, LifeStrategy Income(VASIX), is up 4.5% for the year.

Of course, that’s just a few months of returns. If you want a little more perspective on the Portfolios, I recently posted our long-term performance (linking the models of our prior publication with the current Portfolios). You can find a downloadable PDF with the year-by-year returns here.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.