Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 22.

There are no changes recommended for any of our Portfolios.

What a difference a month makes.

Coming into November, investors were feeling blue on the heels of three consecutive down months that saw Total Stock Market Index (VTSAX) decline 9.1%. The broad index fund has earned nearly that much in November—up 8.3% as of Tuesday’s close.

Those gains have been driven by three sectors—Information Technology ETF (VGT), Consumer Discretionary ETF (VCR) and Communication Services ETF (VOX) —which are up between 9.0% and 12.3% in November. Those are the three best-performing sectors of the year, with gains ranging from 29.5% to 44.3%.

A word on caution: Those three high-flying sectors are highly concentrated in just a handful of stocks. Apple, Microsoft and NVIDIA comprise about 45% of Information Technology ETF’s portfolio. Amazon and Tesla account for nearly 40% of the consumer ETF. Facebook and Google soak up around 45% of Communication Services ETF’s assets.

While it seems that investors can’t go wrong picking those stocks, investors have felt that way about certain stocks in the past—think of tech stocks in the late 1990s or the Nifty Fifty stocks of the 1960s and 1970s. I’m not trying to be a downer—we can all be thankful for market gains as we head into the holiday season—I just want investors to keep perspective.

Bond investors have enjoyed a reprieve from falling prices in November as well. After falling for six straight months, Total Bond Market Index (VBTLX) has gained 3.7% in November—the index fund’s best month since last November.

Bye-Bye Amex

Well, that partnership didn’t last very long.

Less than two years ago, Vanguard and American Express announced the launch of INVEST for Amex by Vanguard. The pitch was that American Express cardholders could access Vanguard’s hybrid robo-advisor and earn additional credit card points.

Sounds good, right? The catch was that Vanguard’s portfolio management and advice cost 0.50% annually. You could go straight to Vanguard and get a similar (or better) service for 0.20% or 0.30%.

And no, the credit card points didn’t make up for the higher fee—unless you had a particular level of assets in the program.

When INVEST for Amex by Vanguard was introduced, I said:

The bottom line is that if you want to invest with Vanguard PAS, don’t introduce a third party to the equation. In this case, three really is a crowd.

While I haven’t seen the stats, I’ve got to think that most investors agreed with me. Given that the math didn’t work, I doubt many people signed up for Invest for Amex by Vanguard.

I can’t say I’m surprised that Vanguard and Amex pulled the plug on the program—I’ve been scratching my head over the partnership and program since the first announcement. I’m just impressed the executives were willing to cut their losses so quickly.

Our Portfolios

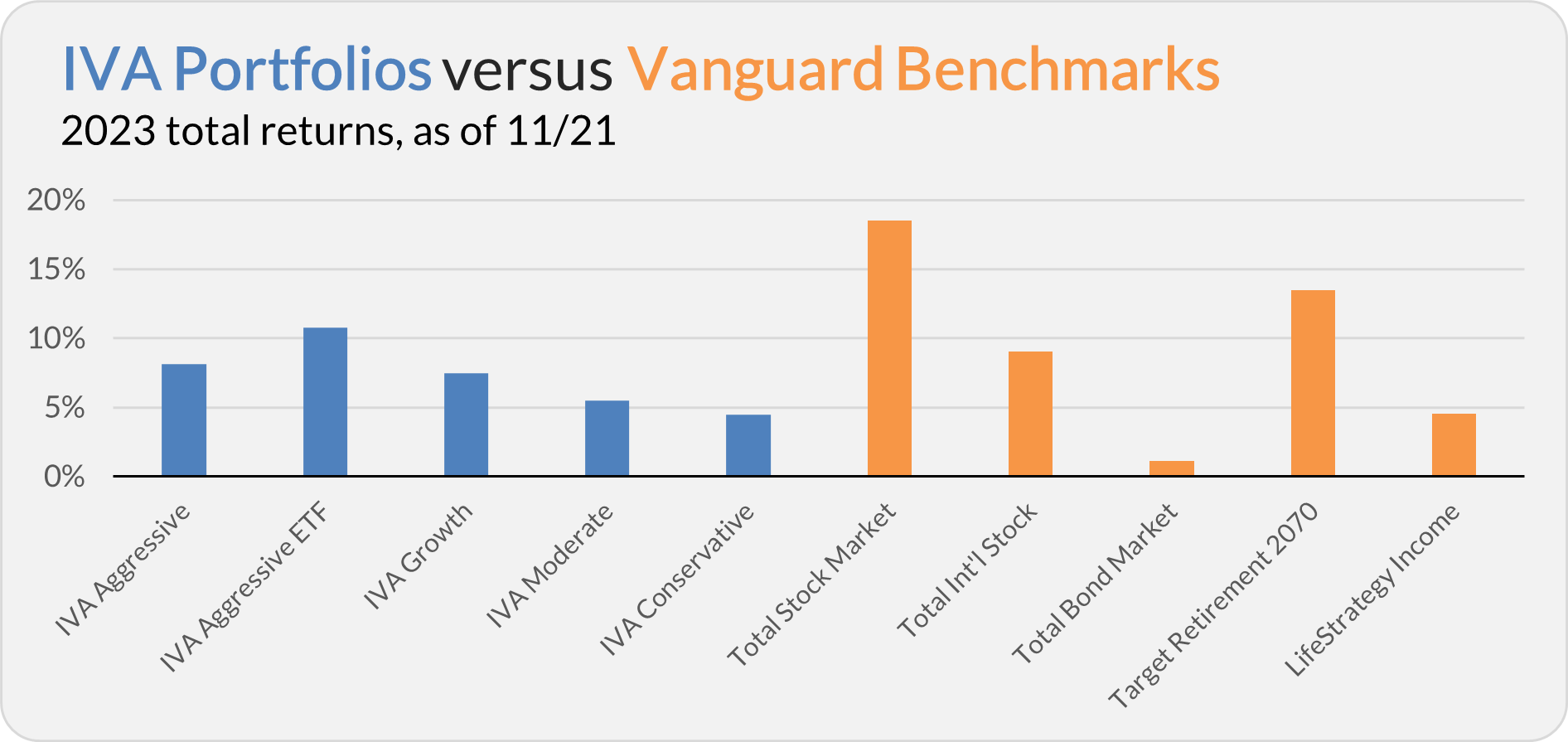

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 8.1%, the Aggressive ETF Portfolio is up 10.8%, the Growth Portfolio is up 7.5%, the Moderate Portfolio is up 5.5% and the Conservative Portfolio is up 4.5%.

This compares to an 18.5% gain for Total Stock Market Index (VTSAX), a 9.1% return for Total International Stock Index (VTIAX), and a 1.1% advance for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.5%.

IVA Research

Yesterday, in Solid Returns, Little Attention, I shared my analysis of Global Credit Bond’s (VGCIX) first five years with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future, and a very happy Thanksgiving.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.