Hello, and welcome to the IVA Weekly Brief for Wednesday, October 22.

🚨🚨Last week, I recommended trades in four of the five IVA Portfolios. You can review the trades and my reasoning behind them here. 🚨🚨

Markets have been nothing if not resilient this month. An extended government shutdown? No problem. Flaring trade tensions between the U.S. and China? Just a one-day hiccup. An Amazon Web Services outage? Business as usual.

And the gains have been widespread.

Stocks in the U.S. and abroad are in the black with Total Stock Market Index (VTSAX) up 0.8% and Total International Stock Index (VTIAX) up 1.0%. Bonds are positive too—Total Bond Market Index (VBTLX) has gained 1.3%. Even the alternative corners of the market are up: Real Estate Index (VGSLX) is up 0.4% and Commodity Strategy (VCMDX) is up 1.6%, respectively. Gold, despite tumbling more than 5% yesterday, still sits 6% higher for October.

Right now, investing feels easy. Buy the S&P 500 and call it a day. Or better yet, load up on the big tech stocks dominating the headlines—they’ve been the best performers, after all.

Don’t get lulled into that story. Investing doesn’t have to be complicated to be effective. But simple doesn’t mean easy.

Charlie Munger (Warren Buffett’s longtime business partner) put it bluntly: “It’s not supposed to be easy. Anyone who finds it easy is stupid.”

Diversification and discipline may not be exciting, but in the end, they’re what get rewarded.

ETFs Delayed

In August, Vanguard made a splash when it announced plans for its first actively managed stock ETFs—with real people, not algorithms, calling the shots. Well, not so fast! Vanguard’s going to take a little more time before diving in.

Originally scheduled to launch on November 3, a recent filing with the SEC pushes the start date to November 13.

Vanguard usually sticks to its timelines, and a short delay isn’t out of character. Just last month, the firm twice postponed the debut of High Yield Active ETF (VGHY) before finally launching it in September.

So, what should we make of this? It might be a sign that the Vanguard’s product development team is a little over its skis in launching funds. But I still fully expect all three actively managed stock ETFs to launch in November. Once Vanguard wades into the actively managed ETF waters, it’s only a matter of time before we see more of them floated.

Investor Choice Expanding

Starting in 2026, 500 Index (VFIAX), Extended Market Index (VEXAX) and Institutional Index (VINIX) will join Vanguard’s Investor Choice program.

The initiative, run in partnership with Broadridge Financial Solutions, lets mutual fund and ETF shareholders have a say in how their proxy votes are cast on the companies their funds hold.

Here’s a list of the funds that will participate in 2026. The bolded funds are the new additions:

- 500 Index (VFIAX or VOO)

- Dividend Appreciation Index (VDADX or VIG)

- ESG U.S. Stock ETF (ESGV)

- Extended Market Index (VEXAX or VXF)

- Growth Index (VIGAX or VUG)

- High Dividend Yield Index (VHYAX or VYM)

- Institutional Index (VINIX)

- LargeCap Index (VLCAX or VV)

- Mega Cap ETF (MGC)

- MidCap Index (VIMAX or VO)

- Russell 1000 ETF (VONE)

- S&P 500 Growth ETF (VOOG)

- Tax-Managed Capital Appreciation (VTCLX)

- Tax-Managed Small-Cap (VTMSX)

- Value Index (VVIAX or VTV)

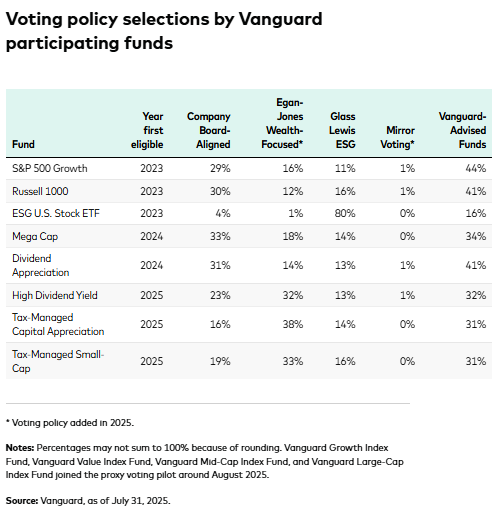

As a reminder, you aren’t voting each proxy yourself—you’re choosing from five preset “voting policies” that Vanguard will follow.

Here are those options in plain English:

- The Vanguard-Advised Funds Proxy Voting: Vanguard will vote the proxies for you as it always has.

- Company Board-Aligned: Vote with the company's board of directors. You’ll abstain if the board does not provide a recommendation on a specific issue.

- Glass Lewis ESG: Follow the recommendations of Glass Lewis—a third-party proxy advisor specializing in environmental, social and governance (ESG) issues. (Read more here.)

- Egan-Jones Wealth-Focused: Follow the recommendations of Egan-Jones—another third-party proxy advisor—which says it will vote to maximize shareholder value without being influenced by politics or social agendas. This choice will reject most (if not all) ESG-related proposals. (Read more here.)

- Mirror Voting: Your votes will be cast to match those made by other shareholders (specifically, those in the Broadridge network).

If you’re curious, the table below shows the selections made by participating shareholders in each fund in the first half of 2025.

According to Vanguard’s data, very few fund investors are opting for the “Mirror Voting” policy, which means you vote with your fellow shareholders. I wouldn’t be surprised if that choice quietly disappears over time.

If you’re comfortable with how Vanguard has been voting your shares—an approach that remained the most (or second-most) popular in every participating fund—you don’t really need to participate in the program.

I joined the Investor Choice program in 2024. As I wrote then, the process was simple and intuitive—one of the few areas where Vanguard nailed the user experience and technology.

Vanguard’s goal is to include all of its index funds in the program. Since each sub-adviser votes its own shares, I wouldn’t expect actively managed funds to join. But over time, the opportunity for index investors to have a louder voice should continue to grow.

Day Trade Your Way to Riches?

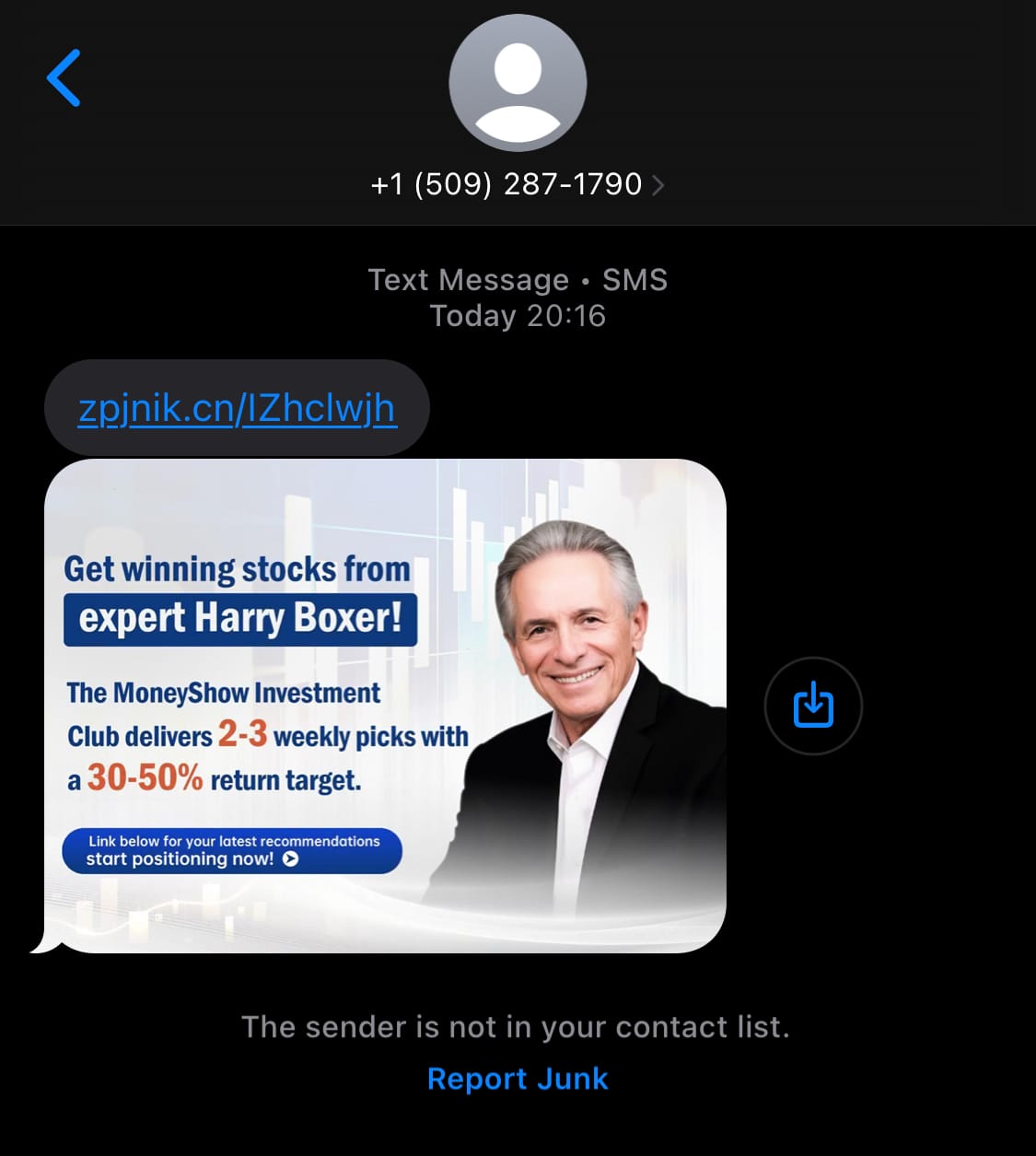

Last week, I got a text message inviting me to the MoneyShow Investment Club, which promised to deliver “2–3 weekly picks with a 30–50% return target.”

Below is a screenshot of the text. (No. I didn’t click the link in the text.)

I’m familiar with the MoneyShow—I’ve participated in their conferences over the years—but I’d never heard of this Investment Club or its leader, Harry Boxer.

A quick search tells me Boxer writes a newsletter focused on technical analysis for day and swing traders. That’s not the kind of investing I do, nor the kind I recommend for anyone who cares about compounding their money rather than losing it.

What really caught my eye, though, was the 30–50% return target. (And if you visit the club’s website, you’ll find claims of average returns between 40% and 70%.)

The text didn’t mention when those returns are supposed to arrive—30% this year? 50% this month? Still, the implication is that by following these “2–3 weekly picks,” you’ll somehow beat the market by a mile.

If that’s true, I should probably stop writing this newsletter and join the club myself. Better yet, Boxer should close down the printing press and start a hedge fund.

Because here’s the reality: Earning 20% a year—let alone 30%, 40%, 50% or 70%—would put you among the investing greats. We’re talking Warren Buffett-level performance.

So, whenever you see a pitch that promises legendary-level investment returns, remember the simple rule: If it sounds too good to be true, it almost always is.

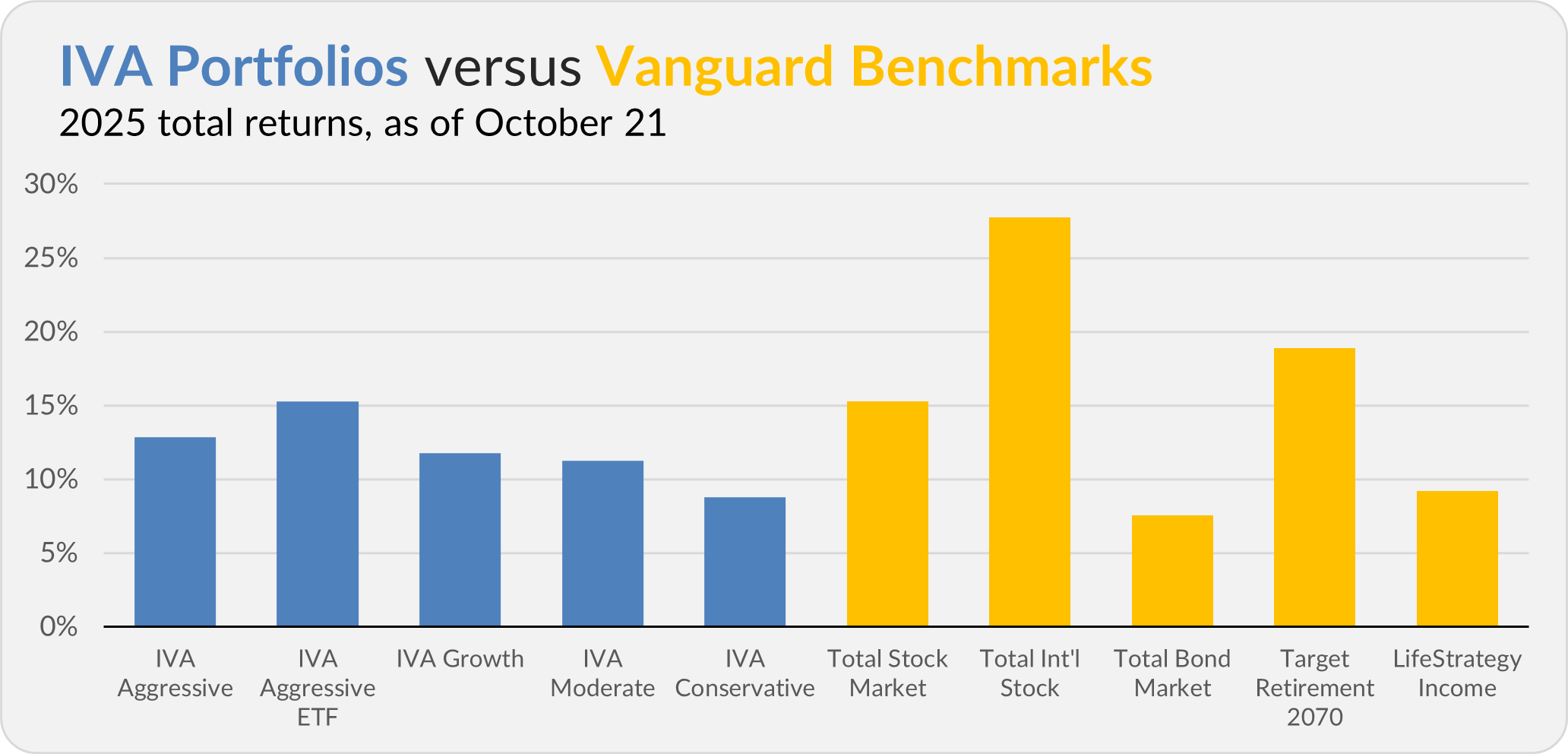

Our Portfolios

Our Portfolios are showing solid returns for the year through Tuesday. The Aggressive Portfolio is up 12.8%, the Aggressive ETF Portfolio is up 15.3%, the Growth Portfolio is up 11.8%, the Moderate Portfolio is up 11.3% and the Conservative Portfolio is up 8.8%.

This compares to a 15.3% gain for Total Stock Market Index (VTSAX), a 27.7% return for Total International Stock Index (VTIAX), and a 7.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 18.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 9.2%.

IVA Research

As I noted at the top, last week, I shared a Trade Alert with Premium Members. Yesterday, those members received an early look at how capital gains season is shaping up for Vanguard’s mutual funds and ETFs.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.