Note: Updated on 9/25/2025 to add context to the performance of Frontier's Small Cap Value strategy under Bill Teichner's leadership.

Hello, and welcome to the IVA Weekly Brief for Wednesday, July 2.

There are no changes recommended for any of our Portfolios.

What a difference a quarter makes.

Just three months ago—April 2, to be precise—President Trump unveiled his “reciprocal” tariff plan. The surprisingly steep tariffs sent traders scrambling and stock prices tumbling. In just five trading days, 500 Index (VFIAX) sank 11.5% before the President hit pause, giving trading partners and traders a 90-day reprieve.

Now, with that 90-day pause set to expire, what do we have? One trade agreement—well, more framework than a deal—and certainly not the “90 deals in 90 days” we were promised. Despite the uncertainty, 500 Index has completely erased its tariff-induced losses to reach new heights. Go figure!

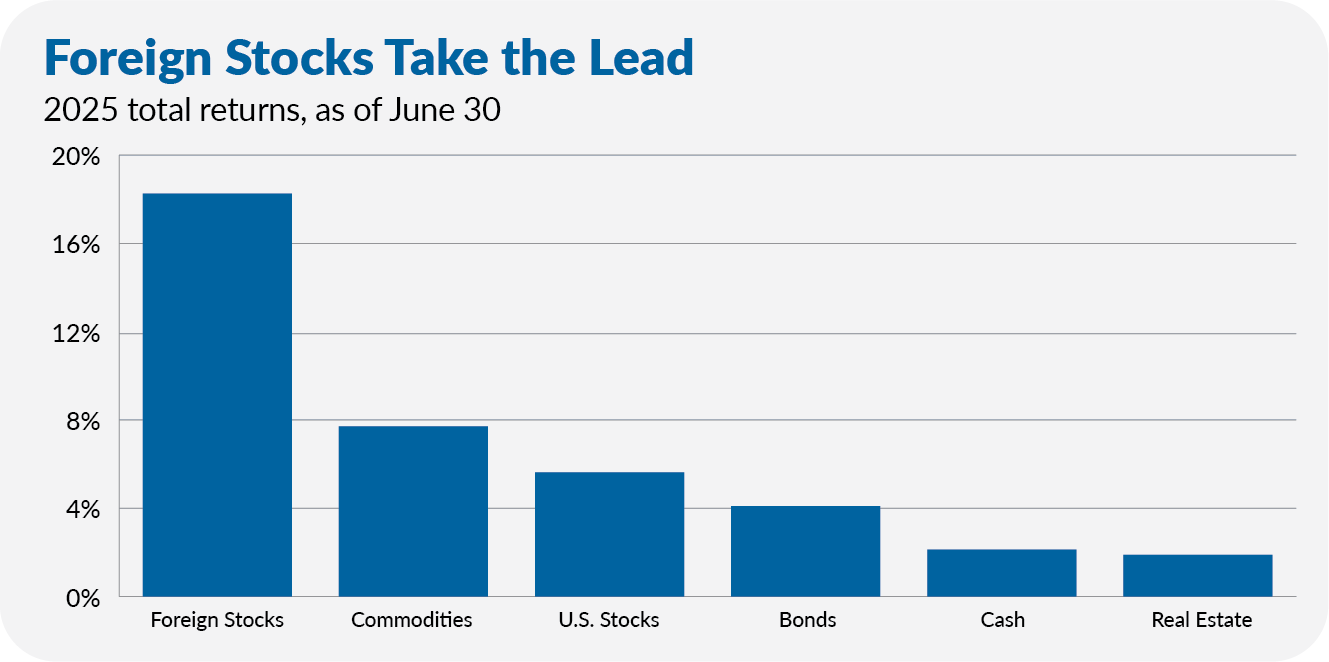

In contrast to the noise, headlines and hand-wringing, the first half of 2025 was broadly positive. All the major asset classes—stocks, bonds, cash, commodities and real estate—posted gains.

Foreign stocks led the way, with Total International Stock Index (VTIAX) up 18.3% from New Years through June. U.S. stocks trailed but still delivered a respectable 5.6% return, on pace to deliver a double-digit gain for the year.

Bonds and cash kept plugging along. Total Bond Market Index (VBTLX) gained 4.1%, nearly doubling Federal Money Market’s (VFMXX) 2.1% return.

Alternative assets were mixed. Commodity Strategy (VCMDX) gained 7.7% in the first six months, largely on the back of gold’s 27.7% rally. But Real Estate Index (VGSLX) lagged, gaining just 1.9%.

In short, it hasn’t been an easy year if you are a trader, but for long-term investors, it’s been a rewarding one.

Vanguard’s ETF Push Continues

On Tuesday, Vanguard filed with the SEC to launch High-Yield Active ETF (VGHY).

Frankly, what took them so long? A high-yield bond ETF has been a glaring hole in Vanguard’s lineup. I’ve been calling for this for years. The only surprise? It won’t be index-based. That’s right—Vanguard, the king of indexing, is going active with junk bonds.

The new ETF will sit alongside Vanguard’s long-running High-Yield Corporate (VWEHX). Both will be actively managed, but with a key difference: The new ETF will be run solely by Vanguard, while the mutual fund is a joint effort between Vanguard and Wellington.

Costs are another point of comparison. The ETF will charge 0.22%, matching the Investor shares of the mutual fund. Investors putting $50,000 or more into High-Yield Corporate qualify for the Admiral shares at just 0.12%—proving yet again that ETFs aren’t always the cheaper route.

The unknown: How aggressive will Vanguard be with this ETF? High-Yield Corporate has historically cut a conservative path, favoring the “highest rated” junk bonds. Will the new ETF adopt a similarly conservative approach or venture further down the quality spectrum?

We’ll find out when the ETF launches in September. Until then, it’s worth watching, not buying. And with the extra yield from high-yield bonds barely outpacing safer alternatives (see here), there’s no urgency to dive into the junk bond waters just yet.

But that’s not the end of the ETF news out of Vanguard.

Vanguard’s news bond ETFs—Total Treasury ETF (VTG), Total Inflation-Protected Securities ETF (VTP) and Government Securities Active ETF (VGVT)—should begin trading any day now, based on recent SEC filings.

For ETF-only investors, the inflation fund offers something new. Vanguard’s only other inflation-linked ETF, Short-Term Inflation-Protected Securities ETF (VTIP), sticks to short-maturity bonds. The new VTP will go broader, holding Treasury Inflation-Protected Securities (TIPS) of all maturities.

Given all of the government-related funds (and ETFs) already at our disposal, there’s no need to rush into Total Treasury ETF or the active government fund.

Teichner Retires

As I shared last month, Bill Teichner of Frontier Capital, who oversaw a portion of Explorer Value (VEVFX), retired at the end of June, as scheduled.

Now we know who’s stepping in: Emmanuel Franjul has joined Rushan Jiang as co-manager on Frontier’s sleeve of the fund.

Unfortunately, neither manager has any personal investment in the fund. That’s not a great look—and certainly not a strong vote of confidence in the strategy they’re helping to steer.

Given Explorer Value has slightly trailed SmallCap Value Index (VMSAX), 322% to 345%, since its inception 15 years ago, it’s not a strategy I have much confidence in either.

To be fair, Frontier's Small Cap Value strategy has been a long-term winner. In fact, a press release celebrating its 25th anniversary (here) touted peer-topping, index-beating returns. Teichner and his colleagues deserve credit for that record.

But Explorer Value shareholders had a different experience. The fund's other sub-advisers dragged down results, leaving investors with an underwhelming version of what could have been a stronger story.

Barrickman Gets a Co-Pilot

Vanguard’s stock index team has made some noteworthy moves this year. First, they strengthened continuity by assigning co-managers to every fund. Second, they announced a significant reorganization, splitting into two groups. You can read everything you need to know about the split here.

But today, the spotlight shifts to Vanguard’s bond index team.

For years, Joshua Barrickman has been the public face of the bond indexing operation as the sole named portfolio manager on nearly all of Vanguard’s bond index funds. That changed last week when Jack Riley was named a co-manager alongside Barrickman on the corporate bond index funds and ETFs:

- Short-Term Corporate Bond Index

- Intermediate-Term Corporate Bond Index

- Long-Term Corporate Bond Index

- Total Corporate Bond ETF

- ESG U.S. Corporate Bond ETF

This is a positive step. Building in managerial redundancy is smart. It also improves continuity, mitigates key-person risk and better reflects the reality that no one runs these portfolios alone.

Don’t be surprised if more co-managers join Barrickman’s side in short order.

$3 Billion Each Year

Last week, I let Premium Members know that Vanguard’s Message Center was missing a rather key feature: a compose or send message button. In other words, you couldn’t message Vanguard from the Message Center. Oops.

A chat support representative told me an update would arrive in a few days. So far, no fix is in sight.

Now, I’m not above making mistakes—there was a typo in the phone number in my original note about the Message Center. (The correct phone number is (877) 662-7447, by the way.)

But rolling out a redesigned Message Center without the ability to, well, send a message? That feels like more than a simple typo.

To put it in perspective: According to Vanguard’s Chief Information Office, Nitin Tandon, the firm is spending over $3 billion a year on technology. (That’s just a touch more than The IVA’s tech budget.)

With that kind of money, I’m hoping this isn’t just covering salaries and overhead but signifies a true investment in Vanguard’s digital tools. Maybe Vanguard will finally start living up to its promise as a tech-forward company? For now they’re still in beta, and we’re still waiting.

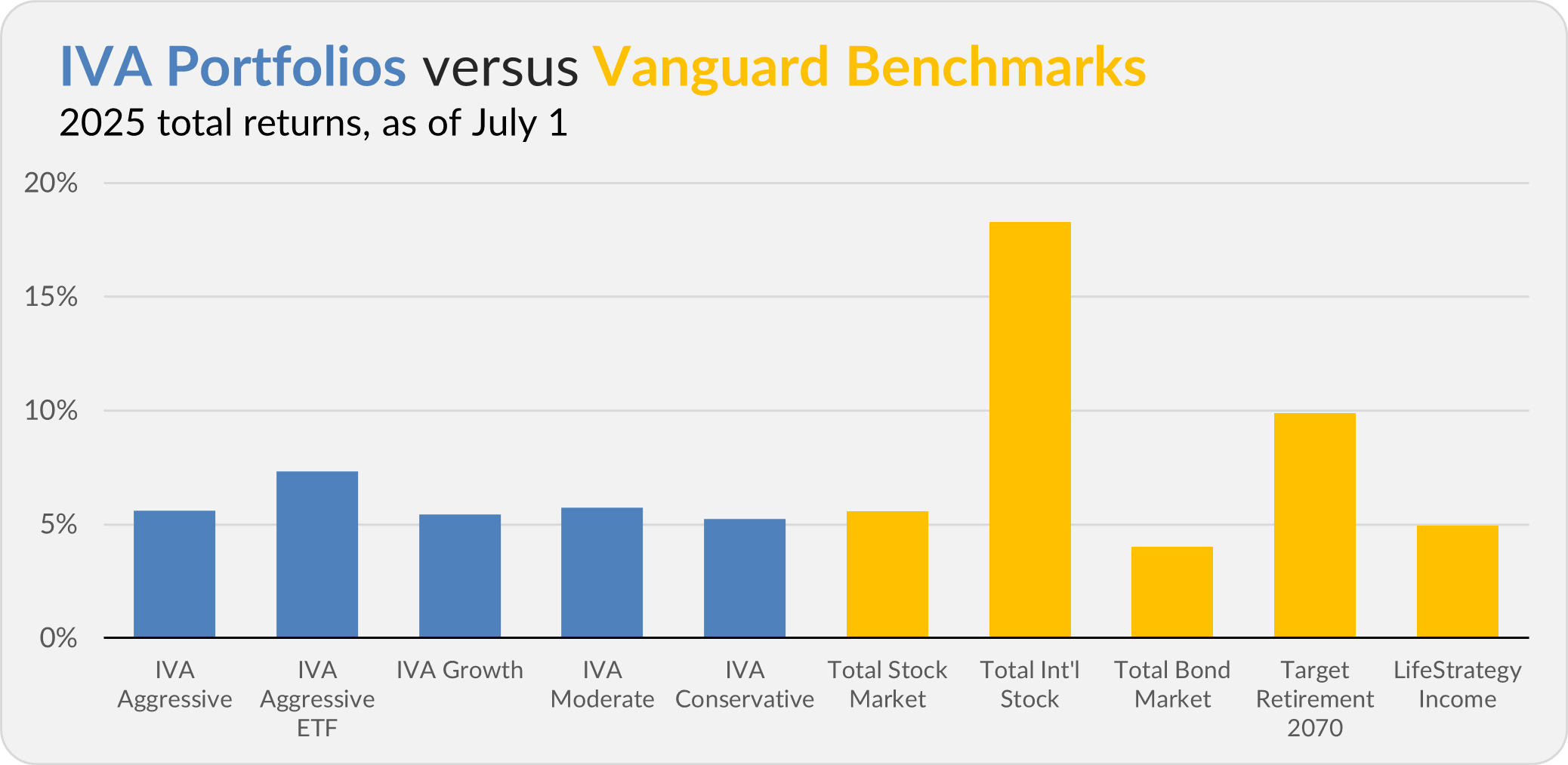

Our Portfolios

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.6%, the Aggressive ETF Portfolio is up 7.3%, the Growth Portfolio is up 5.4%, the Moderate Portfolio is up 5.7% and the Conservative Portfolio is up 5.2%.

This compares to a 5.6% gain for Total Stock Market Index (VTSAX), an 18.3% return for Total International Stock Index (VTIAX), and a 4.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.9%.

Premium Members can read a full rundown of how the Portfolios fared in the first half of the year here.

IVA Research

Yesterday, I shared two articles with Premium Members. In July’s monthly article for Premium Members, I analyzed the stock market’s rebound to new highs, examined the IVA Portfolios and more. And in Balanced, Not Bland, I analyzed all of Vanguard’s balanced funds—separating the best from the rest.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.