Hello, and welcome to the IVA Weekly Brief for Wednesday, May 14.

There are no changes recommended for any of our Portfolios.

Liberation?

Funny, but liberation is supposed to be the act of setting someone free. And yet, ever since Liberation Day, and on-again, off-again reciprocal tariffs, not a single small business (or large one) has been set free from the uncertainties and inconsistencies in the trade policies that have wracked the financial markets.

In the past week, the U.S. and U.K. announced a new trade framework that includes a 10% tariff on most U.K. imports, with exceptions for cars, steel and aluminum. More significantly, the U.S. and China took steps to ease trade tensions, mutually lowering tariffs and agreeing to a 90-day “ceasefire” in their ongoing trade war.

According to The Budget Lab at Yale, if current tariff policy holds, the U.S. will be charging an effective tariff rate of around 17%—down from a week ago, but still dramatically higher than last year’s sub-3% rate. The bottom line: Trading is more expensive than it was just a few months ago.

That is where we are today. Tomorrow could be different. And the on-again, off-again tariff talk has kept Wall Street traders busy.

Traders certainly were not feeling liberated by the initial reciprocal tariff announcement—500 Index (VFIAX) dropped 11.5% between April 1 (the day before President Trump’s announcement) and April 8 (the day before the tariffs briefly went into effect and were then paused). Recently, traders have welcomed progress toward resolving tariff uncertainty. Despite that initial decline, 500 Index (VFIAX) has gained 4.6% since April 1.

The market’s gains are surprising to me. We still face a substantial tariff increase, trade disruption and a murky outlook. Luckily, I didn’t try to trade around the highs and lows. For now, the market’s collective wisdom is that companies and the economy will weather this storm.

I don’t think we’re out of the woods just yet, though. With only one trade “deal” announced—really more of a framework than a complete agreement—there’s still a (very) long way to go on the tariff front, and the clock is ticking.

In the meantime, let’s turn our attention to Malvern, PA—Vanguard’s HQ—where I have a few Vanguard updates to share.

More ETFs

Three weeks ago, I told you that Vanguard had filed with the SEC to launch Total Inflation-Protected Securities ETF. At the time, I speculated that a total Treasury ETF would be next.

Well, apparently great minds think alike—and shame on me for missing the filing—but alongside the total TIPS ETF registration, Vanguard also submitted plans with the SEC to launch Total Treasury ETF. Joshua Barrickman will also manage this index fund.

That’s not all. Vanguard also has plans to bring Government Securities Active ETF to market in July. I expect this actively managed ETF will own a mix of Treasurys, TIPS and mortgage-backed bonds issued by the U.S. government and its agencies. This could be an interesting option if you’re looking for broad exposure to government bonds.

However, given all of the government-related funds (and ETFs) already at our disposal, there’s no need to rush in—wait and see what this portfolio looks like before investing.

Kilbride is Retiring

In another piece of news that flew under my radar, Wellington’s Don Kilbride is retiring at the end of the year. Kilbride managed Dividend Growth (VDIGX) from 2006 through the end of 2023, when he handed the reins to his protégé, Peter Fisher.

Neither Vanguard nor Wellington made an official statement about Kilbride’s retirement—at least, I couldn’t find a press release. No, the “announcement” was made in an update to Advice Select Dividend Growth’s (VADGX) prospectus—a fund only available to Vanguard’s advice channel clients. Fisher was named a co-manager on the Advice Select fund.

Dividend Growth’s shareholder had already digested the transition from Kilbride to Fisher. However, this new news means that Kilbride will no longer have a “seat at the table” as a member of the Dividend Growth team.

Six months ago (here), I discussed in detail why I was sticking with Dividend Growth. This news doesn’t change my opinion, but I’ll be sharpening my pencil and taking a fresh look at the fund and Fisher in the months ahead.

Alternative Investments?

The first public-private mash-up fund from the Vanguard-Wellington-Blackstone alliance is on the way.

The WVB All Markets fund will be an interval fund, essentially a mutual fund that you can only sell quarterly. Wellington will call the shots, investing in public stocks and bonds (via Vanguard funds) and private markets (through Blackstone funds) in an attempt to deliver “attractive risk-adjusted returns.”

If you’re curious, you can read the preliminary prospectus here—just be warned, it’s over 200 pages, so clear your schedule. Alternatively, I shared my initial take on WVB All Markets with Premium Members here.

Vanguard Gets Sued … Again

Another lawsuit has been filed against Vanguard. This one (included below) alleges that Vanguard allowed third parties—like LinkedIn, Google and Meta (think Facebook)—to intercept a boatload of your and my personal information without our knowledge or consent. Those companies then used that information to enhance their profiles of us to provide “targeted” advertisements.

Vanguard discusses this to an extent in the “Interest-Based Advertising” section of its Privacy Notice. Whether that’s enough disclosure to cover the extent of data being collected alleged in the suit, well, I’m not a lawyer or expert on these matters.

The plaintiffs seek class-action status and aggregate compensation of at least $5 million. They are represented by Atlee Hall (personal injury lawyers) and Bursor & Fisher (data privacy specialists).

I’ll keep you updated as this progresses.

Our Portfolios

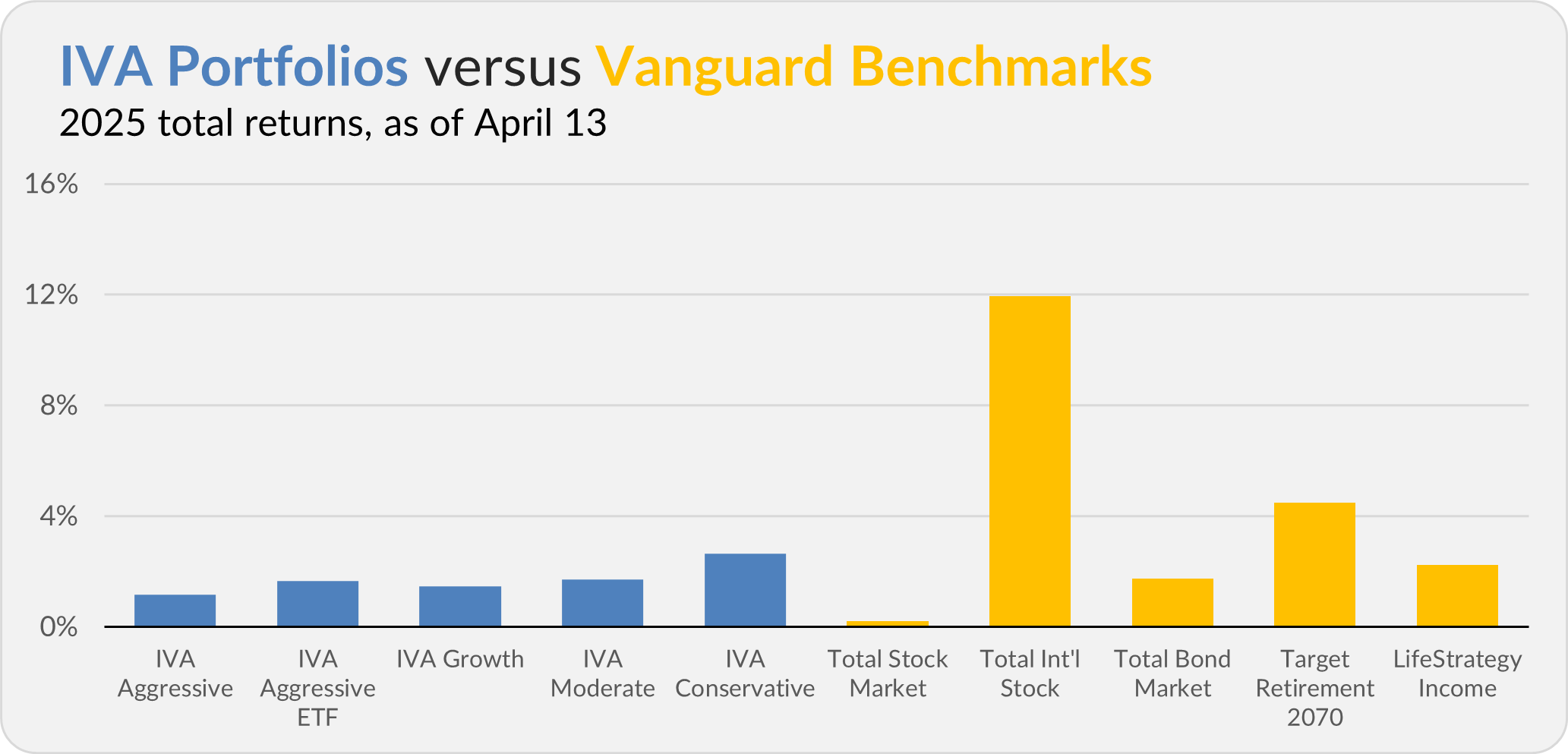

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 1.2%, the Aggressive ETF Portfolio is up 1.7%, the Growth Portfolio is up 1.5%, the Moderate Portfolio is up 1.7% and the Conservative Portfolio is up 2.6%.

This compares to a 0.2% gain for Total Stock Market Index (VTSAX), an 11.9% return for Total International Stock Index (VTIAX), and a 1.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 4.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.2%.

IVA Research

Yesterday, I continued my exploration of after-tax returns by digging deep into the results of the IVA Portfolio holdings. Premium Members can read my analysis here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.