Hello, and welcome to the IVA Weekly Brief for Wednesday, July 16.

There are no changes recommended for any of our Portfolios.

Tech stocks to the rescue? You’d be forgiven for thinking so after Tuesday’s market action.

Stocks broadly sold off on news that inflation (measured by the Consumer Price Index, or CPI) rose 0.3% in June. That puts year-over-year inflation at 2.7%, up from 2.4% just one month ago. Yes, after months of dire predictions, it appears that tariffs may indeed be starting to push prices up, making it harder for Federal Reserve (Fed) policymakers to rationalize lowering interest rates.

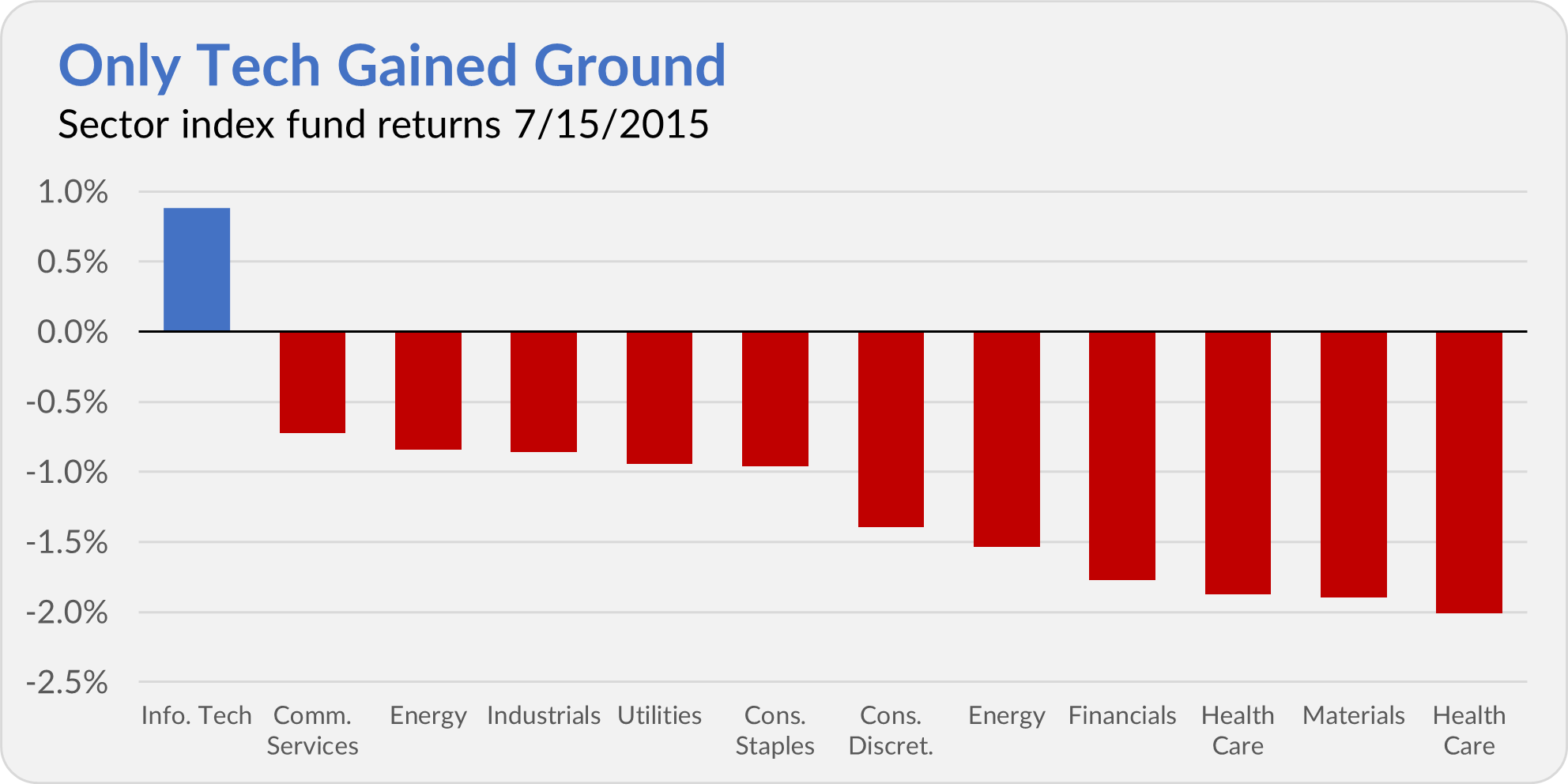

500 Index (VFIAX) slipped 0.4% yesterday, and every Vanguard sector index fund closed in the red … except one: Information Technology Index (VITAX & VGT), which bucked the trend and gained 0.9%.

So, are tech stocks immune to inflation and tariffs? Not quite. Semiconductor stocks—like NVIDIA, Broadcom and AMD—led Tuesday’s gains. They rallied after NVIDIA received approval to sell advanced artificial-intelligence chips to China.

One day doesn’t make a trend, but tech stocks have been the place to be for years.

Over the past 15 years, Information Technology Index has compounded at a remarkable 20.1% annual pace. That’s more than five percentage points ahead of 500 Index’s 14.8% rate, and nearly double SmallCap Index’s (VSMAX) 11.7% pace.

Let’s make that real. If you had invested $10,000 in each of those three funds 15 years ago, here’s what you’d be looking at today:

- Information Technology Index: $156,202

- 500 Index: $79,539

- SmallCap Stocks: $54,417

Tempted to chase those returns? I don’t blame you. But before you hit “Buy”, check out my full sector breakdown here.

PRIMECAP … Downgraded?

A few IVA readers asked me about Morningstar’s recent decision to downgrade PRIMECAP (VPMCX) from “Gold” to “Silver.”

First, I conduct my own research and analysis, rather than relying on Morningstar ratings. I’ll come to my own conclusions. Remember, Morningstar is in the business of changing its ratings. Heck, they’ve made more changes to their “Morningstar 500” list of the “best” mutual funds than Standard & Poor’s has made changes to the S&P 500.

Still, I get that Morningstar has a big megaphone, and they’ve taken PRIMECAP down a peg. Granted, we’re still talking about a “Silver” medalist (in Morningstar’s eyes), and the analyst's note touts PRIMECAP Management’s experienced leadership, deep research, long-term record and low costs.

So, why the downgrade?

Morningstar is apparently concerned that the managers have been holding on to losers for too long and, as a result, have missed out on some big winners, noting that the fund’s picks “have underwhelmed for the past five years.”

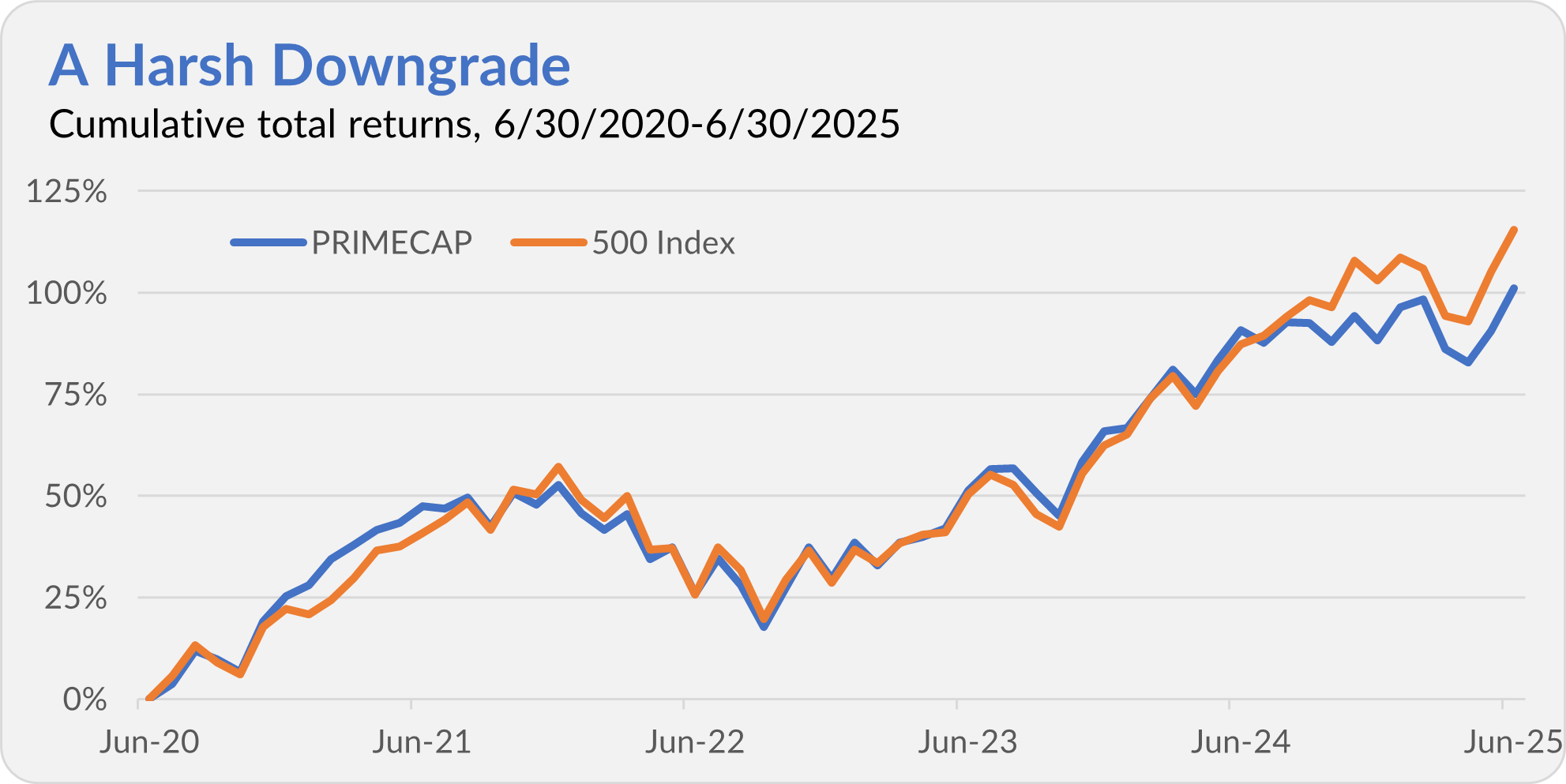

Let’s look at the numbers: PRIMECAP’s 101% return over the last five years falls short of 500 Index’s (VFIAX) 115% gain. But the gap—just 14 percentage points—isn’t dramatic. And as the chart below shows, all of the index fund’s edge has come in the past 12 months.

Interestingly, Morningstar also reportedly downgraded a few other PRIMECAP Management-run funds but maintained a Gold rating on PRIMECAP Odyssey Aggressive Growth (POAGX), the weakest performer of the group. Go figure.

If you’re a Premium Member, you can revisit my deep dive on PRIMECAP and its siblings here. I’ll have more to say in time, but the bottom line today is simple: I still have my own money invested in Odyssey Aggressive Growth, and I’m keeping the PRIMECAP-run funds in the IVA Portfolios.

Vanguard Sued … Again.

As I told Premium Members in Monday’s Quick Take, Vanguard can’t seem to stay out of the courtroom.

The latest legal dust-up stems from its 2021 acquisition of Just Invest, a direct indexing firm whose technology Vanguard apparently wanted to apply to its own offerings. Just Invest's founders now allege Vanguard acted in bad faith—both before and after the deal—to shrink the payout they were owed.

I’m no lawyer, so I’ll let the courts sort through the finger-pointing.

But here’s the bottom line: This lawsuit doesn’t affect the average Vanguard investor. It does, however, ding Vanguard’s reputation—and throws a wet blanket on any other firm that might be considering a sale to Vanguard.

That said, Vanguard will be fine. It didn’t become Vanguard over the past 50 years by buying other companies—acquisitions have never been its calling card.

Cost Basis … My Pick

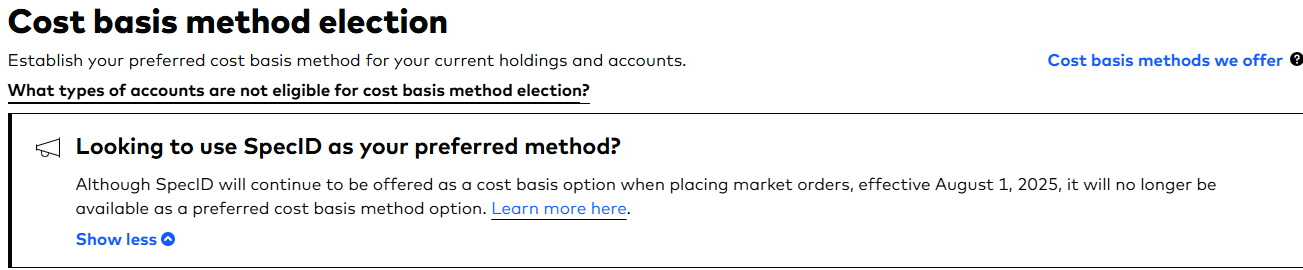

Let me expand on last week’s heads-up about Vanguard’s removing SpecID as a default cost basis option in brokerage accounts.

Here’s the notice that greeted me when I logged into my Vanguard brokerage account and navigated to the Cost Basis section.

At the very end of this Weekly Brief, you’ll find Vanguard’s Q&A-style explanation for the change. However, the short story is that SpecID is being removed as a default option because it is deemed “incompatible with automation.”

The good news: You can still use SpecID when placing market orders—and yes, mutual fund trades count as market orders.

The bad news: You’ve got to select one of three options as a default: first in–first out (FIFO), highest in–first out (HIFO) or MinTax. If you don’t pick one, FIFO will be your default.

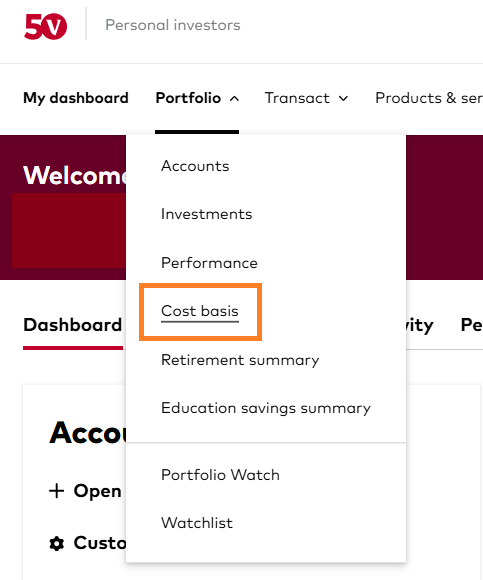

To update your settings, log in to your account, select “Portfolio” from the top navigation bar, and then click “Cost basis” from the dropdown menu.

The obvious question: Which one should you pick?

Here’s a quick breakdown:

- FIFO: Sells your oldest shares first, based on purchase date.

- HIFO: Sells your most expensive shares first to minimize capital gains.

- MinTax: Uses a tax-sensitive waterfall (see here) to sell shares with the lowest tax rate first. (You can read more on MinTax here.)

Personally, I’ve changed my default to HIFO—though MinTax was a close second.

Why? HIFO will reliably minimize your gain (or maximize your loss) in dollars while MinTax tries to minimize the tax rate applied to your gains. It’s not the same goal—and they won’t always arrive at the same result. In some cases, HIFO might leave you better off; in others, MinTax might.

It depends on what you’re solving for—and on your broader tax picture. For example, neither HIFO nor MinTax is ideal if you are gifting or transferring shares.

That said, I plan to use SpecID when trading; HIFO will just be the backup default setting.

And, as always, when it comes to taxes, consult your accountant. What works for me may not work for you.

Our Portfolios

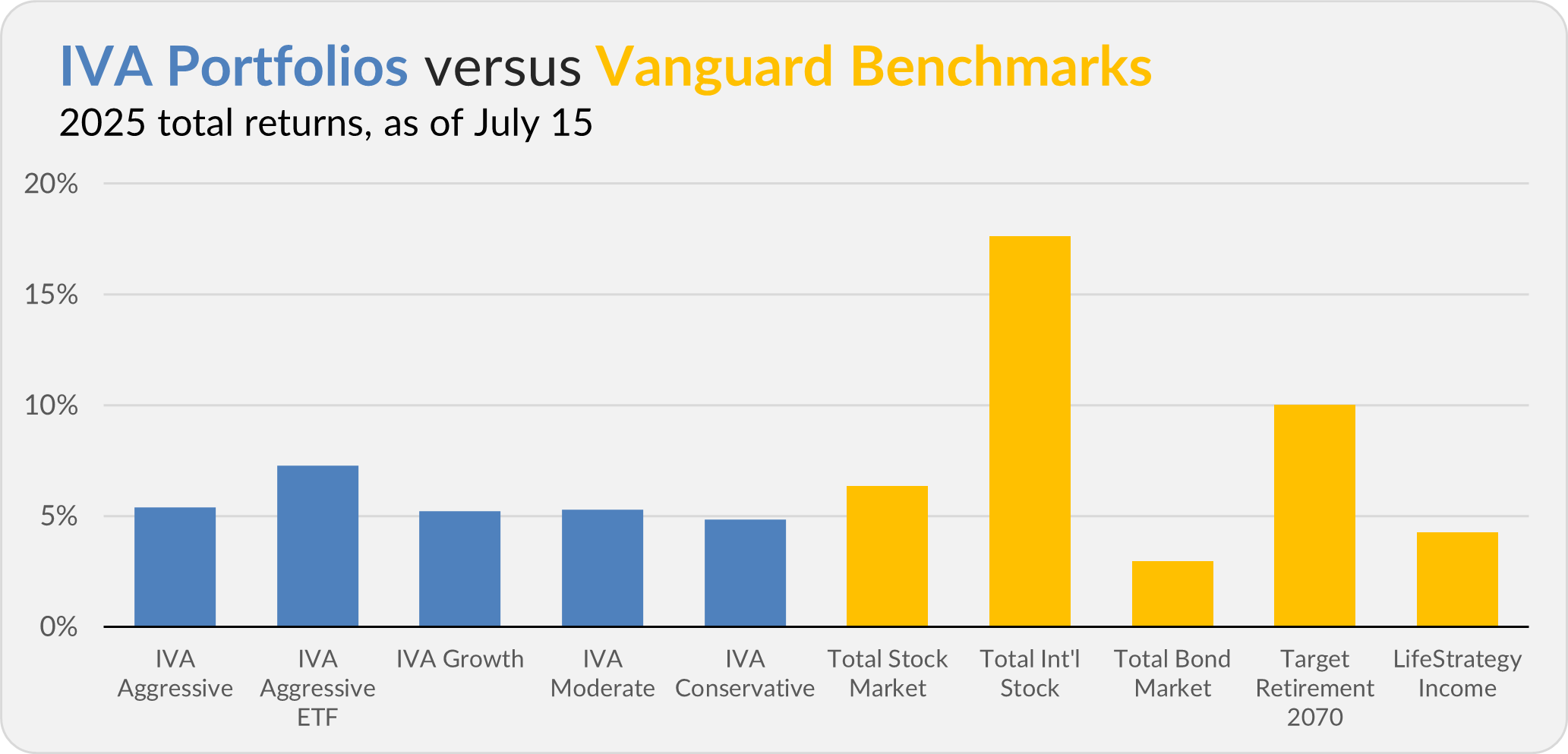

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.4%, the Aggressive ETF Portfolio is up 7.3%, the Growth Portfolio is up 5.2%, the Moderate Portfolio is up 5.3% and the Conservative Portfolio is up 4.9%.

This compares to a 6.4% gain for Total Stock Market Index (VTSAX), a 17.6% return for Total International Stock Index (VTIAX), and a 3.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 10.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.3%.

IVA Research

I’ve shared two Quick Takes in the past week. In one, I gave my first assessment of Vanguard’s new government bond ETFs. In the other, I broke down the recent lawsuit filed against Vanguard.

Yesterday, in Should You Buy and Hold a Sector Fund?, I shifted my focus to the stock market, using a long-term investor’s lens to examine the different sectors and how they’ve performed over time. Next week, I’ll revisit the sectors with my trader’s cap on.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Appendix. Vanguard’s Frequently Asked Questions

Why is Vanguard making this change?

SpecID requires you to manually identify specific lots for each sale or transfer, which makes it incompatible with automation. In some cases, such as automatic distributions, IRS rules may default your trade to FIFO if SpecID instructions aren't provided by the settlement date, which could potentially result in unfavorable tax consequences.

By switching to an automated method, you'll still have the flexibility to use SpecID at the time of a transaction, while also benefiting from having additional automated options beyond FIFO.

What are my other options?

For details about the cost basis methods Vanguard offers, go to Cost basis methods available at Vanguard.

Can I still select SpecID when placing an order?

Yes. You'll still be able to select SpecID as a method when placing individual market orders or requesting a transfer, such as gift or a change of ownership. For example, if your preferred cost basis method is MinTax, you can still select SpecID at the time of the transaction. SpecID is no longer available for limit orders, stop orders, and stop-limit orders.

How can I change my cost basis method for a particular order?

To switch your preferred method to SpecID or another method for an order, locate the investment and select Sell. Under Cost basis, select Edit and choose from the options that display.

Why is SpecID still available for market orders?

Market orders are executed immediately at the current market price, making it easier to match the specified shares with the sale. This immediacy aligns well with the SpecID method, ensuring that the chosen shares are accurately sold.

What action should I take now?

If you've selected SpecID as your preferred cost basis method for any investments, we ask that you switch them to another method before August 1, 2025.

What if I don't take any action?

Any investments still set to SpecID as a preferred cost basis method on August 1, 2025, will be transitioned to the first in, first out (FIFO) method. Open orders won't be affected.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.