Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 23.

There are no changes recommended for any of our Portfolios.

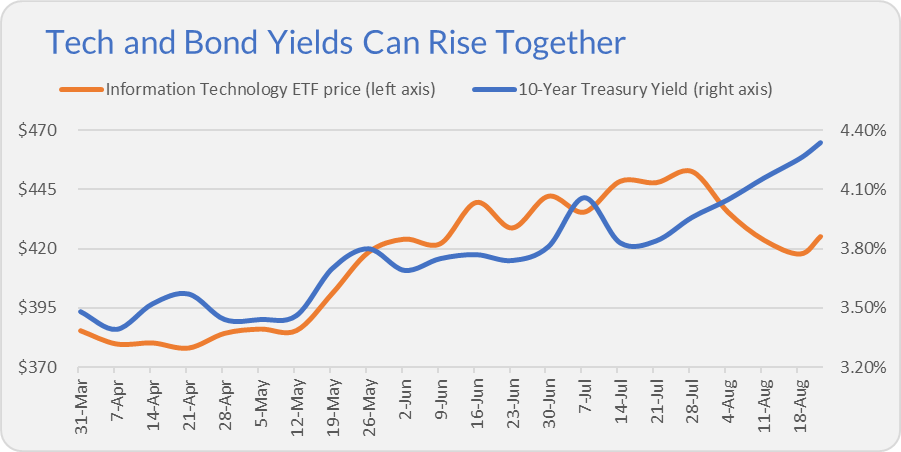

Where is it written in stone that if bond yields rise, then tech stocks must sell off? If it is, well, I can’t find that stone.

I know. Over the past month (since July 21), the yield on the 10-year Treasury has jumped from 3.84% to 4.34%—a 50 basis point (or 0.50%) increase. And, over that period, Information Technology ETF’s (VGT) price has dropped 5.1%. Yields up and tech stock prices down—as the “rule” dictates.

But you don’t have to look back all that far to see bond yields and tech stock prices rising together. In the prior three months (from April 7 to July 21, to be specific), the benchmark bond’s yield increased by 45 basis points—from 3.39% to 3.84%. And yet, over that stretch, Information Technology ETF gained 17.9%.

Yes. I have cherry-picked my dates. (Though I’m looking at weekly numbers, so I am not precisely timing the swings.) But that doesn’t change the fact that tech stocks and bond yields rose together in April, May and June.

Speaking of bonds, two weeks ago, I wrote about bonds being in a funk. Well, the smell only got worse. Total Bond Market Index (VBTLX) has fallen 2.2% this month and is now down fractionally on the year (off 0.1%).

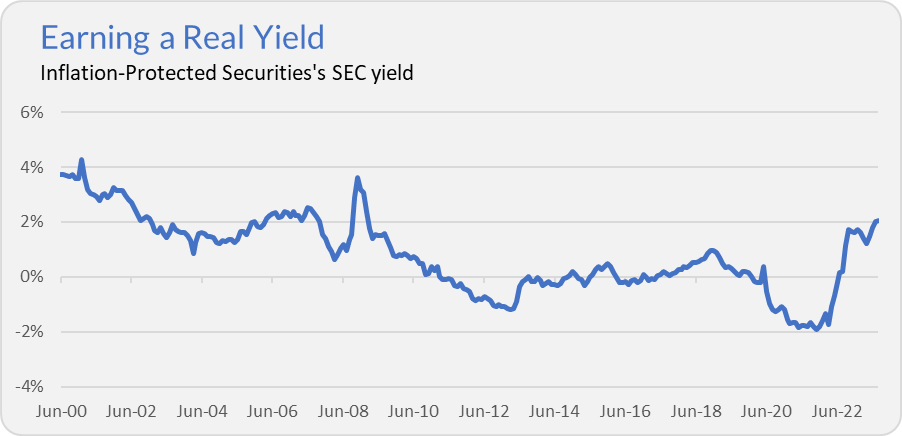

I’ve told you that the silver lining of short-term pain (falling prices) in the bond market is the ability to earn more income. However, higher yields often result from higher inflation. So, rising inflation may be negating higher yields.

Asked differently: Are we earning more income after inflation? Is our “real” yield rising? The answer is yes.

I track real yields by following Inflation-Protected Securities’s (VIPSX) yield.

The yield on a Treasury Inflation-Protected Security (TIPS) adjusts with inflation. (Technically, it’s the bond’s principal that changes, but the result is the same.) The yield you see on a TIPS today is the yield you should earn after inflation if you hold the bond to its maturity date. (Though bond funds don’t have maturity dates, the same principle applies—see here for more on this topic.)

As you can see in the chart below, Inflation-Protected Securities’s yield is clocking in above 2% for the first time since the global financial crisis. Getting to this point has been painful, but earning a safe 2% after inflation is a big win for savers who have been losing out to low inflation for the past 15 years or so.

Stamping Dividend Growth’s Passport

Last week, Vanguard filed to launch a new foreign stock fund—International Dividend Growth. The fund will be managed by Peter Fisher, who is taking the reins from Don Kilbride at Dividend Growth (VDIGX) at the end of 2023.

The news may have come while I was on vacation, but that didn’t stop me from getting a Quick Take out to Premium Members about the upcoming launch. If you’re a Premium Member who missed last week’s note, you can read it here.

Given Dividend Growth’s success (in performance and asset gathering) and Fisher’s track record running foreign dividend growth strategies for Wellington, I thought it was only a matter of time before Vanguard launched this fund—and I said so in May.

I’ll be digging further into the fund and analyzing how it fits, relative to Vanguard’s other foreign stock funds, in greater detail for Premium Members in the months ahead. I’m keen on the idea of this strategy, but with liftoff scheduled for November, there’s plenty of time for thoughtful and thorough analysis.

Changing Platforms

Vanguard has been making another push to transition investors off of its legacy mutual fund platform and over to its brokerage platform.

Vanguard’s primary means of nudging shareholders off the old platform is raising fees. I wrote about this in June when Vanguard said they would charge $25 per fund for each mutual fund held on the legacy platform.

In theory, there isn’t anything to fear about switching to the brokerage platform. A brokerage account is standard operating procedure in the industry now. Open an account at Fidelity, Schwab, E*TRADE, wherever, and you’ll get a brokerage account. New to Vanguard? You’ll also get a brokerage account.

The reality is that transitioning to the brokerage account has been a nightmare for some subscribers.

I’ve heard from one subscriber that he had to reset the distribution parameters for his IRA—though that was only noticed after a monthly distribution was missed, requiring new calculations to withdraw the amount needed. His account was also frozen for 10 days as Vanguard reauthorized his bank account.

This is ludicrous and suggests Vanguard’s billion-dollar technology spend is not going well.

Another subscriber reported that his wife’s IRA had been combined with his IRA. To fix the issue, he had to cancel a power of attorney set up on the account, which had been in place since 2012.

Yet another subscriber said his IRA accounts transitioned smoothly, but his trusts have required a lot of paperwork. As he put it, “They want everything except a blood sample.” He’s had his trusts at Vanguard for over two decades.

I am not making any of this up. The bottom line is that, after years of practice, Vanguard should be getting this right!

I don’t share these stories to stop anyone from transitioning to the brokerage platform—I made the move years ago, and I’m sure many of you have made the transition without any issues. (I tend to only hear about it when Vanguard messes up!)

But, as I’ve said before, no one (not even Vanguard) cares about your money as much as you do. If (when) you make the transition, keep an eye on it and make sure it goes smoothly. If something goes wrong, act quickly to correct it. (Be prepared for long wait times on Vanguard’s phone line—another sign that things aren’t exactly running like a well-oiled machine in Malvern.)

Minimum Tax?

Speaking of Vanguard’s tech, the firm rolled out “a new, automated cost basis method" today. They are calling it MinTax; you can read more about it here.

By selecting MinTax, you give Vanguard control over which specific shares (of your mutual funds, ETFs and stocks) you sell when you hit the sell button. Vanguard will choose shares based on which ones are trading at gains or losses.

MinTax is not going to be for everyone. For example, if you are gifting shares, you probably don’t want to use MinTax.

MinTax also won’t minimize your tax bill 100% of the time. Here’s one situation where MinTax could hand you a larger tax bill:

Say you bought 500 Index (VFINX) 10 years ago. Those shares are up some 225%. (Congrats!) Three months ago, you doubled your investment in 500 Index. Your newer shares have appreciated about 5%.

Now, you have to sell some of your 500 Index position. MinTax will sell all your shares with that significant 225% long-term capital gain before selling any shares with the tiny 5% short-term capital gain.

Chances are you’d be better off realizing that small short-term gain instead of that big long-term gain.

So, as Vanguard states, there are “a few things to consider” when it comes to MinTax. Notably, one “factor” missing from their list of considerations is that you are counting on Vanguard to get the technology and execution right.

Should you switch to MinTax? I can’t give you individual tax advice—taxes are complicated, and everyone’s situation is theirs. I suspect that MinTax will work just fine for many people, but, as I said, it won’t be for everyone.

Will I be moving to MinTax? The short answer is, I don’t know. I only received an email invitation to the program an hour ago. (Plus, most of my money at Vanguard is held in retirement accounts.) For what it’s worth, I currently use Specific identification (SpecID) as the cost basis method on my brokerage account—you get more control, but it’s also more involved.

Expanding Cash Deposit

One final note on Vanguard: When I logged into my account today (to look at the cost basis methodologies), I got a pop-up window inviting me to use Cash Deposit as a settlement fund. This previously was not an option for me, which suggests Vanguard is rolling it out to more and more investors.

Vanguard can say Cash Deposit is "new and improved," but I'm not biting. Since Cash Deposit yields just 3.7% while Federal Money Market (VMFXX) yields nearly 5.3%, I’ll stick with the money market fund as my settlement fund.

Our Portfolios

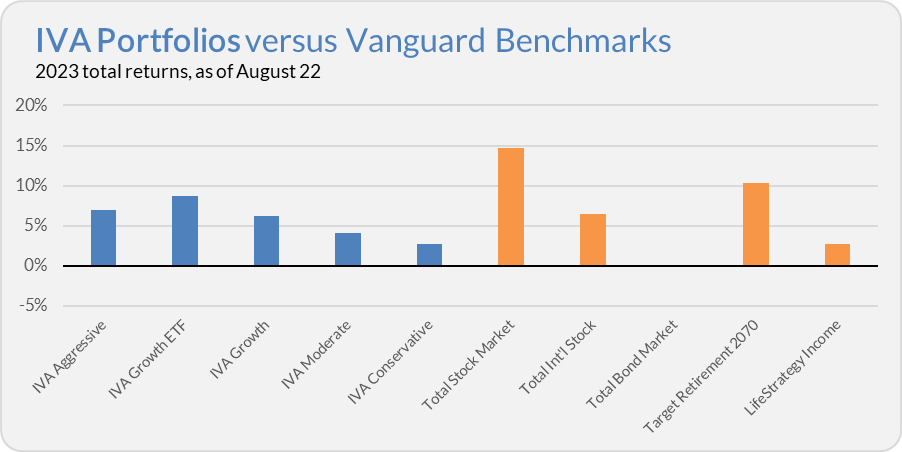

Our Portfolios are showing decent absolute but lagging returns for the year through Tuesday. The Aggressive Portfolio is up 7.0%, the Growth ETF Portfolio is up 8.7%, the Growth Portfolio is up 6.2%, the Moderate Portfolio is up 4.1% and the Conservative Portfolio is up 2.7%.

This compares to a 14.7% gain for Total Stock Market Index (VTSAX), a 6.4% return for Total International Stock Index (VTIAX), and a 0.1% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 10.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.8%.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.