Hello, and welcome to the IVA Weekly Brief for Wednesday, December 10.

There are no changes recommended for any of our Portfolios.

Vanguard’s Final Distribution Update

A month ago, I shared Vanguard’s preliminary year-end capital gains distribution estimates with Premium Members. Yesterday, Vanguard provided its final estimates, which include both capital gains and dividends.

I've attached the updated estimates as a PDF below. You can also follow this link to them.

Expectations in Check

As of last night, 500 Index (VFIAX) has gained 17.7% this calendar year. That’s on the heels of returning 26.2% in 2023 and 25.0% in 2024. Even if 2025’s return doesn’t crack the 20% line, there’s no denying that 500 Index shareholders have enjoyed a terrific run—compounding at a 22.9% annual pace.

But just how good is that run?

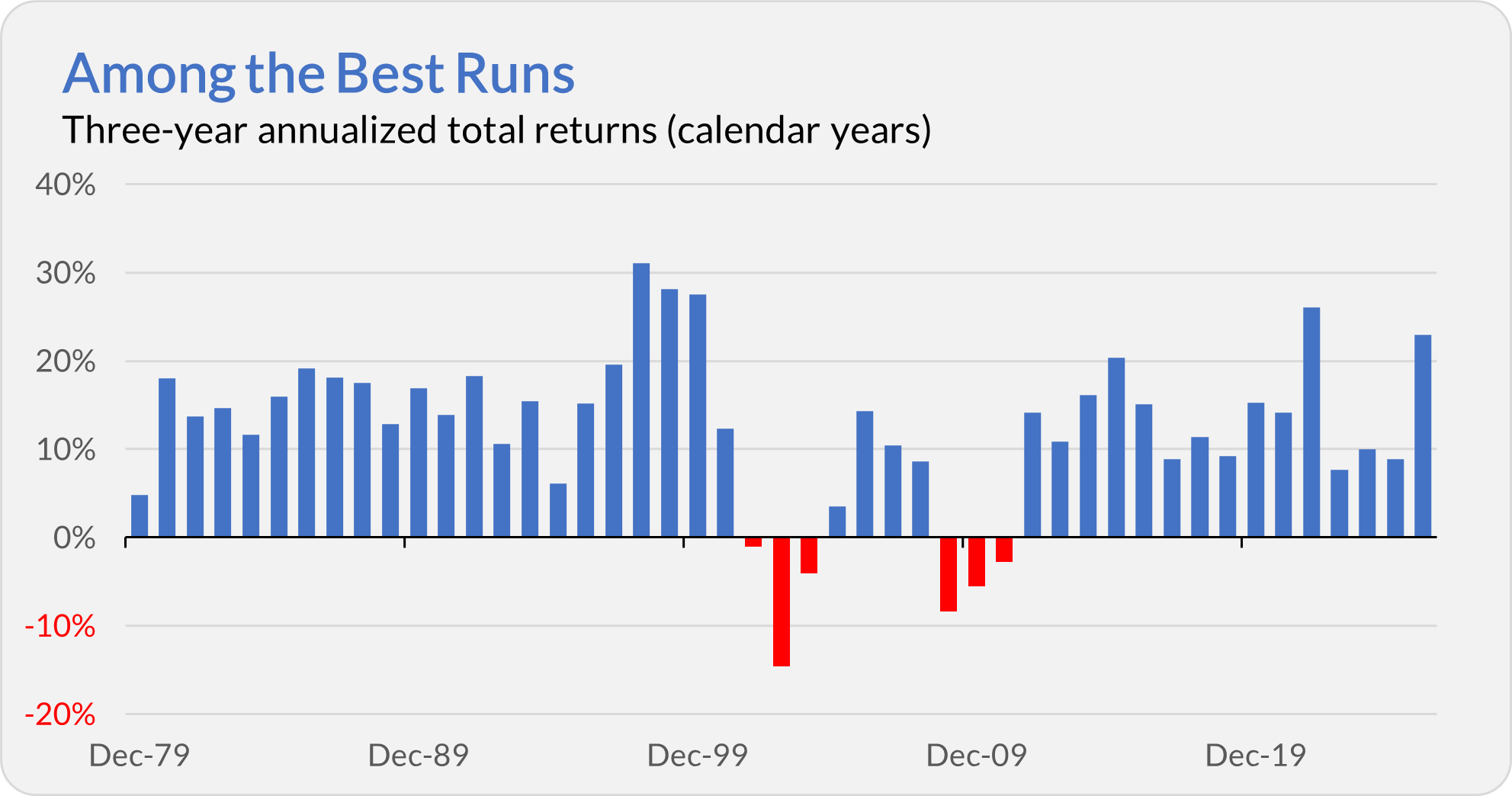

The chart below shows 500 Index’s rolling three-year annualized returns (based on calendar years). If 2025 ends around the 22.9% mark, this three-year window would land well above the fund’s 12.2% long-term average—ranking as the fifth-best three-year stretch since the index fund’s 1976 inception. The only better periods? The late-1990s tech bubble and 2019–2021.

(And for the record, I checked this using monthly data as well—not just year-end figures. Same story: Today’s three-year pace is in the top 10% of all historical observations.)

The past three years have been unusually strong. Could the run continue into 2026? Absolutely. But you shouldn’t build your financial plan around earning 20% per year for the rest of your investing life. Markets don’t work that way—and history shows that above-average periods are typically followed by something more, well, average.

Stay invested, stay disciplined and keep your expectations grounded.

Setting the Record Straight on Checkwriting

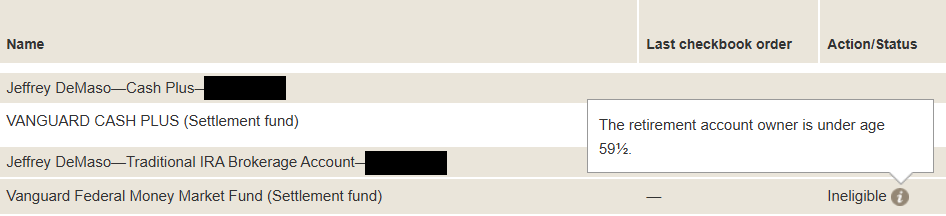

A quick clarification from last week’s IVA Research article comparing Federal Money Market (VMFXX) and Cash Plus Account:

I told Premium Members that you can add checkwriting to the money market fund. That’s true, but I should’ve added a caveat—it’s only possible in taxable brokerage accounts.

Vanguard permanently discontinued checkwriting from IRAs in September. Here’s the opening of the notice that Vanguard sent to “impacted clients” in June:

“We're writing to inform you that Vanguard will be permanently discontinuing checkwriting services for your IRA account on September 24, 2025. This change is part of our ongoing efforts to enhance the security of your retirement savings. We've noticed that many clients have already transitioned to more secure and convenient options, such as electronic bank transfers.”

My apologies for any confusion. I wasn’t an impacted client, so I didn’t get the letter—and the message in my IRA suggested checkwriting wasn’t available because of my age, not because it had been eliminated entirely.

So, here’s the bottom line on checkwriting at Vanguard today:

- You can write checks from Federal Money Market in a taxable brokerage account.

- You cannot write checks from Federal Money Market in your IRA.

- You cannot write checks from a Cash Plus Account (even if you hold Federal Money Market).

QCDs in a Post-Checkwriting World

Losing the ability to write checks from an IRA complicates the qualified charitable distribution (QCD) process. A QCD is a great way to direct part (of all) of your required minimum distribution (RMD) to charity—but the mechanics have gotten clunkier.

You can read Vanguard’s instructions here, but here’s how one IVA reader described it to me:

You have to request a QCD check from Vanguard. The check is made payable to the charity, but mailed to your home address. You then need to forward it to the charity.

Each step can take several days. So, if you’re planning to make a QCD this year, don’t wait until the very last minute.

Frankly—as I warned last week—given Vanguard’s recurring tech hiccups, you shouldn’t wait until the last minute, no matter how you plan to take your RMD.

🎁 Give the Gift of The IVA

Help someone make the most of their Vanguard investments.

Our Portfolios

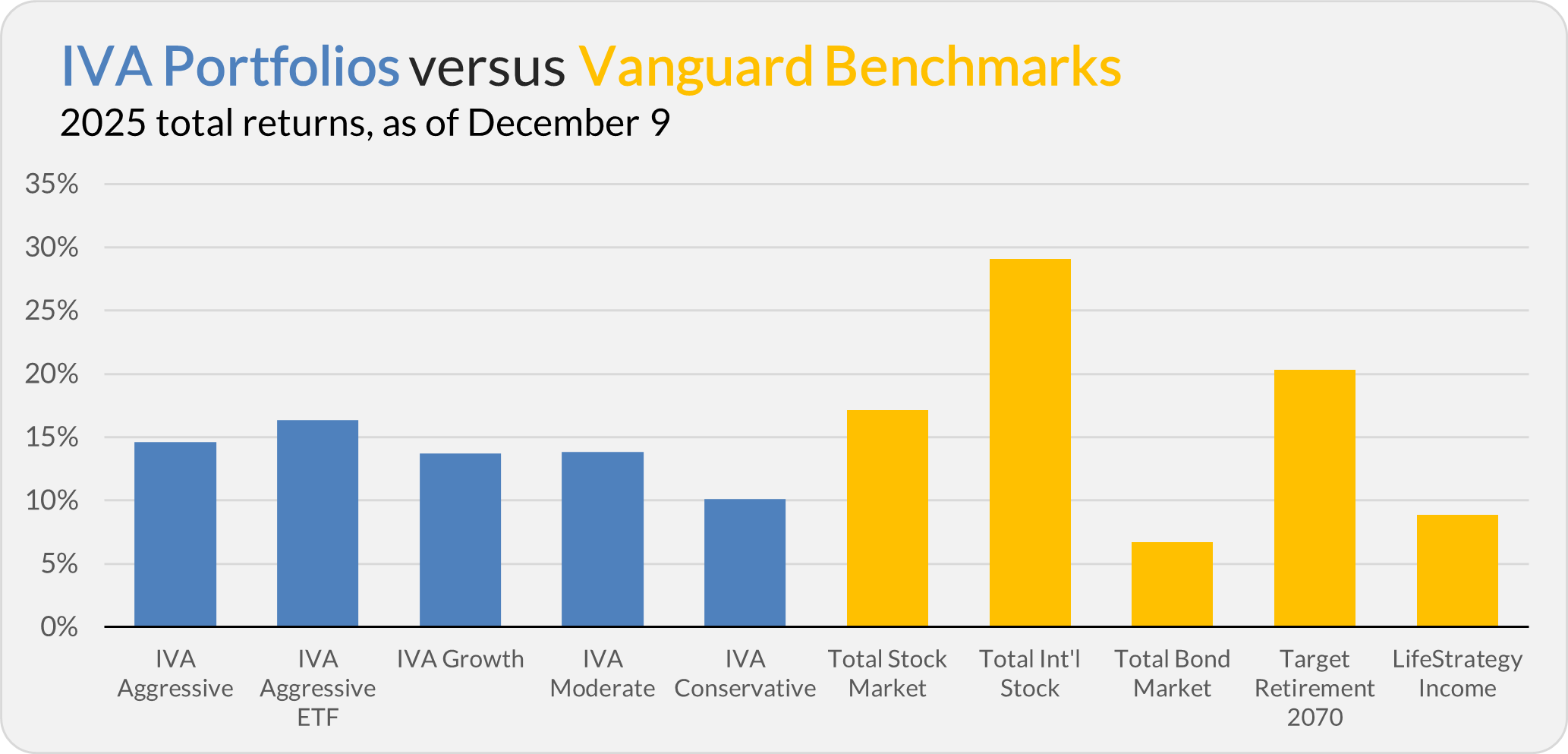

Our Portfolios are showing double-digit returns for the year through Tuesday. The Aggressive Portfolio is up 14.6%, the Aggressive ETF Portfolio is up 16.3%, the Growth Portfolio is up 13.7%, the Moderate Portfolio is up 13.9% and the Conservative Portfolio is up 10.1%.

This compares to a 17.1% gain for Total Stock Market Index (VTSAX), a 29.1% return for Total International Stock Index (VTIAX), and a 6.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 20.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 8.9%.

IVA Research

Yesterday, I walked Premium Members through which Vanguard funds are most exposed to artificial intelligence (AI) stocks—and which ones aren’t. See here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.