Hello, and welcome to the IVA Weekly Brief for Wednesday, February 18.

There are no changes recommended for any of our Portfolios.

According to a recent Wall Street Journal article, the economy “may have stuck the soft landing.”

Wait. What?

When economists talk about a soft landing they traditionally mean inflation has fallen without unemployment rising sharply or the economy slipping into recession. Yet, despite what the Wall Street Journal says, it was in September 2023 that I told you I thought we’d already pulled it off.

So, what’s the issue here?

It may simply be a mismatch in definitions.

The Journal seems to suggest that a soft landing isn’t official until inflation returns all the way to the Federal Reserve’s 2% target. Fair enough—that’s one way to define it.

I’m not so doctrinaire. In my book the soft landing happened when inflation fell from 9% to 3% between June 2022 and June 2023—without a meaningful rise in unemployment. That was the tricky part—the high-wire act that got us back to the runway, unscathed. (In the chart below, it’s the grey section where inflation plunged while unemployment remained steady.)

Yes, getting from 3% down to 2% has been a slog. (And we aren’t there yet.) So, no argument on that front. It just strikes me as odd to declare victory now, when the most delicate phase of the touchdown is already years behind us.

What’s an investor supposed to take away from this soft-landing debate?

First, don’t get too hung up on labels. Economists and talking heads toss around terms like “soft landing” as if they’re universally defined. They’re not. Often, there’s no agreed-upon finish line.

Second, the economy is a complex machine made up of millions of decisions and interactions. Anyone who tells you that for X to happen (inflation falls), Y must happen (unemployment rises) is oversimplifying. Economics isn’t physics. There are no fixed laws guaranteeing that one outcome follows another.

Third, focus on what you can control: How much you save and which funds you own. Whether the soft landing was achieved in 2023 or today doesn’t change the fundamentals of long-term investing. Your savings rate, your asset allocation and your discipline matter far more than the headline of the day.

In other words, let the economists debate definitions. We’ll stick to building wealth.

No, Wall Street Isn’t Coming for Your 401(k)

A recent Fox News opinion piece warning of a “Great Taking”—that “Wall Street could seize your retirement savings in the next financial crisis”—prompted several IVA readers to ask, Should we be concerned?

My short answer: No.

The article points to the fact that most investors don’t drectly own their stock certificates. Instead, stocks and ETFs are held electronically in “street name” through a centralized clearing system—the Depository Trust Company (DTC).

From there, the author argues that because you don’t directly hold title, financial institutions could “reassign ownership” in a crisis, and creditors could seize customer assets if a brokerage fails.

However, the jump from “shares are held electronically” to “your retirement account can be confiscated” ignores how the system actually works.

First, brokerage firms are required to keep customer assets separate from the firm’s own assets. They can’t use your securities to pay their debts.

Second, if a brokerage fails, customer accounts are transferred to another firm. That’s what happened during the Lehman Bros. collapse in 2008. The Securities Investor Protection Corporation (SIPC) exists to oversee exactly that process.

And it’s worth noting: Mutual funds aren’t held at the Depository Trust Company in the same way stocks and ETFs are. They’re recorded directly on the books of the fund company. The idea that all securities could simply be “reassigned” glosses over important structural differences.

For the nightmare scenario described in the article to unfold, nearly every safeguard in the system—regulators, courts, SIPC and multiple major brokerages—would have to fail at once.

That’s not a typical bear market. That’s a full-scale collapse of the financial system.

It’s a bit like saying, “The dam could break.” Yes, it could. But it’s engineered with redundancies, inspected regularly and designed to withstand stress. Not every storm means the reservoir is about to burst.

And practically speaking, if retirees’ brokerage accounts were seized, the political backlash would be immediate and overwhelming—across party lines.

Look, if you want to be extra cautious:

- Don’t use margin.

- Don’t participate in securities lending programs like Vanguard’s Fully Paid Lending program.

But the bottom line is this: I’m not concerned about the mutual funds and ETFs I own at Vanguard—or Fidelity, Schwab, or E*TRADE—being confiscated in the next downturn.

Alarmist headlines grab attention and, in this case, help to sell books, which I believe is the author’s prime motivation for writing this article. For now, the system’s safeguards remain intact—and that’s what matters.

Our Portfolios

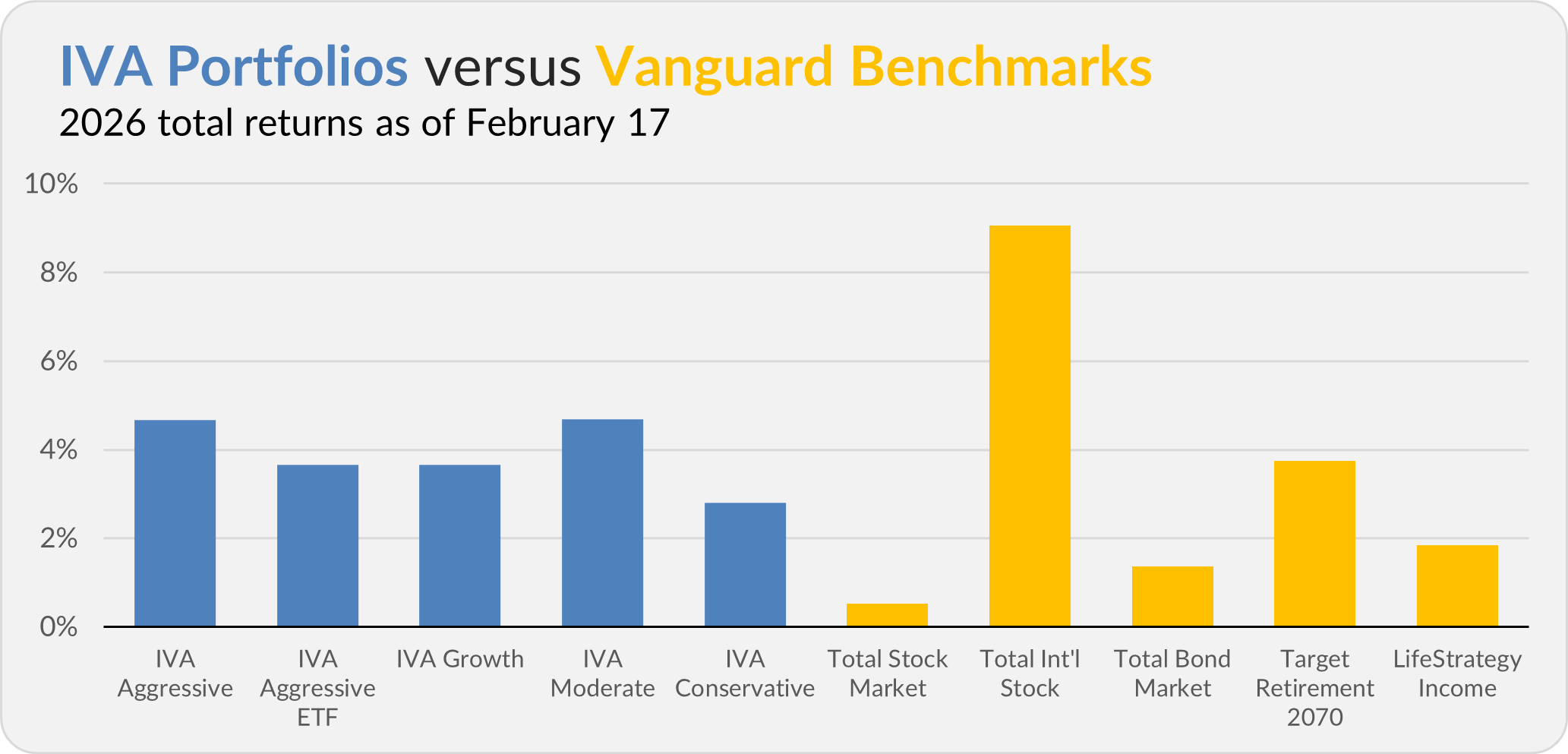

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 4.7%, the Aggressive ETF and Growth Portfolios are up 3.7%, the Moderate Portfolio is up 4.7% and the Conservative Portfolio is up 2.8%.

This compares to a 0.5% gain for Total Stock Market Index (VTSAX), a 9.1% return for Total International Stock Index (VTIAX), and a 1.4% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.8%.

IVA Research

Yesterday, I broke down Vanguard’s four “new” stock funds for Premium Members—the trio of Wellington-run actively managed ETFs and MidCap Growth (VMGRX).

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.