Hello, and welcome to the IVA Weekly Brief for Wednesday, February 4.

There are no changes recommended for any of our Portfolios.

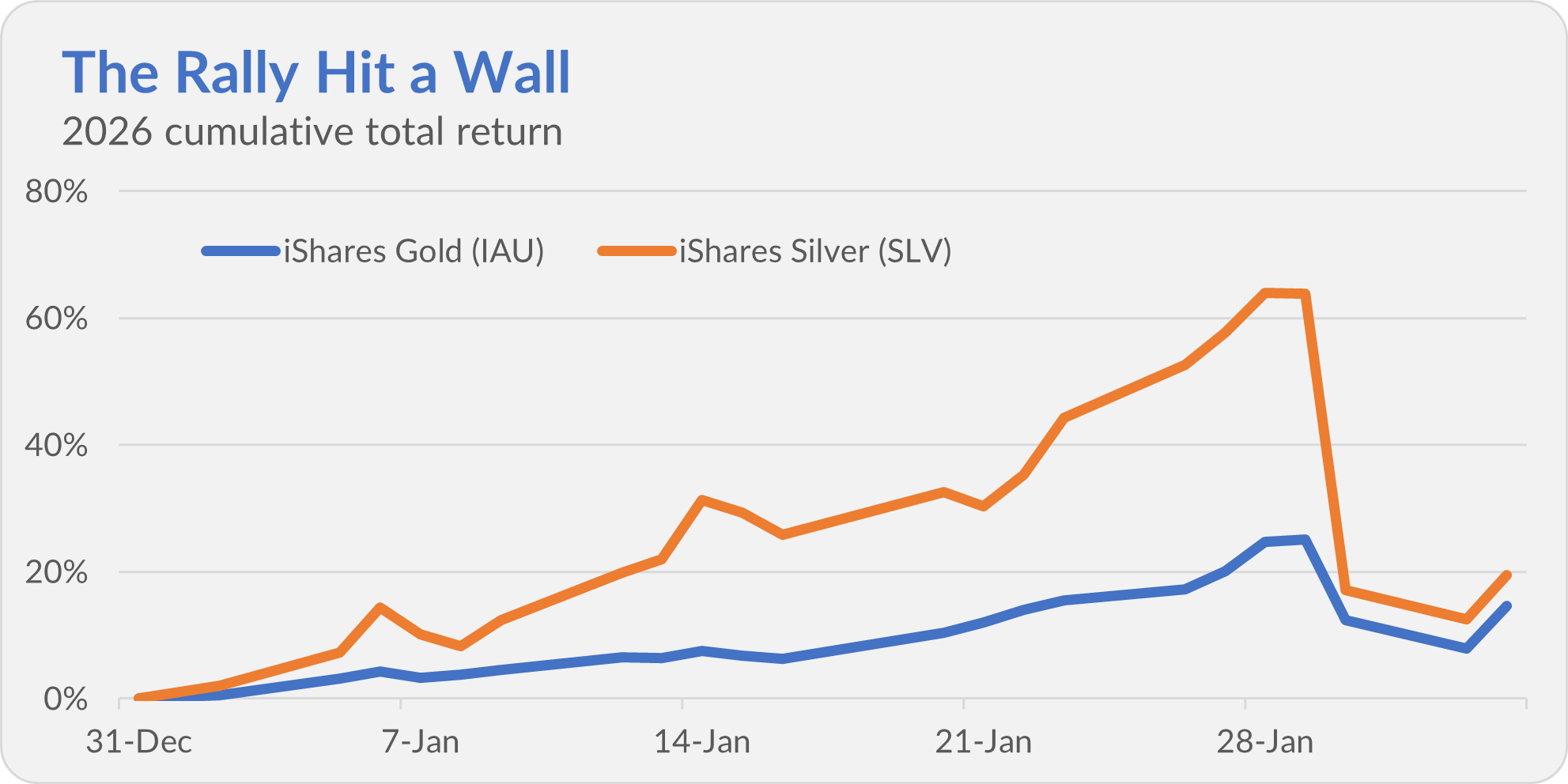

This time last week, I was trying to put gold’s rally into broader context. Two days later, that rally hit a wall.

Gold fell 10% on Friday and another 4% on Monday. Silver—whose run-up had been more dramatic—collapsed by a stunning 30% on Friday alone—its worst one-day drop since the Hunt brothers’ attempt to corner the silver market unraveled in 1980.

Gold and silver prices bounced about 6% on Tuesday. If nothing else, it’s safe to say that volatility has returned to the precious metals market.

Gold (or silver) may be a store of value—or “safe haven”—over very long periods, measured in centuries. But, as last week’s action made painfully clear, prices can be wildly unpredictable over shorter horizons.

As I said last week, I prefer to own productive, cash-generating assets—stocks and bonds—so let’s turn our attention back to the stock market.

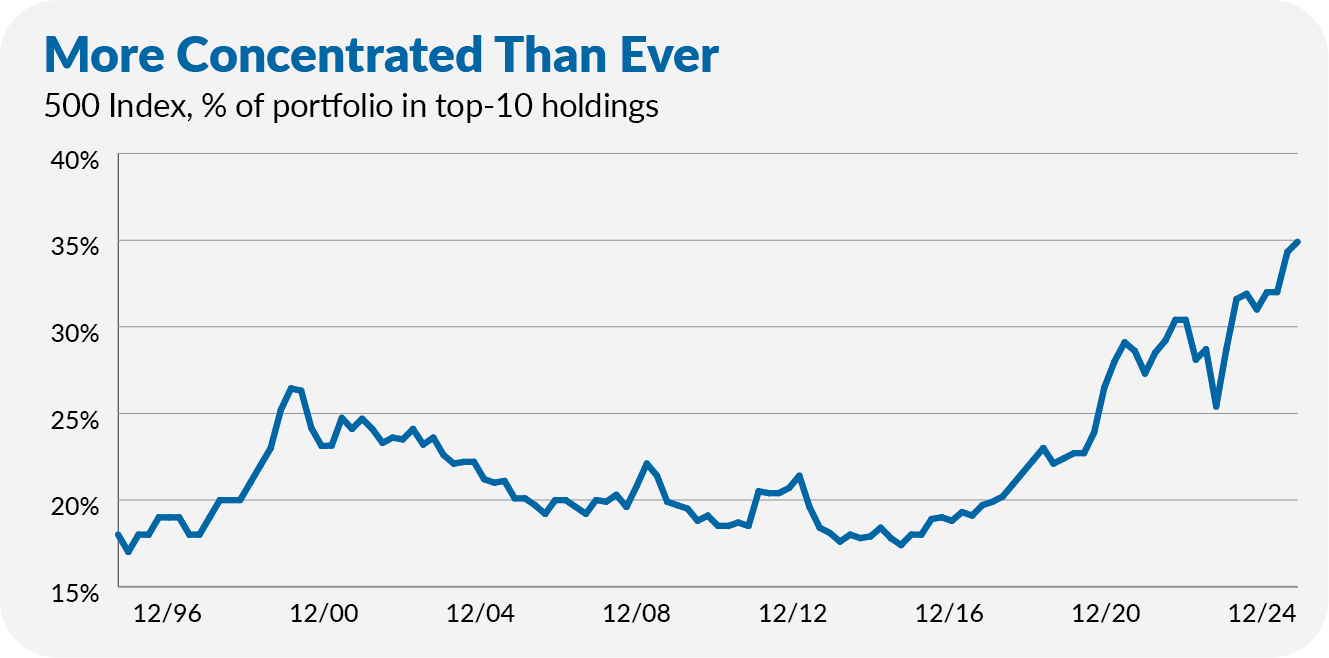

Several IVA readers wrote in asking about Jeff Sommer’s recent The New York Times article, Your ‘Safe’ Stock Funds May Be Riskier Than You Think. In it, Sommer describes how today’s stock market has become so concentrated that the “broad” index funds—like Total Stock Market Index (VTSAX) and 500 Index (VFIAX)—now meet the SEC’s technical definition of “nondiversified funds.”

Crossing that technical line may be new, but the extreme concentration is not.

In my 2025 Outlook, I shared the chart below, which tracks the combined weight of the top-10 holdings in 500 Index. The index was already as top-heavy as it had ever been in late 2024—and it’s only grown more so. By the end of 2025, the top 10 stocks accounted for 39% of the fund’s assets.

Late last year, I approached the same issue from a different angle, examining artificial intelligence (AI) exposure in Vanguard’s funds. One of the key takeaways from that analysis was simple:

500 Index is not the broadly diversified “market” fund many assume.

So while Sommer and I took different paths, we arrived at similar conclusions.

That brings us to the obvious question: What’s an investor to do?

First, it’s important to remember that concentration cuts both ways. If today’s market giants stumble, they can drag broad index funds down with them. But if they continue to rally, those same index funds will benefit. In other words, there are risks to owning the market’s biggest stocks—and risks to not owning them.

As I said in my 2026 Outlook, I still want to spend time in the market. But I want to do so with portfolios that are resilient and genuinely diversified. With foreign stocks, dividend growers, small-cap exposure, and real estate in the mix, the IVA Portfolios should participate if the market’s giants keep running—but they aren’t dependent on them.

Sommer concludes by advocating for holding a globally diversified portfolio. That view should sound familiar. Last year, I increased the allocation to the foreign stock funds in the IVA Portfolios. (See here and here.)

So, yes, I’ll admit it: I may like his article in part because it confirms my own views. But, in a market this concentrated, diversification isn’t a drag—it’s a defense.

Vanguard Cuts Fees, Again

Turning to Malvern, PA, Vanguard announced another round of fee cuts on Monday.

As I told Premium Members in my Quick Take, lower expense ratios are a win for investors. That said, the race to zero is largely over. Most of the affected funds already carried expense ratios of 0.10% or less before this round, and in 8 out of 10 cases, the cuts amounted to just 0.02% or less.

In aggregate, those reductions add up. For any single investor, however, they barely move the needle—if at all.

Stale Prices at Vanguard

I’m not one to suggest checking your account every day. But if you happen to log into your Vanguard account in the evening, be aware that the prices you see for non-Vanguard mutual funds are likely stale.

About six months ago, I told you (here) that this was happening around the holidays. What’s troubling is that it now appears to be happening every day.

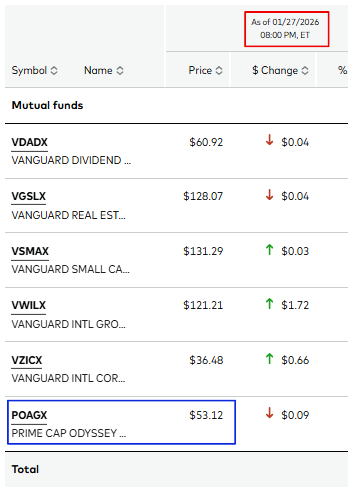

Below is a screenshot of my IRA at Vanguard, taken at 10:00 p.m. ET on January 27. (Yes, my holdings match what I recommend in the IVA Portfolios—but that’s not why I’m sharing this.)

Vanguard notes the prices are “As of 1/27/2026 08:00 PM, ET.” That’s accurate for Vanguard mutual funds. It’s not accurate for PRIMECAP Odyssey Aggressive Growth (POAGX).

The $53.12 price Vanguard shows for the Odyssey fund is the January 26 closing price. The fund’s actual NAV as of January 27 was $53.38.

When I checked my account the next morning, the price—and my account value—had been updated accordingly.

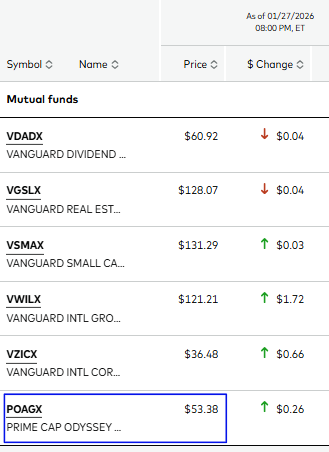

A quick clarification: I’m showing prices from last week because that’s when I started consistently tracking this issue. I wanted to see whether it persisted day after day and to hear directly from Vanguard.

Here’s Vanguard’s explanation. They aim to provide pricing data as accurately and quickly as possible, but prices come from different sources. Vanguard calculates NAVs for its own funds. Prices for third-party mutual funds come from an external provider—and there’s clearly a lag.

According to Vanguard, the timestamp reflects the last time the data was refreshed, not necessarily the date of the fund’s NAV.

In other words, if Vanguard doesn’t yet have today’s price at 8 p.m., it shows yesterday’s price. But how is an investor supposed to know which price is being shown? To make matters worse—as you can see in the screenshot above—when I checked the next morning, the price had changed, but the timestamp hadn’t.

If you ask me, that’s confusing. And it’s hard to justify in 2026. Six hours after the market closes, Vanguard should be able to display the current day’s NAV for a widely held mutual fund.

The bottom line: If you own a non-Vanguard mutual fund in a Vanguard brokerage account, you’re better off waiting until the next day to check performance or returns.

We should expect more from Vanguard. But for now, this is the reality.

Our Portfolios

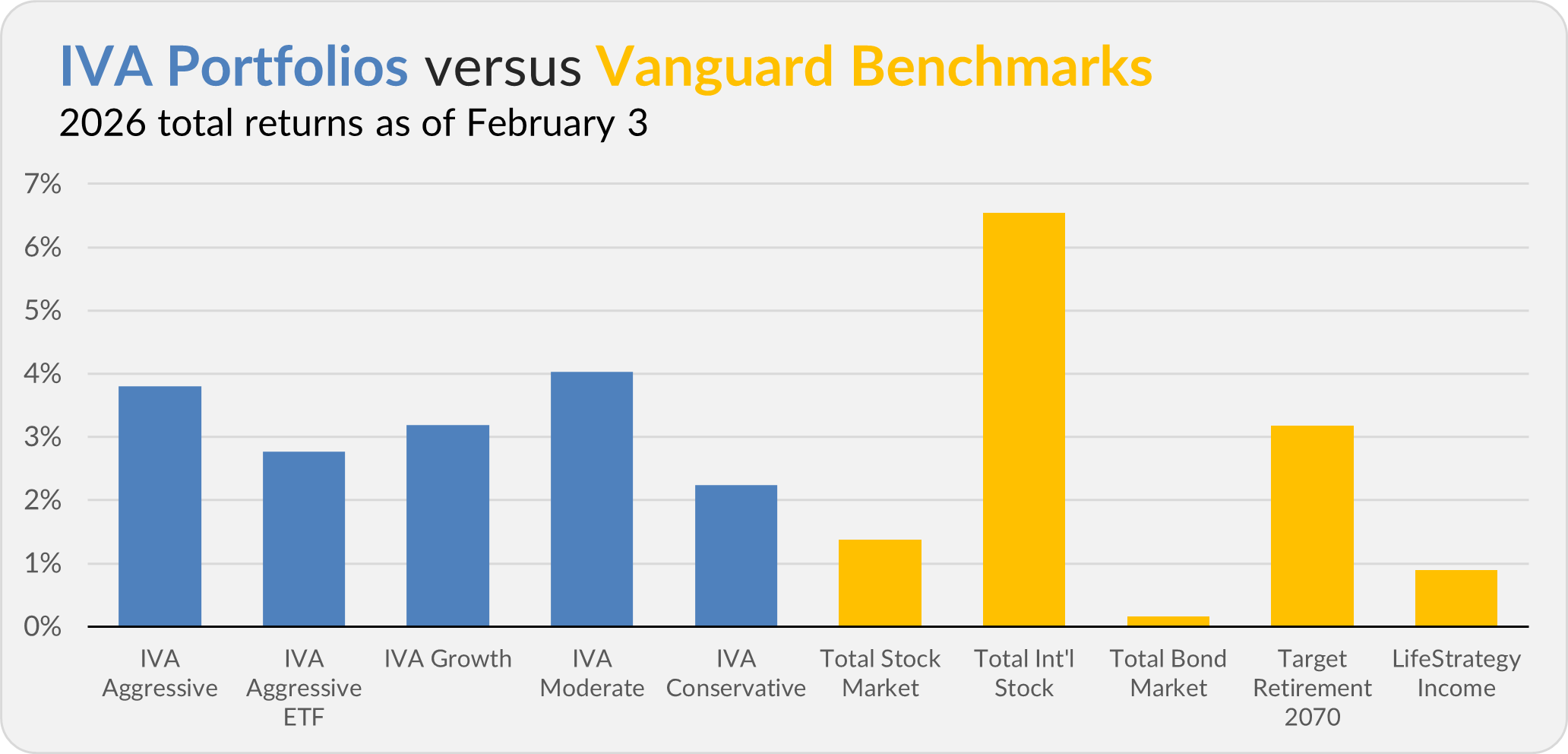

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 3.8%, the Aggressive ETF Portfolio is up 2.8%, the Growth Portfolio is up 3.2%, the Moderate Portfolio is up 4.0% and the Conservative Portfolio is up 2.2%.

This compares to a 2.2% gain for Total Stock Market Index (VTSAX), a 6.5% return for Total International Stock Index (VTIAX), and a 0.2% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.9%.

IVA Research

Yesterday, analyzed Vanguard’s actively managed Growth & Income funds to see if any cleared the high bar set by the firm’s index funds.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.