Executive Summary: In this article, I break down how price, total and after-tax returns differ and explain why ETFs and index funds don’t erase taxes. They simply let you decide when to pay them—a small edge that adds up over time.

Every January, investors open their statements to find an unpleasant surprise: Data on December’s distributions, heralding a future tax bill. While index funds and ETFs generate their own share of taxable income (think interest and dividends) and sometimes capital gains, it’s the actively managed mutual funds that are often the main culprits.

So, this begs the question: Is there ever a good reason to own actively managed mutual funds in a taxable account?

My early read on 2025’s distribution season suggests this question will be uppermost on investors' minds again as 2026 unfolds.

Earlier this year, I analyzed returns before and after taxes to help answer that question—see here and here. My conclusion in May was that most investors are best off using index funds (or ETFs) in their taxable brokerage accounts. Still, a few select actively managed mutual funds can clear the tax hurdle, making them appropriate for both taxable and tax-deferred accounts.

That conclusion still rings true today, so I’m not going to rehash the argument entirely. But with some significant capital gains distributions likely coming in December, now’s a good time to revisit how distributions impact your portfolio, your taxes and your returns.

It’s also the perfect time to tackle a common misconception. Many investors assume that owning ETFs lets them sidestep taxes entirely. Not so. ETFs (and index mutual funds) don’t eliminate tax bills—they simply give you more control over when those taxes come due.

Key Points

- Don’t forget to include distributions when calculating (and reviewing) performance.

- Index funds and ETFs don’t eliminate taxes; they give you more control over the timing of your tax bill.

Notes

- In this analysis, I lump index mutual funds and ETFs together because at Vanguard they are effectively the same thing—see here. Use the share class that makes the most sense to you.

- When it comes to capital gains distributions, you only need to worry about them in taxable accounts. Inside tax-deferred accounts—like 401(k)s and IRAs—distributions aren’t taxable when paid. In those accounts, you pay taxes only when you withdraw the money, and all withdrawals are taxed as ordinary income.

- In this analysis, I’m focusing on one five-year period because it does a good job illustrating the key points I’m trying to make. But keep in mind that it is just one period.

Total Returns > Price Returns

First, before talking taxes, we need to dispel a misconception about the often misleading mutual fund and ETF performance data you find on the internet.

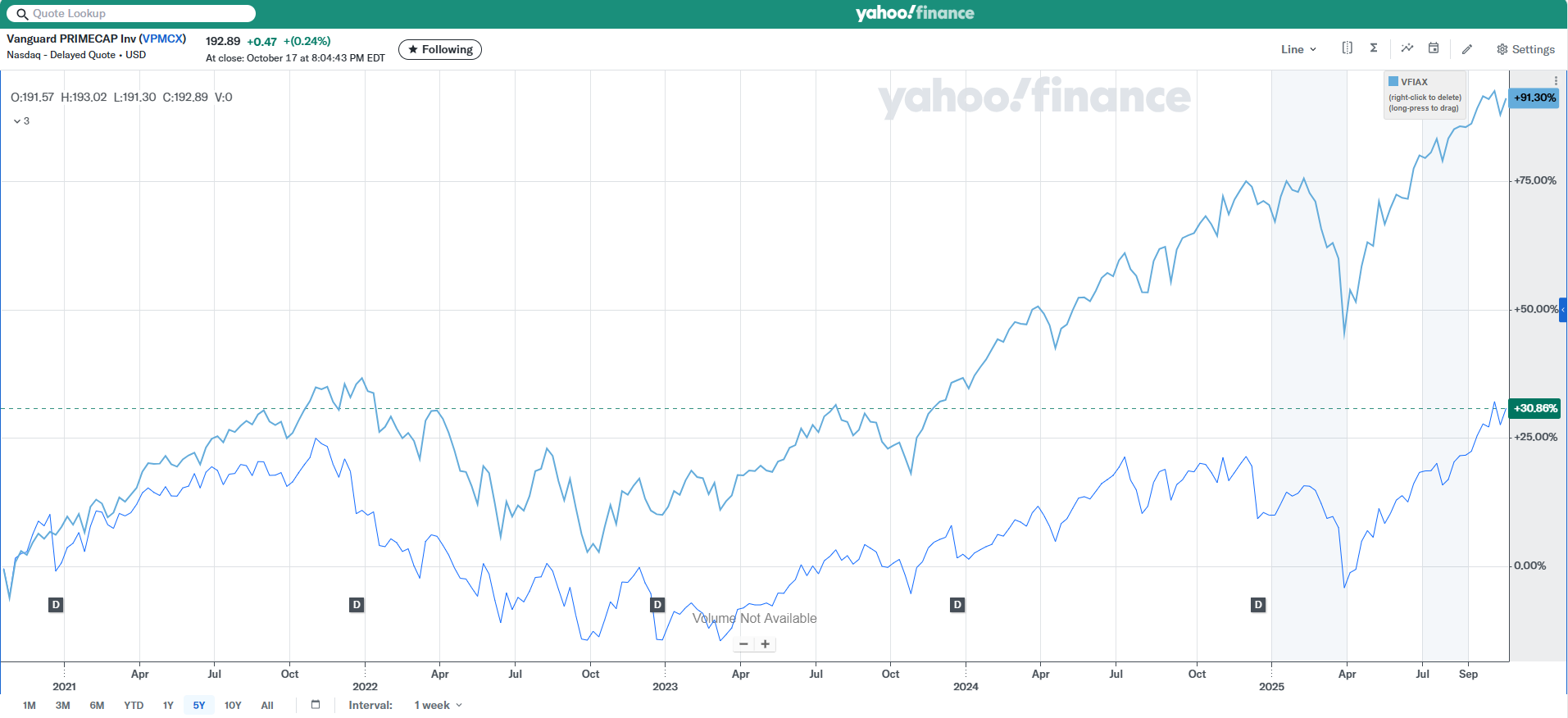

An IVA reader recently asked why PRIMECAP (VPMCX) was doing so horribly, citing data from Yahoo! Finance.

I was a bit taken aback by the question. So, to understand what they were asking about, I pulled up the chart they had referenced. According to Yahoo! Finance, PRIMECAP had gained roughly 30% over the past five years, while 500 Index (VFIAX) had risen more than 90%. What’s wrong, indeed?!

Well, nothing’s wrong with PRIMECAP—the problem lies with the chart. Yahoo! Finance only tracks price returns, not total returns. (And they aren’t the only finance site that does this.)