Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 26.

Get a pencil and paper ready; I'm recommending trades in three of the five Portfolios. Premium Members have received a separate Trade Alert email—which they can also read here—explaining the trades and my thought process behind the moves.

Are you interested in a Premium Membership? Start your free 30-day trial now.

Fed Chair Powell and his colleagues tweaked their policy at the conclusion of their two-day meeting today. They will now target a range of 5.25%-5.50% for the fed funds rate—a slight 0.25% increase.

This interest rate hike is more a policy fine-tuning than a material change. We could see some more tuning in the months ahead. But, according to the CME FedWatch Tool (which looks at futures pricing data, a measure of market participants’ expectations), the most likely outcome is that the fed funds rate will end the year right here—no more hikes or cuts.

We’ll see.

Sentiment on the Rise

Bulls are running; they outnumber bears for the first time in over two years!

That’s according to the American Association of Individual Investors (AAII) sentiment survey. For the first time since April 2021, more than half of the respondents thought the stock market would be higher in six months. Only four months ago (in March), just one in five were bullish on the stock market.

What should we make of this big swing in sentiment?

A more-than-50%-bullish response rate to the AAII survey is usually a yellow flag. Typically, stocks have delivered below-average returns in the month, quarter and year after such a positive outlook from investors.

I think of sentiment surveys as contrarian indicators. Remember the classic Warren Buffett quote, “Be fearful when others are greedy, and greedy when others are fearful?” Well, that’s my sentiment exactly.

So, based on the AAII data, we should be fearful since “everyone” is bullish (greedy) today. But there’s another way to look at the recent uptick in bullish responses: a return to a normal sentiment level after an extended period of downbeat outlooks.

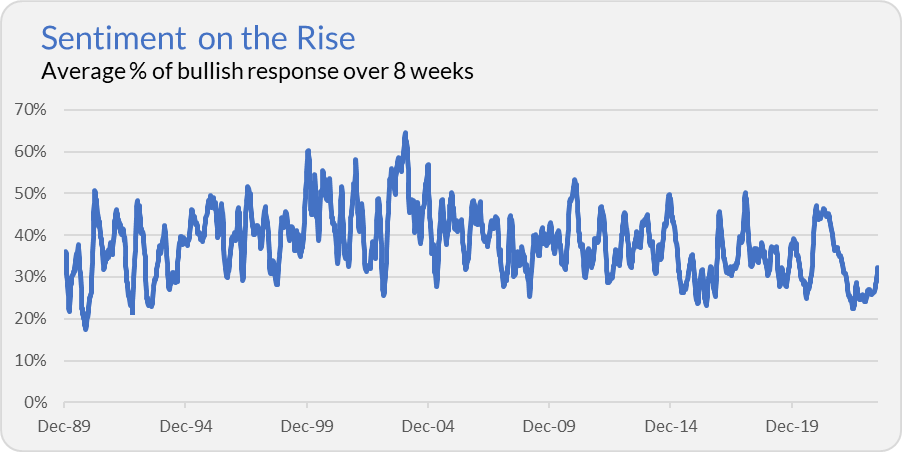

The AAII responses have been bearish for a very long time. Rather than look at the weekly data, I track the average percentage of bullish responses over eight weeks—which you can see in the chart below.

For the past year, fewer than three out of 10 respondents were bullish. According to this survey, investors were more downbeat last year than during the Global Financial Crisis of 2008 and 2009 or the bursting of the tech bubble.

After such a long period of highly bearish responses, an uptick in sentiment is arguably a good thing—shaking off an overly dour outlook. So, I’m not as cautious as I otherwise might be when more than half of the room is bullish.

How Sweet It Is

Last week, Vanguard announced that Grant Reid, the former CEO of Mars Incorporated (the candy company), had joined its board of trustees—the group responsible for overseeing the mutual funds and ETFs on our (shareholders) behalf.

As always, I’ll be on the lookout to see if Reid is invested alongside the shareholders he represents—how many Vanguard funds does he own? How much does he have invested?

We’ll have to wait a year or so for that disclosure to start coming through, but I’ll keep you posted as I learn more.

Tidying House

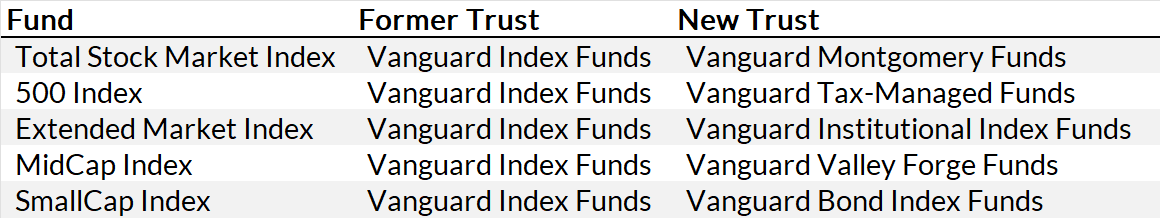

Also, last week, Vanguard filed with the SEC to effectively move five stock index funds from one trust to another. Trusts are simply the legal entities that each fund operates under. The funds moving house include Vanguard’s two largest stock funds, Total Stock Market Index and 500 Index. The other three funds are Extended Market Index, MidCap Index and SmallCap Index. (I did not include tickers because this move impacts all share classes of these funds.)

As you can see in the table below, all five funds are moving out of the Vanguard Index Funds trust into five separate existing trusts.

Don’t get too caught up in the different names of the trusts—some are no longer relevant to the funds that make them up.

Technically, to “move” these index funds, Vanguard will have to merge them with newly registered funds. Still, investors shouldn’t notice anything at all. Your account value should stay unchanged on October 20, 2023 (the transition day), barring any market action. Tickers, managers, expense ratios, objectives, none of that is changing.

Vanguard is just tidying house, saying the move will “enable the realization of administrative efficiencies by spreading filing and reporting requirements of the funds across different legal entities.”

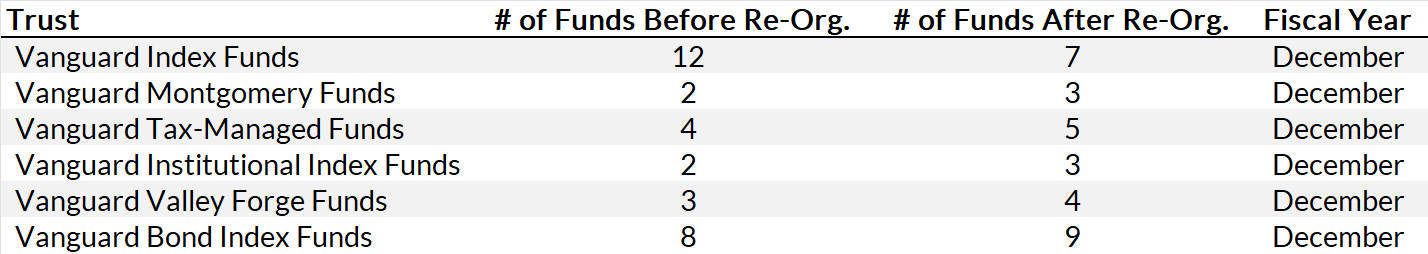

At first glance, I get how this reorganization spreads the work. Currently, 12 funds are in the Index Funds trust. That compares to just two funds in the Montgomery Funds trust, two in the Institutional Index Funds trust, three in the Valley Forge trust and four in the Tax-Managed Funds trust. Fine. That makes sense.

But, adding a fund to the Bond Index Funds trust, which has eight funds today, is more of a head-scratcher. Also puzzling, all of these trusts are on the same fiscal schedule (December and June). So, the work may be spread across more trusts, but it must still be completed on the same schedule.

A Black Eye for Being Green?

Vanguard’s Australian arm was accused of “greenwashing” one of its environmental, social and governance (ESG) funds.

The Australian Securities and Investments Commission is suing Vanguard because its Ethically Conscious Global Aggregate Bond Index fund held bonds from 14 companies, like Chevron and Colonial Pipeline, that should’ve been excluded based on the ESG criteria the managers had said they were following. In short, Vanguard said they would avoid buying bonds from certain companies and then bought them anyways.

The bond fund in question may be small, with only $680 million in assets, but you’ve got to walk the talk when it comes to ESG screens and fund management. Unfortunately, this isn’t Vanguard’s first ESG snafu.

Vanguard’s Australia unit was fined $27,000 in a separate greenwashing case in 2022.

Separately, in mid-2019, a miscommunication between Vanguard and FTSE resulted in ESG U.S. Stock ETF (ESGV) purchasing several un-ESG stocks, like gun manufacturer Sturm Ruger. Around the same time, the ESG ETF held shares in oil drillers and refiners, which didn’t comport with Vanguard’s original ESG definitions and descriptions … Vanguard eventually changed its language and ESG criteria.

Socially responsible, ESG, ethically conscious, values-driven investing (call it what you want) means different things to different people. (Heck, to some, Vanguard’s ESG efforts might have violated antitrust law.) If Vanguard is going to offer investment solutions for this crowd—as it currently does—the bare minimum required is to define how they will exclude (or include) certain stocks and then follow those rules.

Vanguard has stumbled on that lowest of hurdles several times. Investors deserve better. ESG investing is hard enough without constantly confirming that Vanguard is doing what it says it will do.

Our Portfolios

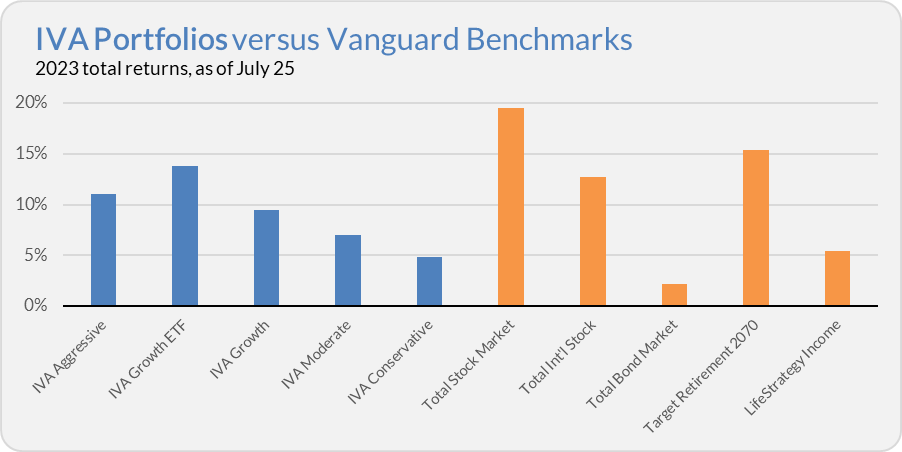

Our Portfolios show solid absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 11.1%, the Growth ETF Portfolio is up 13.7%, the Growth Portfolio is up 9.5%, the Moderate Portfolio is up 7.0% and the Conservative Portfolio is up 4.8%.

This compares to a 19.5% gain for Total Stock Market Index (VTSAX), a 12.7% return for Total International Stock Index (VTIAX), and a 2.2% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.5% for the year.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.