Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 12.

There are no changes recommended for any of our Portfolios.

Index investing is meant to be simple. And I suppose if you buy Total Stock Market Index (VTSAX), it is—you just own all of the stocks in the market according to their size. But the financial industry has created myriad indexes (and index funds) that slice and dice the market countless ways.

Indexes (and the funds that track them) aren’t static—they are reviewed and rebalanced regularly. The definitions used to define, say, value or growth, change over time and vary depending on who is constructing the index.

Let me give you two recent examples.

First, Nasdaq is doing a special rebalance of its Nasdaq 100 index on July 24. The Nasdaq 100 is the index that Invesco’s popular QQQ ETF aims to track.

The rebalance will reduce the weight of the Super Seven—Amazon, Apple, Facebook (Meta), Google (Alphabet), Microsoft, NVIDIA and Tesla—in the index. I wrote about the Super Seven and their impact on the S&P 500 index here and here, but their influence on the Nasdaq 100 index, where they account for over 60% of the index’s market value, is even greater.

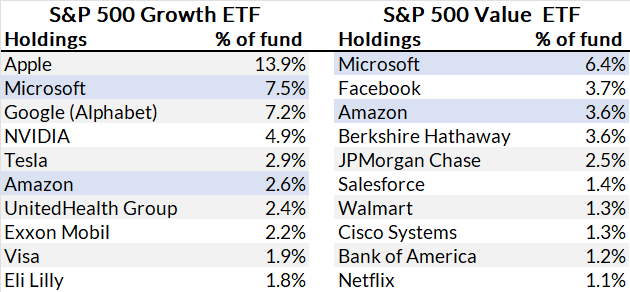

Second, James Mackintosh has a great piece over at The Wall Street Journal explaining how Microsoft is the second-largest stock in the S&P 500 Growth index and the largest stock in the S&P 500 Value index.

This flows through to Vanguard’s S&P 500 Growth ETF (VOOG) and S&P 500 Value ETF (VOOV). You can see each ETF's top holdings in the table below.

How can a stock be one of the biggest growth stocks and value stocks at the same time? (You can also see that Amazon is one of the biggest holdings in both ETFs too.)

Well, as James explains, it comes down to how S&P defines value and growth. In short, S&P includes momentum as part of its definition of growth. Since Microsoft's price declined last year, it qualifies less as a growth stock in S&P’s eyes … and hence, must be a value stock (to an extent).

I’m not looking to debate one definition of value or growth over another, but the definitions matter.

Consider that so far this year (as of Tuesday night), S&P 500 Value ETF is up 12.9%—well ahead of its value index fund siblings. Russell 1000 Value ETF (VONV) is up 5.7% and Value Index (VVIAX) has gained just 2.9%.

The difference? Microsoft isn’t held in Russell 1000 Value ETF or Value Index. Zooming out from just Microsoft, S&P 500 Value ETF has roughly twice as much allocated to technology stocks as its value siblings.

If you’re looking to add value stocks to your portfolio, you’re probably going to be tempted by S&P 500 Value ETF’s recent returns. But you’ve got to dig deeper and confirm that the stocks you are buying meet your definition of value.

Don’t just trust the label on the box, read the ingredients!

(Final) Inflation Check-In

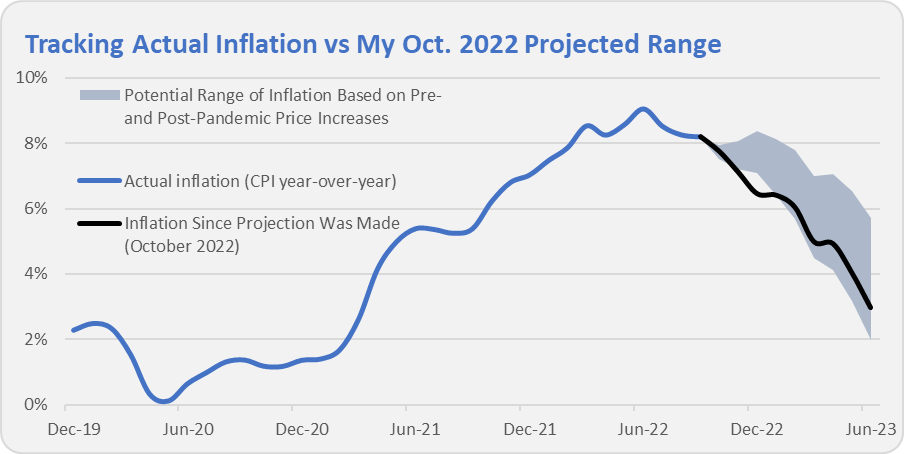

Nine months ago, I went out on a limb and projected a range for the future path of inflation. I’m not usually one to make narrow, short-term economic predictions but, at the time, investors (and consumers) were up in arms over inflation, which was running around 8%, and I had a pretty strong (out of consensus) view that inflation was going to come down.

Sharing a projection seemed like an effective way to communicate my view. And, unlike other forecasters who toss out predictions without consequence, I wanted to hold myself accountable. So, each month, I’ve compared reported inflation against my forecast—a task made easier by the fact that my estimate was spot on.

A month ago, I narrowed my forecast for June’s inflation rate, saying “it wouldn’t surprise me if the annual inflation figure for June clocks in somewhere around 3%.

Well, according to the Bureau of Labor Statistics (BLS), consumer prices increased 0.2% in June, which means over the past year the Consumer Price Index (CPI) is up 3.0%. So, with my final shot in this “experiment,” I hit the bullseye.

So, what’s next for inflation?

While that’s the next logical question, it doesn’t have an easy answer. It wouldn’t surprise me if inflation bounced around the current 3% level for a while … but I’m working on an article on inflation and will share it with Premium Members when it’s complete.

Not a Premium Member, yet? Start a free 30-day trial now.

ESG Isn't Going Away

As I’ve said before, Vanguard finds itself in a tricky spot when it comes to environmental, social and governance (ESG) efforts. One side of the issue contends that Vanguard is simply not doing enough, while the other says Vanguard is doing too much—and may have broken the law.

Last week, Congressional Republicans led by House Judiciary Chairman Rep. Jim Jordan sent Vanguard, BlackRock and State Street (the three biggest index fund companies) letters requiring them to explain their ESG efforts. In short, lawmakers are concerned that fund companies may have violated antitrust law by coordinating efforts to decarbonize their assets under management.

The crux of the issue is the Net Zero Asset Managers (NZAM) alliance and the commitment its members make to reduce emissions to net zero. Yes, Vanguard pulled out of the NZAM—as I told you back in December—but the concern is that even though Vanguard’s membership was temporary, they still may have been involved in collusive activity.

It’s not clear where these efforts will lead. The letters were sent “to advance [Congressional] oversight and inform potential legislative reforms.” That’s fairly vague.

Even though Vanguard is caught up in this inquiry, pulling out of the NZAM has sheltered the firm from other potential antitrust issues. For example, back in April, Republican attorneys general from 21 states warned over 50 asset managers—but not Vanguard—that they could be subject to antitrust prosecution if their proxy voting “prioritize[s] political goals over financial interests.”

Expanding the Line Up

While ESG investing is fast becoming a third rail in the investment world, I’ve long suggested that a more effective means of advancing your views and values as an investor than following an ESG investment mandate, is to maximize your returns and then donate to the causes and charities you care most about.

Vanguard’s Charitable Endowment Program (VCEP) is a hidden gem for anyone looking to donate to charities in a tax-efficient manner—it’s a cost-effective way for individuals to set up their own personal charitable account.

I’ll dig deeper into VCEP in a future article, but here’s how it works: You donate stocks, bonds, cash, fund shares or other marketable assets to the program, taking a tax deduction today. The assets will be sold and then invested into certain “pools” (or investment portfolios). Then, over time, the assets can be gifted to various charities of your choosing.

Technically, once you make the initial donation, VCEP controls the assets and could invest or distribute them as they see fit. But, in practice, VCEP will follow your recommendations on those matters—hence, why it’s called a donor-advised fund (or DAF).

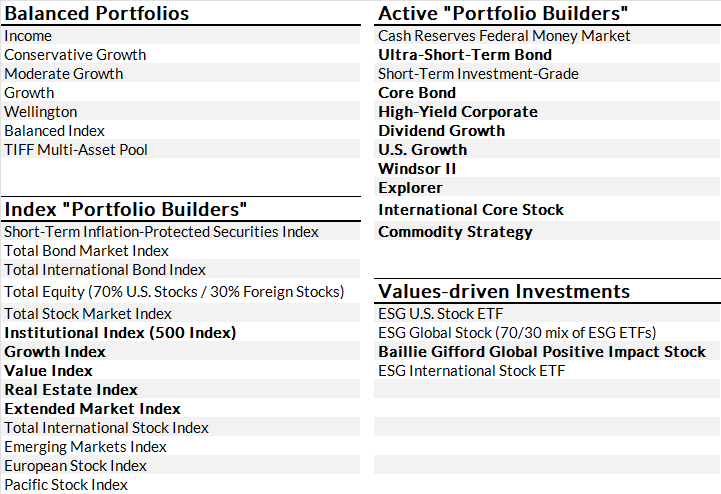

There are some nuances and rules to be aware of if you’re interested in this program, but I’ll cover that another day. I bring up VCEP because Vanguard nearly doubled the number of investment options in the program from 20 to 36 yesterday. The table below shows all of the investments now available.

As you can see, Vanguard pushed to make more active funds available to participants—for each index fund that was added to the list, two active funds were enrolled.

Vanguard says that they “identified an appetite for an even greater number of high-value, low-cost investment options that allow donors to customize their investment blend …” If that’s the case, why not just make all Vanguard funds available?

Maybe it’s just because of last week’s ESG news, but it jumps out to me that Vanguard has a separate category for what it calls “Values-driven investments.” Saying "values-driven" instead of "ESG" is a deliberate (and I suspect carefully made) choice.

Also, Vanguard added Baillie Gifford Global Positive Impact Stock (VBPIX) to VCEP’s lineup, but not its other two active ESG-oriented funds—Global ESG Select Stock (VEIGX) and Global Environmental Opportunities Stock (VEOIX).

Vanguard is walking a fine line when it comes to ESG.

Your Wait Time Is ...

I eagerly look forward to the day when I can rave about Vanguard’s technology and customer service—today is not that day.

Tuesday morning, between 1:55 am and 2:19 am, I received 28 emails from Vanguard Brokerage Services letting me know that the latest PRIMECAP Odyssey semiannual report is available. I appreciate the heads-up, but I only own PRIMECAP Odyssey Aggressive Growth (POAGX) in three accounts at Vanguard … I didn’t need nearly 30 emails crowding my inbox.

Also, I recently heard from a subscriber that the balance in his sweep account was not showing on Vanguard’s website. That’s clearly not good, but compounding the issue … the wait time to speak with someone at Vanguard was nearly an hour!

I know … no one is perfect. But Vanguard can and should do better.

Our Portfolios

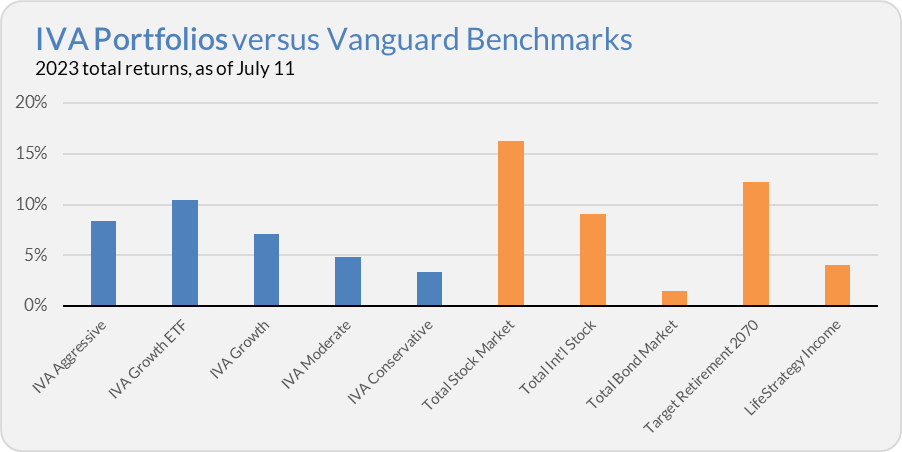

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 8.4%, the Growth ETF Portfolio is up 10.4%, the Growth Portfolio is up 7.1%, the Moderate Portfolio is up 4.9% and finally the Conservative Portfolio is up 3.3%.

This compares to a 16.3% gain for Total Stock Market Index (VTSAX), a 9.1% return for Total International Stock Index (VTIAX), and a 1.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 12.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.1% for the year.

Until my next IVA Weekly Brief this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member, yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.