Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, June 14.

There are no changes recommended for any of our Portfolios.

Taking a Breather

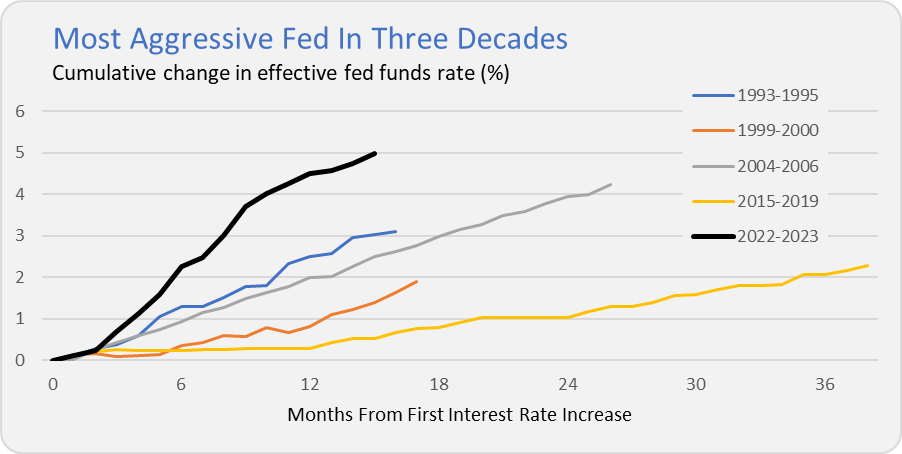

Fed Chair Powell and his colleagues concluded their two-day meeting today and left interest unchanged for the first time since March 2022. It’s been a busy 15 months for Powell and company as they took the fed funds rate from the near-zero bound of 0.00%-0.25% all the way to 5.00%-5.25%.

To put that into perspective, the chart below compares the Federal Reserve’s (Fed) current action to the past four interest rate hiking cycles. In short, over the past three decades the Fed hasn’t raised rates this quickly nor by this much. Then again, the Fed hasn’t had to contemplate inflation running around 9% over the past three decades. Speaking of inflation …

Inflation Check-In

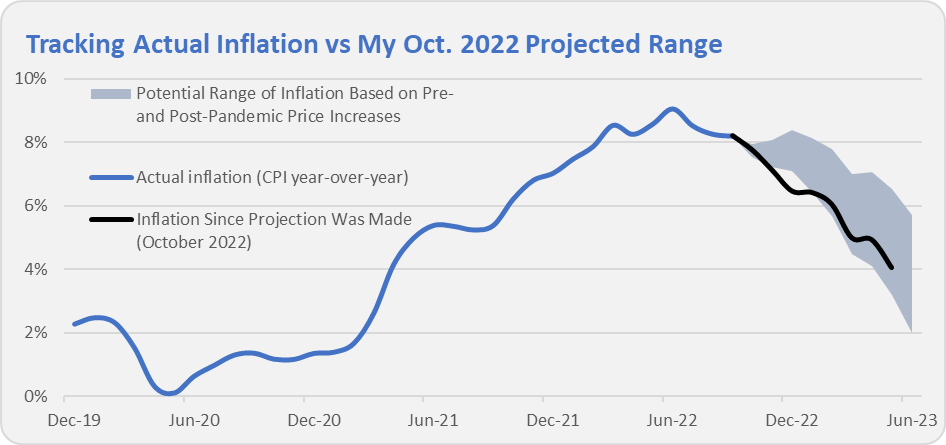

A month ago, I said “we can be pretty confident that the annual inflation figure will drop over the next two months.” Well, according to the Bureau of Labor Statistics (BLS), consumer prices increased 0.1% in May, which means over the past year the Consumer Price Index (CPI) is up 4.0%—down from April’s annual inflation rate of 4.9%. One month down, one to go.

For several months now, I’ve been comparing reported inflation against the range I forecast back in October—below is the latest update. My base case assumption was for inflation to slow but to stay above pre-pandemic levels. As we near the end of this experiment, my forecast is spot on.

It wouldn’t surprise me if the annual inflation figure for June clocks in somewhere around 3%. I typically don’t make short-term economic predictions like this, but, simple math is driving that roughly 3% expectation. Prices increased 1.2% in June 2022. With that number rolling off the annual calculation, unless prices increase 1% or so this month and next, then the annual inflation figure will drop again.

Inflation of 3% is above the Fed’s target of 2% and would be running hotter than we did for most of the 2010s but, well, it is also a far cry from 9% inflation. With inflation cooling coupled with how hard and fast the Fed has run for the past 15 months, it’s only reasonable the Fed took a breather and to assess the situation before taking further action.

When Average Isn’t Good Enough

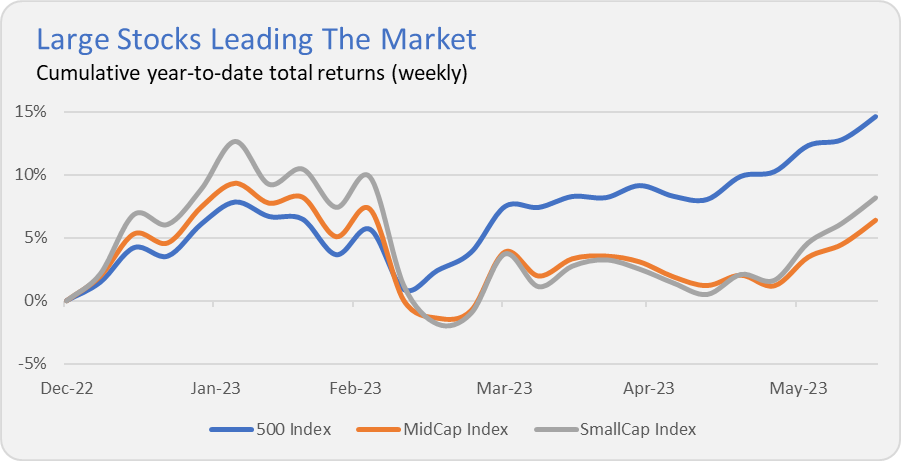

As I said last week, I don’t think there is much to be gained from engaging in the “are we in a new bull market?” debate. What is clear is that a handful of large stocks have been driving a lot the “market’s” return—or at least the return of the S&P 500 index. There are countless ways to slice and dice the market, but here are just two cuts of the data:

First, we can compare S&P 500 ETF (VOO) to Invesco’s S&P Equal Weight ETF (RSP). Vanguard’s ETF (and the S&P index cited in the media) follows a market-cap weighting system which gives more dollars to the largest companies. The equal weight ETF, as you might guess by the name, gives the same dollars to all of the stocks in the S&P index. So far this year through Tuesday, S&P 500 ETF had gained 14.7% while the S&P Equal Weight ETF was up 5.0%.

This tells me that a handful of large stocks are driving returns for the traditional S&P 500 index. Consider that Amazon, Google (Alphabet), Apple and Microsoft are up around 40% to 50% this year while Tesla, Facebook (Meta) and NVIDIA are up 110%, 125% and 180%, respectively. Those seven companies account for nearly 25% of the index. If you don’t own those seven companies—or even simply don’t own them as much as the index—you’ve been out of luck this year.

We can also see this narrow market leadership by comparing the performance of 500 Index (VFIAX) to MidCap Index (VIMAX) and SmallCap Index (VSMAX). As you can see, stocks of all sizes roughly rose and fell together during the first two-and-a-half months of the year. In mid-March, large stocks (measured by 500 Index) began to pull ahead and have a healthy lead of six to eight percentage points over small- and mid-sized stocks.

How to explain the divergence? Part of the story may be that as the deadline to raise the debt ceiling came into focus and the debate intensified, there was a flight to safety (or quality) within the stock market. Basically, investors were banking on Apple and Microsoft’s ability to weather a default or recession better than the average small company out there.

More recently, artificial intelligence (AI) has sparked interest and demand in these companies and their stocks. There’s simply no other way to explain NVIDIA’s rise this year other than the emergence of AI into the limelight. Microsoft and Google are big players in the AI space as well.

Will the largest stocks continue to drive the market returns? It’s impossible to say. But I’d note that small stocks are already beginning to close the gap—through Tuesday night, SmallCap Index is up 7.7% in June while 500 Index is up 4.6%.

Our Portfolios

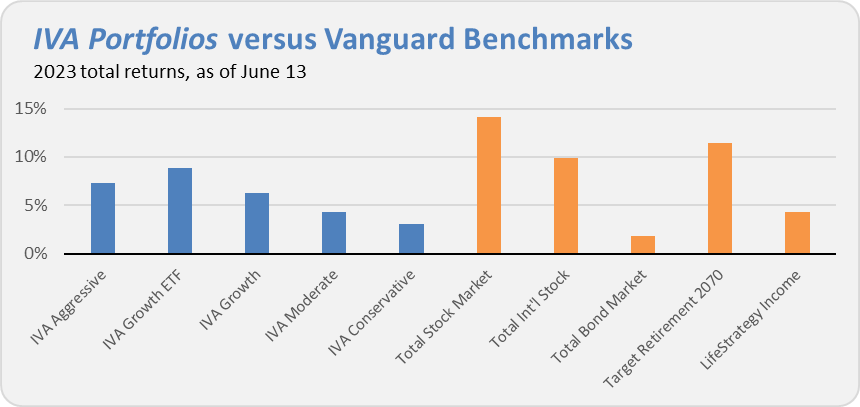

Our Portfolios are showing positive but lagging returns for the year through Tuesday. The Aggressive Portfolio is up 7.3%, the Growth ETF Portfolio has gained 8.8%, the Growth Portfolio is up 6.3%, the Moderate Portfolio has returned 4.3% and finally the Conservative Portfolio is up 3.1%.

This compares to a 14.1% gain for Total Stock Market Index (VTSAX), a 9.9% return for Total International Stock Index (VTIAX), and a 1.9% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 11.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.3% for the year.

How to explain our lagging returns this year? There are two main culprits: Dividend Growth (VDGIX) and Health Care ETF (VHT).

Don Kilbride and Peter Fisher have steered Dividend Growth to a gain of just 1.2% so far this year. They’ve fallen behind by not owning those seven companies I mentioned above. Okay. They own Microsoft and it is a top-10 holding, but they still have about half as much allocated to the tech giant compared to the S&P 500 index.

As I’ve explained, I don’t expect Dividend Growth to keep up with the market when stocks are rallying (and a few highflyers are doing the driving)—so, to see the fund behind the curve this year isn’t a surprise. It isn’t fun to be trailing but look beyond the past six months and things look a bit better. For example, since the end of 2021, Dividend Growth is off just 3.7% while Total Stock Market Index has dropped 8.1%.

As for Health Care ETF, well, the sector fund had a good 2022 but has been out of favor this year. Expand the time horizon from 6 months to 18 months, and Health Care ETF is ahead of the broad market—down just 6.9%.

The bright spots in our Portfolios have been International Growth (VWIGX) and Capital Opportunity (VHCOX)—up 14.0% and 13.5%, respectively. And if you followed my advice and bought PRIMECAP Odyssey Aggressive Growth (POAGX) when it reopened in December, well, it’s up 17.7% this year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.