Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, December 13.

There are no changes recommended for any of our Portfolios.

Fed Chair Jerome Powell and his colleagues continue to sit back and watch how events unfold. In 2022, policymakers raised the fed funds rate by 4.25%. During the first seven months of this year, they added another full percentage point—hitting the 5.25% to 5.50% range. But they’ve held steady since the end of July.

I can’t blame policymakers for sitting on their hands—neither raising interest rates further to fight inflation nor cutting them to battle an incipient recession. The unemployment rate ticked down from 3.9% to 3.7% in November. Headline inflation (measured by the Consumer Price Index or CPI) also came in marginally lower—down from 3.1% to 3.0%.

Low unemployment and slowing inflation? That’s what the Fed wants. Why mess with a good thing?

A quick note on inflation: Don’t be surprised to see inflation clock in a little higher next month. If prices are unchanged in December, the annual inflation rate will increase from 3.0% to 3.5%.

How’s that possible? Prices actually fell 0.3% last December. This means that while prices are currently up 3.0% over the past 12 months, they have increased 3.5% since the start of the year.

When you read articles in a month warning about rising inflation, don’t be alarmed—it’s just math.

Last week, I told you that 500 Index (VFIAX) was nearing a new record total return high. As of Tuesday’s close, the flagship index fund was only 0.12% below a new high—once you count dividends, which all investors should. As I write this, it seems likely 500 Index will set a new record tonight.

And, if you were curious, here’s a list of Vanguard’s diversified stock and balanced funds that beat 500 Index (VFIAX) to the punch and have notched new record highs over the past few days:

- Dividend Appreciation Index (VDADX)

- Dividend Growth (VDIGX)

- Global Wellington (VGWLX)

- Global Minimum Volatility (VMVFX)

- PRIMECAP (VPMCX)

- PRIMECAP Core (VPCCX)

- Selected Value (VASVX)

- U.S. Minimum Volatility ETF (VFMV)

- U.S. Multifactor (VFMFX)

- Windsor II (VWNFX)

Yes, the attention may be on the S&P 500 and the funds and ETFs that track it, but investors in a host of funds and strategies are benefiting from a growing economy unencumbered by worries about inflation, jobs or recession.

Turning to Malvern

If you follow the news, it hasn’t been a great week for Vanguard.

First, I told you a month ago that Vanguard was in the process of closing Vanguard Invest—its direct investing platform in Germany. Well, Vanguard reportedly spent as much as $65 million to design the platform, which attracted less than $5 million in client assets as of the end of 2022.

I can’t verify those numbers, but I suspect they are directionally correct—if the platform was growing by leaps and bounds, Vanguard wouldn’t have shut it down.

Second, closer to home, Vanguard has been subpoenaed by the House Judiciary Committee. I told you in July that lawmakers had requested documents from Vanguard, BlackRock and State Street (the three biggest index fund companies) explaining their ESG (environmental, social and governance) efforts. Lawmakers were (and still are) concerned that the companies may have violated antitrust law by coordinating efforts to decarbonize their assets.

The subpoena claims that Vanguard’s response to the House’s initial inquiries has been “inadequate.” While Vanguard has provided 3,619 documents—not all were relevant to the matter—that falls far short of what others have provided.

That said, reports are that subpoenas are coming for BlackRock and State Street … we’ll see.

It’s still not clear where these efforts will lead. The recent subpoena letter says the Committee is motivated “to advance our oversight and inform potential legislation related to collusive ESG policies …” That’s pretty vague and also smacks of politics rather than policy.

Not So Fast

Last week, I told you that Vanguard had launched two new active bond ETFs—Core Bond ETF (VCRB) and Core-Plus Bond ETF (VPLS). That wasn’t quite right.

Vanguard did indeed launch Core-Plus Bond ETF last week. Core Bond ETF, however, will launch … sometime before year-end. My apologies for any confusion; the prospectus I saw includes both ETFs and lists December 6 as the effective date.

However, when it comes to ETFs, being “effective” doesn’t necessarily mean the fund has started trading. Here’s how Vanguard explained it:

Unlike mutual funds, which typically are available for investment the same day that the updated regulatory documents are filed, Vanguard ETFs can have a slight lag between the effective date of the filings and the start of trading for the ETFs. Such planned lags enable Vanguard to ensure that investors have a smooth experience when purchasing the new ETFs.

Well, I learned something new!

Vanguard also stressed that “the staggered launches of Core Bond ETF and Core-Plus Bond ETF do not represent a change in Vanguard’s plan to roll out these new products to investors.” I’ll keep an eye out and let you know when Core Bond ETF is up and running—it shouldn’t be long now.

Distributions Coming

A friendly reminder: Vanguard’s mutual funds and ETFs will start paying out capital gain distributions on Friday. You can find everything you need to navigate distribution season confidently here.

As I warn every year at this time, if you see one of your funds’ price drop dramatically on a given day, chances are it is not market related but rather due to a capital gains payout.

Our Portfolios

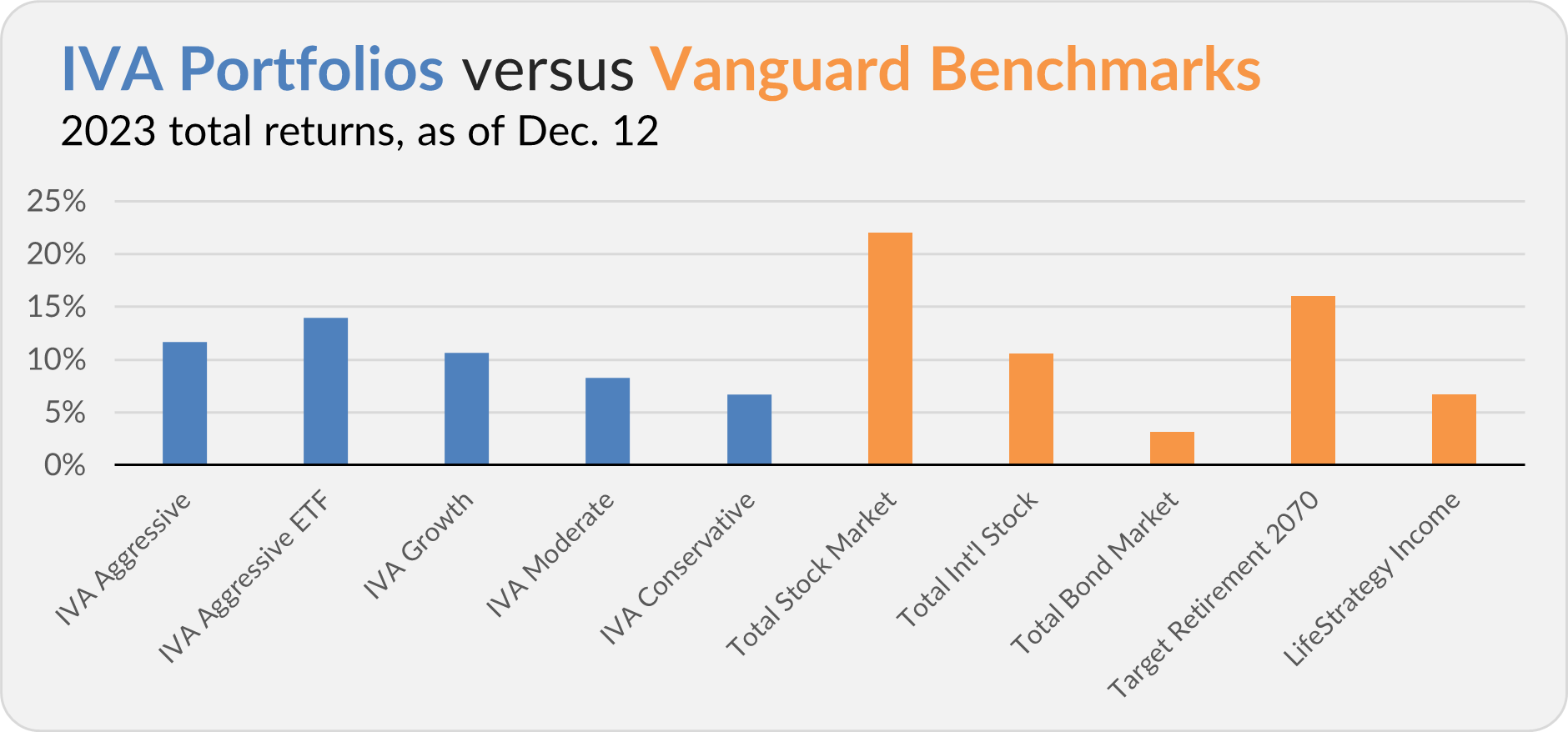

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 11.6%, the Aggressive ETF Portfolio is up 13.9%, the Growth Portfolio is up 10.6%, the Moderate Portfolio is up 8.2% and the Conservative Portfolio is up 6.7%.

This compares to a 22.0% gain for Total Stock Market Index (VTSAX), a 10.5% return for Total International Stock Index (VTIAX), and a 3.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 16.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.7%.

IVA Research

Yesterday, in What Have You Done for Me Lately?, I shared my analysis of the PRIMECAP Management-run funds with Premium Members. Next week, I’ll be digging into the performance of my Portfolios.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.