Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, June 5.

There are no changes recommended for any of our Portfolios.

As long-term risk-aware investors, one of the big questions (if not the big question) we each have to answer for ourselves is how much of our portfolios should be invested in stocks and how much in bonds.

For most investors, that decision is driven by our investment time horizons and how much risk we are willing and able to take. However, for some investors, the answer also depends on whether stocks or bonds are more attractively priced.

Well, for the first time in roughly two decades, bonds look like relative bargains compared to stocks. Let me explain.

Bonds are relatively easy to value. A bond’s yield at purchase determines your return if you own that bond until its maturity (or end date). For example, as of Tuesday’s close, the 10-year Treasury yielded 4.33%. The bond's price will fluctuate over time, but if you buy today’s 10-year Treasury bond, you will earn a 4.33% annual return if you are patient and hold the bond until it matures and the U.S. Treasury returns the money it borrowed from you.

Stocks are a little harder to value. Since we are talking “yields,” it may be tempting to look at dividend yields. But that’s not quite right because not all of a company’s earnings are paid out via dividends. Heck, some companies don’t pay dividends at all.

The price-to-earnings (p-e) ratio is a common measure of how cheap or expensive a stock (or the stock market) is. It tells you how much you are paying for each dollar of earnings.

According to Standard & Poor’s, the S&P 500 index has a p-e ratio of 27.0. (You can find many different p-e ratios out there. This p-e ratio is based on the index's price as of Tuesday’s close and its “as reported” earnings per share from 7/1/23 through 6/30/24. The most current quarter’s earnings are estimated.)

How does a p-e ratio of 27.0 compare to the 10-year Treasury’s 4.33% yield? To get an apples-to-apples measure, we can invert the stock index’s p-e ratio (27.0). This gives us an earnings-to-price measure or, as it’s commonly referred to in the investment world, an earnings yield. Today’s S&P 500 has an earnings yield of 3.71%.

The earnings-yield measure has been tracked for decades, and as you can see in the chart below, bond yields are higher than stock earnings yields for the first time since 2004. (I don’t count the global financial crisis in this declaration because earnings were so messy that it doesn’t count.)

So, by one well-known metric, bonds look cheap compared to stocks for the first time in a long time. To be clear, I’m not arguing that you sell your stocks (or stock funds) en masse to buy bonds. I wouldn’t recommend overhauling your portfolio based on one factor. But it’s worth noting.

It’s also worth noting that this yield comparison isn’t a flawless tool for timing your trades between stocks and bonds. For example, for most of the 1990s, bonds outyielded stocks. That didn’t stop stocks from trouncing bonds over the decade—500 Index (VFIAX) returned 426% while Total Bond Market Index (VBTLX) only gained 107%.

What the chart tells us is that after a lengthy bear market in bonds and a bull market in stocks, bonds are starting to look relatively attractively priced. So, if you’re looking at your bonds and their punk returns over the past three years, don’t sell when their value is beginning to look attractive.

One More RMD Follow-up

In June’s monthly recap article, Calm Seas Turning Choppy, I shared a few potential pitfalls some IVA readers had run into when taking their RMDs later in the year. Well, several of you wrote in pushing back on this point:

… if you take your RMD late in the year and pay estimated taxes quarterly, you’ll need to factor your RMD into your estimated tax payments as if your RMD were spread throughout the year.

I appreciate the “pushback” as it’s the only way we learn. Plus, I want to share accurate and helpful information with you all. If I made a mistake, I’d rather correct it than hide it under the rug.

The rules around estimated taxes are not simple—as you can see here. Frankly, to play it safe, I probably should’ve hedged my original statement by saying, “… you may need to factor in your RMD into your estimated tax payments.”

While the IRS has a method—the annualized income installment method—to handle situations where you receive income unevenly throughout the year, you must fill out additional worksheets and forms. At least one of your fellow IVA readers got caught on this and paid a penalty.

As I understand it, the easiest way to avoid getting penalized for underpaying your estimated taxes is to make so-called safe harbor payments. This means paying 90% of the tax you owe this year (2024) or 100% (or 110%, depending on your adjusted gross income) of the tax you owed the prior year (2023).

However, let me repeat what I said in the monthly recap article: I’m not a tax professional, so, as with all tax-related commentary, please consult your accountant.

Shake Up at Explorer Value

On Monday, Vanguard announced it had fired Cardinal Capital Management from Explorer Value (VEXFX). Vanguard has replaced Cardinal with Wellington Management and handed Ariel Investments (which joined the fund in 2022) a larger portion of the fund’s assets to invest.

Under the new management structure, Frontier Capital will continue to invest 45% of Explorer Value’s assets. Ariel’s responsibilities are increasing from 17% to 27.5%. Wellington’s Sean Kammann will oversee the final 27.5% of the portfolio. The fund's expense ratio is expected to increase from 0.49% to 0.53%.

When the news broke, I shared it and my take on what it means for the fund with Premium Members—see here.

Khan Out

Today, Vanguard quietly alerted shareholders that Awais Khan is no longer a co-manager of a dozen index funds and ETFs. (You can see the funds listed below.) I say “quietly” because unless you keep a close eye on Vanguard’s filings with the SEC (which I do), then you wouldn’t know about Khan’s departure. (Unless, of course, you’re an IVA reader!)

- Communication Services Index

- Consumer Discretionary Index

- Consumer Staples Index

- Energy Index

- MidCap Index

- MidCap Growth Index

- MidCap Value Index

- S&P MidCap 400 ETF

- S&P MidCap 400 Growth ETF

- S&P MidCap 400 Value ETF

- Tax-Managed Capital Appreciation

- Utilities Index

Vanguard has not responded to my inquiry into whether Khan has left the firm or assumed a different role. Notably Vanguard has not replaced Khan on any of the funds; his co-managers will continue without him. That suggests his departure wasn’t planned. I suspect it’s only a matter of time before Vanguard adds co-managers to the funds.

Vanguard ought to announce all manager changes to shareholders. Maybe it doesn’t matter who (specifically) is managing your index fund—it might just be enough that it says Vanguard on the label—but Vanguard should err on the side of transparency.

Also “announced” in today’s SEC filings, Vanguard’s internal municipal money market fund—Vanguard Municipal Cash Management Fund—is no longer a money market fund. In March, the board approved reclassifying it as a short-term municipal bond fund and changing its name to Vanguard Municipal Low Duration.

I believe this change is more of a response to changes in municipal money market regulations than a material change in the fund's approach. In other words, I'm not going to lose any sleep over this.

Our Portfolios

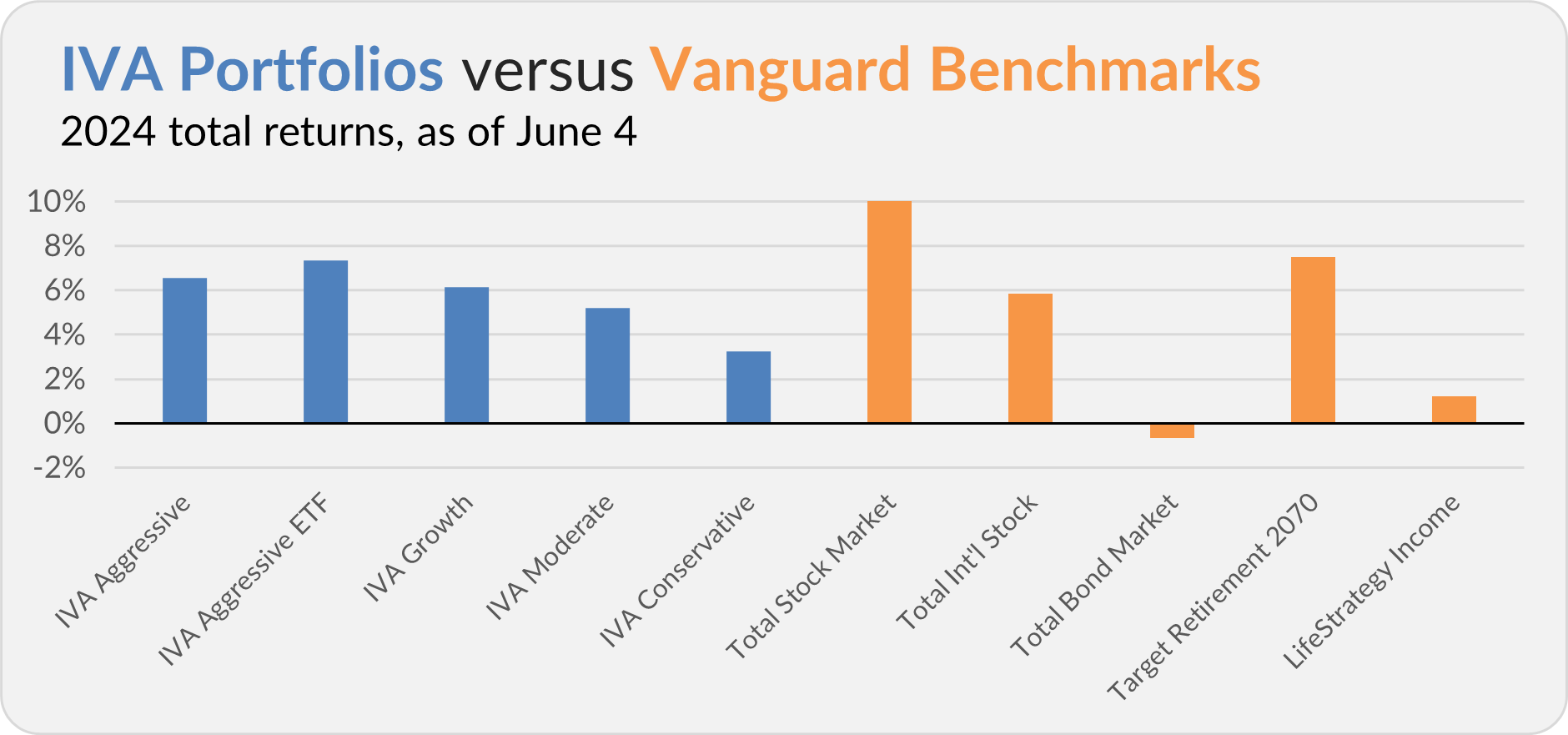

Our Portfolios are showing positive but mixed returns for the year through Tuesday. The Aggressive Portfolio is up 6.5%, the Aggressive ETF Portfolio is up 7.3%, the Growth Portfolio is up 6.1%, the Moderate Portfolio is up 5.2% and the Conservative Portfolio is up 3.2%.

This compares to a 10.2% gain for Total Stock Market Index (VTSAX), a 5.8% return for Total International Stock Index (VTIAX), and a 0.7% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 7.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.2%.

IVA Research

Yesterday, in Gifting a Roth IRA, I told Premium Members how they can jumpstart a young person’s retirement.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.