Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 20.

There are no changes recommended for any of our Portfolios.

Federal Reserve policymakers concluded their second two-day meeting of the year today. As expected, they sat on their hands and left the fed funds rate unchanged. As I told you last week, the economy is in good shape, with inflation around 3% and unemployment below 4%. So, policymakers can sit back and see how future data rolls in.

As investors, we’ll continue to earn 5% on money market funds—for the time being. I’ve seen several articles lately lamenting the end of this “5% era.” (See here, for example.) The hand-wringing is a little over the top if you ask me.

If, down the road, Fed officials cut the fed funds rate three times this year (as is expected), the benchmark interest rate would drop from its current 5.25%—5.50% range to a 4.50%—4.75% target. Let’s take the lower number.

Would I rather earn 5.27% on Federal Money Market (VMFXX) than 4.50%? Yes, of course. But 4.50% is still better than inflation and more than anyone earned on cash over the last decade—that’s still a win.

A lot of energy is exhausted trying to predict the Fed’s next move. For long-term investors, this is just noise. Barring a dramatic turn in the economy, the Fed’s next move will be a policy tweak, not a shift in the tide.

Securities Lending for All?

Vanguard is out pushing its (relatively) new Fully Paid Lending program on brokerage clients. I just received an email from Vanguard telling me I could “generate additional income using securities [I] already own.” Vanguard then told me how I could benefit and invited me to “explore this opportunity.”

This “opportunity” is commonly called securities lending. It involves loaning shares of a stock you own to a counterparty (typically someone who wants to short the stock, like a hedge fund) in exchange for some income. “Fully Paid Lending” makes it sound fancy, mysterious, or, well, I don’t know. But it’s nothing Vanguard invented, and it does involve some risk.

If you want to learn more about securities lending and Vanguard’s program, I wrote about it when Vanguard first rolled out Fully Paid Lending in June—see here.

The catch nine months ago was that Fully Paid Lending was only available to “self-directed Vanguard investors with a minimum of $5 million in assets” and a Vanguard brokerage account.

The email I received on Monday says the program “is only available to eligible clients like you.” I, umm, don’t have $5 million in assets. Unfortunately, neither the email nor the website clearly state the eligibility requirements. I’ve asked Vanguard for clarity on the requirements but haven’t heard back. I’ll let you know when I do (if I do).

In the meantime, I’m left wondering if the requirements have changed or if Vanguard is blasting this email out to customers regardless of their eligibility status.

I hope it’s the former. I hope that Vanguard respects my inbox (and time) enough not to send me offers I’m not eligible for.

And as for signing up to lend my shares, as I wrote last summer, I’ll probably let it pass me by. I don't own individual stocks (where most of the opportunity for securities lending lies). And, frankly, I don’t need another complication for an extra basis point or two of income.

Clearing the Air

Last Wednesday, I warned you that the “Many Happy Returns" email campaign that appeared to have been sent by Vanguard had set off my scam-alert alarm bells. As I told Premium Members in a Quick Take on Thursday, it was a false alarm.

Many Happy Returns wasn’t a scam. It was a well-coordinated campaign by the activist group The Yes Men. It was run in support of the broader Vanguard S.O.S. campaign, which aims to raise awareness of what they see as a disconnect between being worried about the climate and owning a Vanguard mutual fund.

In addition to the fake Vanguard press release, the group also forged PR materials and websites from Apple and Hims as part of the Many Happy Returns campaign. On top of that, the group also produced a mock commercial, wrote a phony scientific article, delivered a presentation at Wall Street’s Green Summit conference and appeared on local TV news.

Whether this well-coordinated hoax will achieve the group's goals or if they'll get sued by any of the companies, well, time will tell. But, as I’ve said before, Vanguard, as an “elephant in the investing room,” is now a target for activists. This isn’t the first attempt to influence Vanguard’s behavior (or its clients), and it won’t be the last.

FTSE’s Call

Vanguard and FTSE (the index provider behind Vanguard’s foreign stock index funds and ESG stock ETFs) will no longer rely on the United Nations Global Compact Principles when deciding which stocks to include or exclude from ESG U.S. Stock ETF’s (ESGV) and ESG International Stock ETF’s (VSGX) portfolios.

Here's a little background on how the two ESG ETFs function: FTSE builds its ESG indexes by screening out companies involved in a long list of activities or products—think adult entertainment, alcohol, tobacco, gambling, firearms, weapons, coal, oil, etc. They then send the list of approved companies and their weights to Vanguard, which buys and sells the stocks.

In addition to screening companies against that long list of excluded activities and products, FTSE also kicks companies out of the index that, in its judgment, fall short of particular labor, human rights, environmental, and anti-corruption standards. In the past, those standards were defined by the United Nations.

Below is the language in the old prospectus.

The Index methodology also excludes the stocks of companies that, as FTSE determines based on its internal assessment, do not meet certain labor, human rights, environmental, and anti-corruption standards as defined by the United Nations Global Compact Principles, as well as companies that do not meet certain diversity criteria.

FTSE will still be able to remove companies based on its assessment, but it dropped the “as defined by the United Nations Global Compact Principles” language. Below is the updated text.

The Index methodology also excludes the stocks of companies that, as FTSE determines based on its internal assessment, do not meet certain labor, human rights, environmental, and anti-corruption standards, as well as companies that do not meet certain diversity criteria.

My guess is that this move gives FTSE more flexibility to manage the index while lowering their reporting requirements—if you say you’re following an outside definition, you have to demonstrate that.

Ultimately, this doesn’t move the needle for investors in these ESG ETFs. FTSE isn’t going out on a ledge here. Plus, with over 1,400 stocks in ESG U.S. Stock ETF’s portfolio, it’s not like any company or holding has much impact.

Over time, you could do much worse than owning these diversified, low-cost ETFs. Just don’t expect that owning ESG U.S. Stock ETF or ESG International Stock ETF will lead you to outperform the market or move the needle on any ESG issue that’s particularly important to you.

Permanently Closed

A final bit of Vanguard-related housekeeping.

Vanguard has “permanently closed” two underutilized share classes: The Institutional Select shares of Total International Bond Index (VSIBX) and the Institutional shares of S&P 500 Growth Index (VSNGX). The two share classes have under a million dollars in assets, so this move doesn’t impact many people.

Our Portfolios

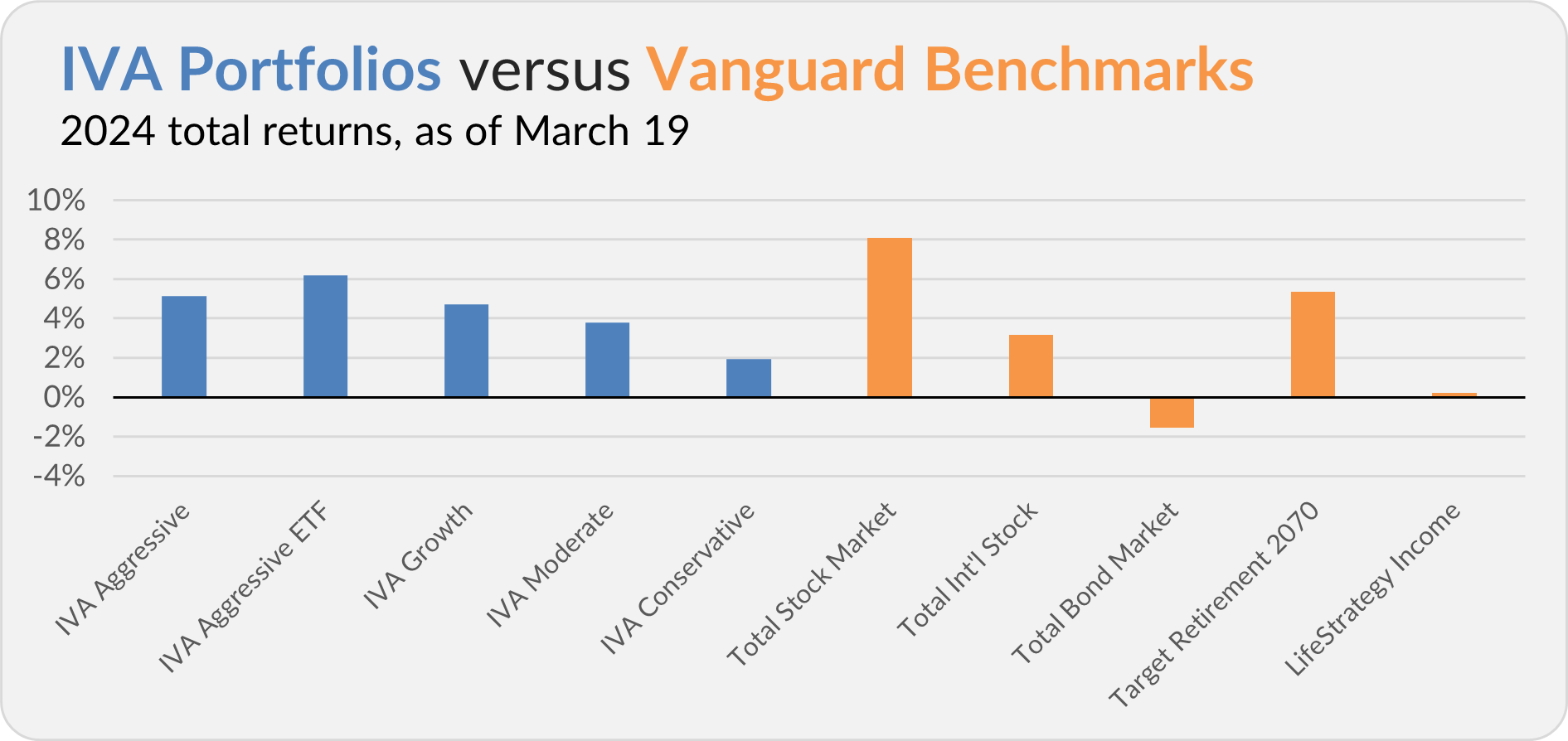

Our Portfolios are showing reasonable returns for the year through Tuesday. The Aggressive Portfolio is up 5.1%, the Aggressive ETF Portfolio is up 6.2%, the Growth Portfolio is up 4.7%, the Moderate Portfolio is up 3.8% and the Conservative Portfolio is up 1.9%.

This compares to an 8.1% return for Total Stock Market Index (VTSAX), a 3.2% gain for Total International Stock Index (VTIAX), and a 1.5% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.2%.

IVA Research

Yesterday, I started my three-part series for Premium Members exploring 529 plans—a tax-advantaged college savings vehicle. In the first installment, Tax-Free Savings for College, I covered the basics of 529 plans. In the weeks ahead, I’ll dig into The Vanguard 529 Plan and give you my take on how to invest your 529 plan assets.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.