If you’ve ever watched an NFL game, you know that even those giant linemen can move fast—if over short distances. According to Wikipedia, the average center (the enormous human hiking the football) runs the 40-yard dash in 5.3 seconds! That’s faster than the average person, and NFL centers are far from average in size.

Why am I talking about sports? (I don’t even consider myself a football fan. I, umm, didn’t watch the Super Bowl this year!) Well, in February, some of the biggest stocks showed that they, too, can sprint.

On February 2, Meta (better known as Facebook) became the first company to add over $200 billion to its market capitalization in a single day, when its stock price jumped 20%.

Not to be outdone, on February 22, NVIDIA gained 16%, adding $272 billion to its market capitalization.

Let’s look at these big one-day gains through a Vanguard lens.

At the start of the year, Vanguard held 186 million shares of Meta (across all of its funds). Based on my math, Vanguard’s Meta position increased $16.4 billion in value on February 2.

The NVIDIA numbers are even larger. Vanguard held over 204 million shares of NVIDIA coming into the year, meaning its position increased in value by $22.6 billion on February 22. Not too bad!

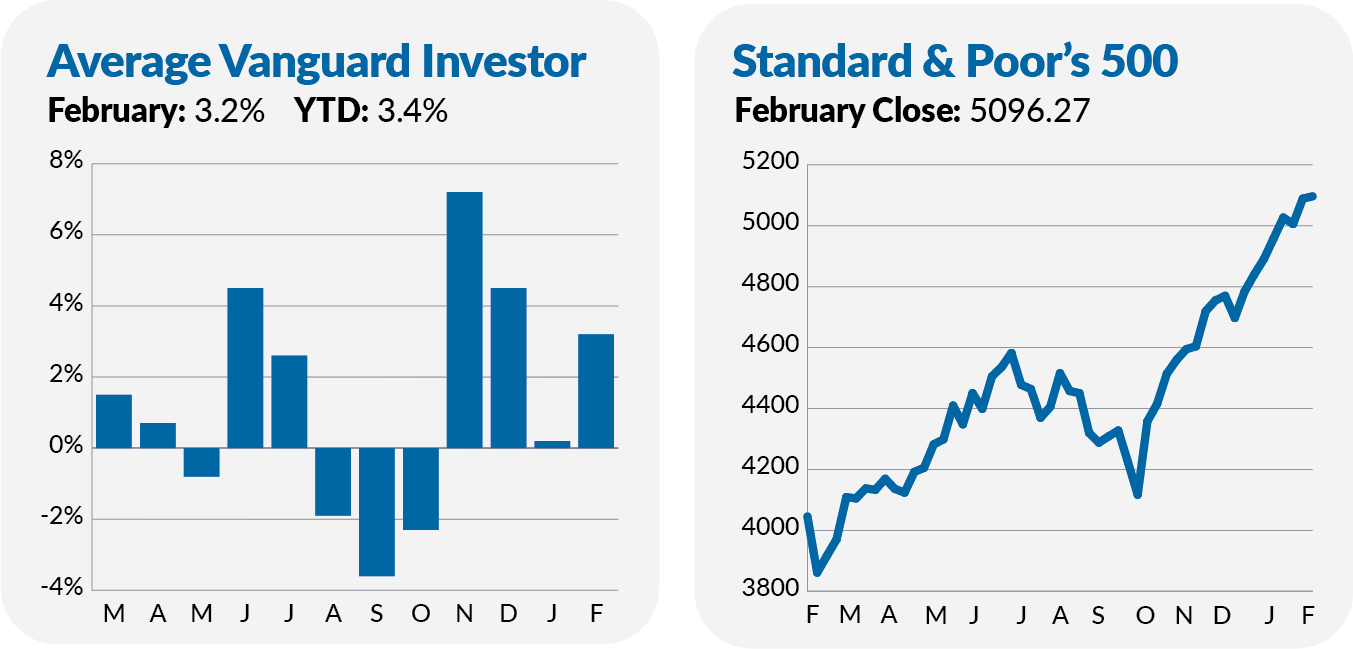

A lot was made in the media about NVIDIA driving the indexes higher. And those big one-day moves by Meta and NVIDIA certainly helped 500 Index (VFIAX) gain 5.3% in February.

But the gains in the stock market were more broad-based in February than they were in January. SmallCap Index (VSMAX), for example, gained 5.8%—beating 500 Index’s return.

Granted, Growth Index (VIGAX) still outpaced Value Index (VVIAX) by a decent margin, 7.0% to 3.3%. Also, foreign stocks trailed once again, with Total International Stock Index (VTIAX) gaining just 3.1%. So, February wasn’t exactly a turning point in the stock market.

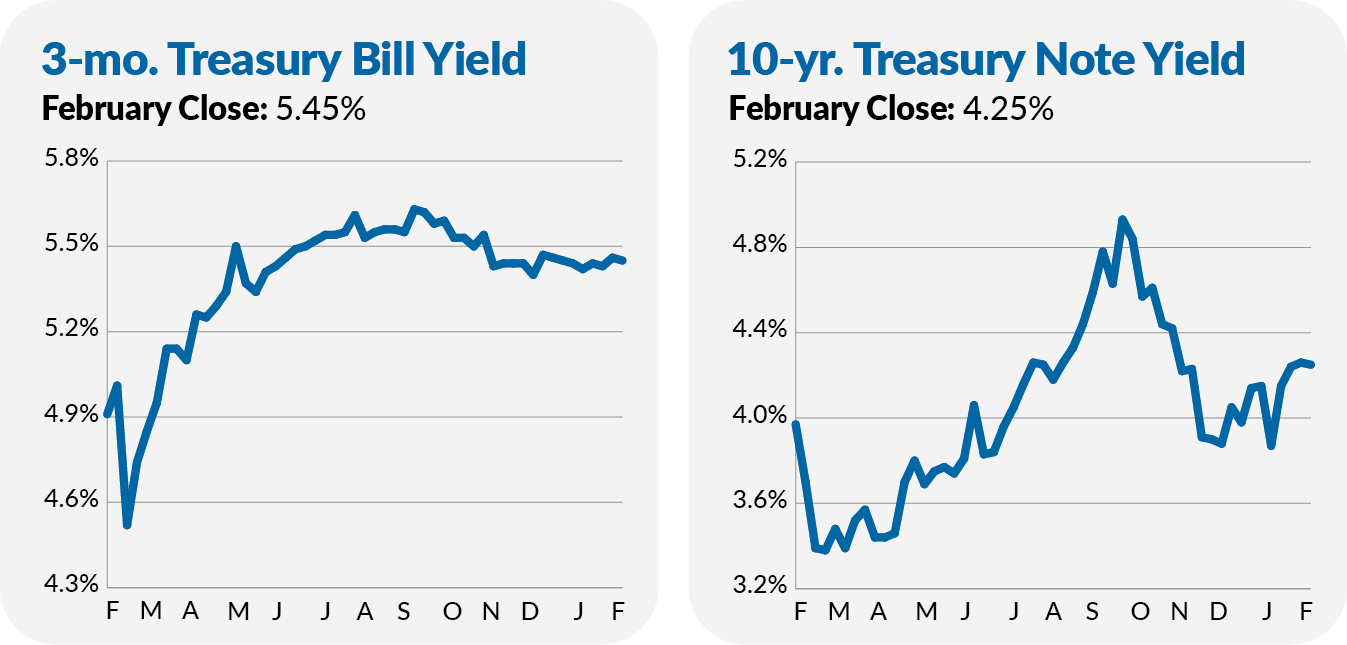

In the bond market, yields rose (and prices fell) as traders shifted their expectations about when Federal Reserve policymakers will cut interest rates. Total Bond Market Index (VBTLX) fell 1.4% in February.

As bonds continue to wobble (to use a technical term), investors are increasingly looking to cash. Next week, I’ll try to answer the question of whether cash has a role to play in a long-term investment portfolio. Stay tuned.

Land of the Rising Stock Market

As I told you yesterday, on February 22, Japan’s Dow-like Nikkei index hit a record high for the first time in nearly 35 years. I know that I’ve talked about this a few times already—notably here—but it is a “big” event, and I think there are some lessons investors can learn from it.