Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, February 28.

There are no changes recommended for any of our Portfolios.

Queue the confetti. Japan’s Dow-like Nikkei index closed at a record high of 39098.68 on Thursday, February 22. That was the index’s first new high in … 12,473 days, or a little over 34 years.

I shared my thoughts on the three lost decades in the Japanese stock market last week. But, in short, I see it as a prime example of why you don’t want to hitch your portfolio's fortunes entirely to any one country—even the United States.

Yes, I know Warren Buffett just explained in his latest shareholder letter how he has always had “a majority of [his] net worth in equities, U.S.-based equities.” So, if you want to stick with U.S. stocks, you’ll have good company.

While Buffett emphasized “U.S.-based” in the text, I’d call out a different word—majority. Buffett doesn’t own only U.S. stocks—he has ventured beyond our borders with Berkshire’s portfolio. Heck, he spent a fair amount of the letter discussing Berkshire’s “long-term” interest in none other than five Japanese companies and how he increased his holdings last year.

Do you need to go as far as Vanguard suggests and put 40% of your stock allocation and 30% of your bond holdings overseas? No. But owning some foreign stocks makes good financial sense—even Buffett has found investment opportunities overseas.

What’s more important than finding the optimal portfolio on a spreadsheet is finding the portfolio you can hold through time.

Buried in the Footnotes

First off, let me say that I’m not an accountant, and what follows isn’t tax advice.

That said, I’m going to talk taxes for a minute because a key data point for a fund that nearly all Vanguard investors own, Federal Money Market (VFMXX), is extremely easy to miss.

Starting from the beginning … the income earned from holding “U.S. government obligations” (think Treasury bonds) is taxed at the federal level but (generally) not at the state level. If you own a Treasury bond directly, this is pretty straightforward. But it also applies if you own a mutual fund (or ETF) that holds Treasurys and passes that income along to you.

Now, if you own a diversified mutual fund, chances are that not all of the income you received came from government obligations. Some of the income may have come from corporate bonds, for example. If you know how much of the income you received was from U.S. government obligations, you can report it accordingly and (potentially) save some money on your state taxes.

Fortunately, you don’t have to guess the number. Each year, mutual fund companies (including Vanguard) report what percentage of the income their funds paid out came from U.S. government obligations—but you typically have to go searching for it.

At Vanguard, you can find the relevant document in their tax center. For your convenience, I’ve included a copy below:

This year, Vanguard’s 1099s have a “Mutual Fund and UIT Supplemental Info” section, which includes the percentage of income that came from U.S. government securities for each fund you held over the year. All of the information in one place? That’s handy!

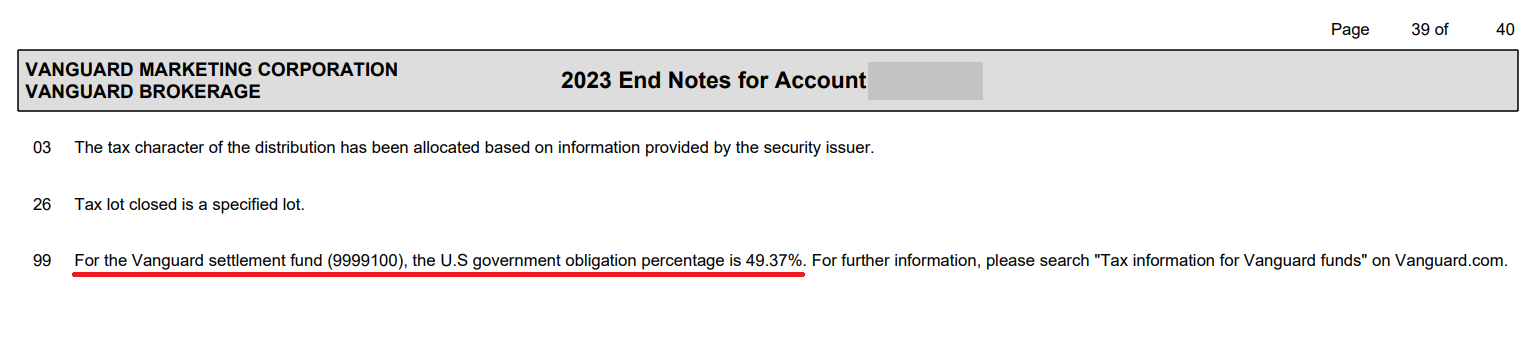

However, Federal Money Market, which is every Vanguard investor’s default settlement fund, is a glaring omission from the list. Technically, the information is there—on my 1099, it is buried in endnote 99 on the second to last page—it is just very hard to find. Even the most diligent accountant could be forgiven for missing it.

Putting the U.S. government obligation information on our 1099s is a nice touch from Vanguard. I applaud the effort. But why is the data for the one fund nearly all of us own relegated to the footnotes?

For the record, 49.37% of Federal Money Market’s income came from U.S. government securities last year. You might want to give your accountant a heads-up.

Round Five

Vanguard is out pounding the pavement (or at least inboxes), raising money for its fifth private equity fund.

As a reminder, Vanguard launched its private equity program in 2020 in partnership with HarbourVest. I use the word “program” deliberately because Vanguard doesn’t have just one private equity fund—it’s a series of funds.

You see, with a mutual fund, you can buy and sell shares day after day. And, unless Vanguard closes the mutual fund (temporarily or permanently), it has no “end date.” Private equity is different.

Vanguard is raising money for its 2024 private equity fund (called a “vintage” in private equity lingo). When Vanguard has raised a certain amount they will close the fund, and HarbourVest will get to work building the portfolio (primarily by giving the money to other private equity funds). This 2024 fund will run its course and distribute any profits to investors over time (think seven to 15 years from now).

Next year (in 2025), Vanguard will start raising money for its 2025 private equity fund. And the annual cycle of raising money for a new fund will continue for as long as Vanguard keeps running the program.

Vanguard is pushing fairly hard in its effort to raise money for the 2024 vintage. My mentor shared the email Vanguard sent him twice in one week inviting him to join the program.

Two things jumped out about the email.

First, it felt surprisingly sales-y for Vanguard. Here’s part of the pitch:

It's designed specifically for our most ambitious investors looking for potentially higher returns, and you're invited to join them.

How do you define an “ambitious investor?” A conservative investor? An aggressive investor? I’m familiar with those terms. But ambitious? That’s a new one to me. Your level of ambition isn’t what makes private equity an appropriate investment for you or not.

Second, the legal disclaimers dwarf the actual body of the email. The pitch for the private equity fund runs around 165 words. The legal notice clocks in at over 1,100 words!

And that may be all you need to know about private equity.

One final observation. Buried in the legalese is some information on fees.

In short, Vanguard charges an annual “Servicing Fee” ranging from 0.30% to 0.10%, depending on how much money you commit to the private equity fund.

When you sign up for a private equity fund, you commit to invest a certain amount of capital. The fund may or may not ask you to hand over all of that money—it depends on how many investment opportunities the managers find. Nonetheless, Vanguard will charge its Service Fee on your capital commitment, not the amount of capital that is “called.”

Now, 0.30% (or 30 basis points) may not be a lot in the world of private equity—but that’s just Vanguard’s cut. It doesn’t include HarbourVest’s fee, or the fees charged by the underlying private equity funds. The point is that fees on top of fees can start to add up.

Oh. And if you’re a client of Vanguard Personal Advisor Wealth Management, that 0.30% Service Fee will be charged on top of your annual advisory fee.

Our Portfolios

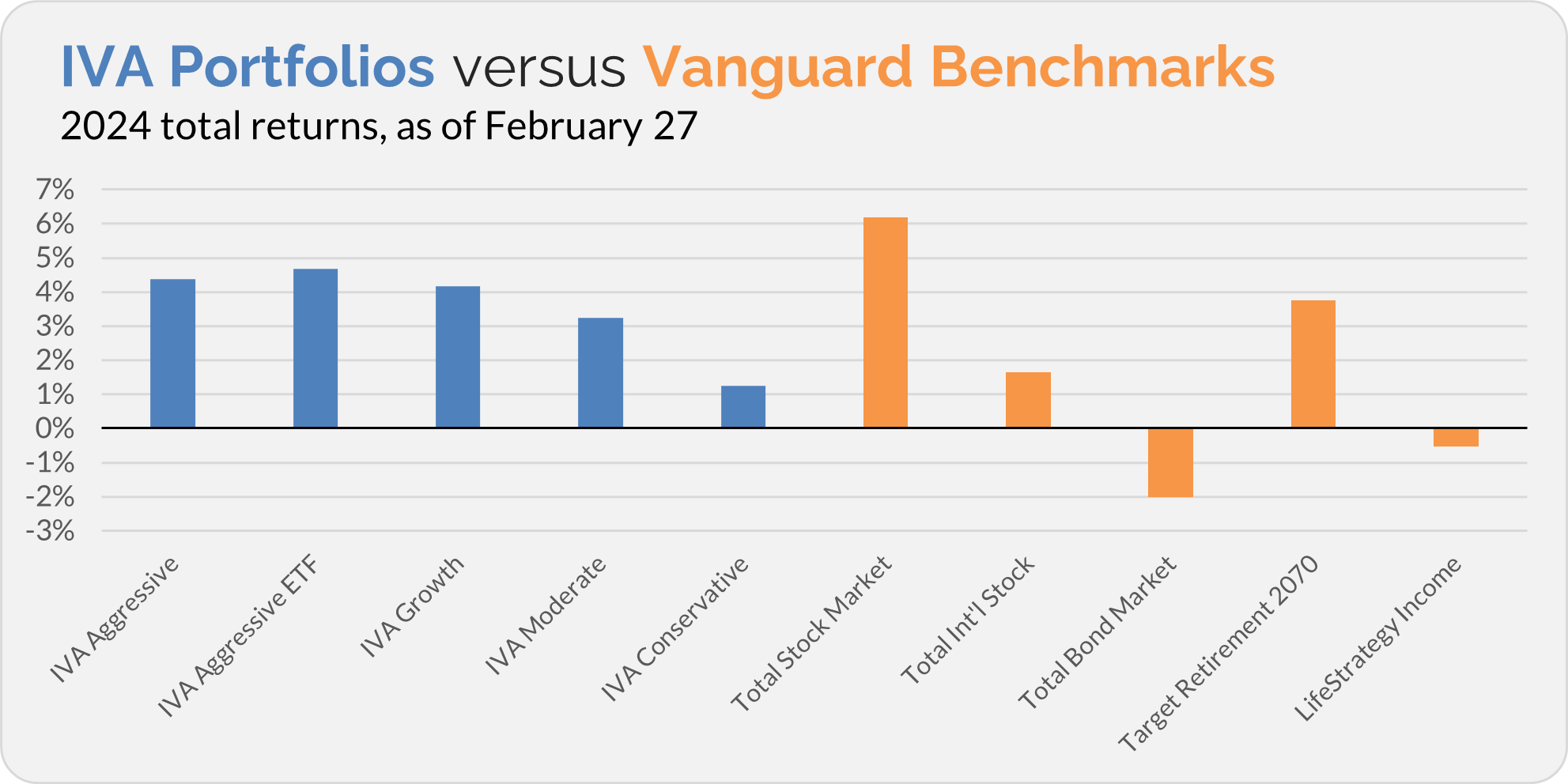

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 4.4%, the Aggressive ETF Portfolio is up 4.7%, the Growth Portfolio is up 4.2%, the Moderate Portfolio is up 3.2% and the Conservative Portfolio is up 1.2%.

This compares to a 6.2% return for Total Stock Market Index (VTSAX), a 1.6% gain for Total International Stock Index (VTIAX), and a 2.0% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 0.5%.

IVA Research

Yesterday, in Managing Your Cash, I shared a simple framework for managing your cash needs with Premium Members.

Next week, I’ll try to answer the question of whether cash has a role to play in a long-term investment portfolio. But before that, Premium Members can look forward to receiving my February recap article on Friday.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.