Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 6.

There are no changes recommended for any of our Portfolios.

With Super Tuesday behind us, we’re set for a repeat Biden vs. Trump presidential election this year—barring a dramatic turn of events. This isn’t a political newsletter, so I’ll leave my opinions at the door.

When it comes to investing and the markets, try to keep politics out of your portfolio. I always say that every four years, investors of one political party are at risk of letting politics (and emotion) derail them from spending time in the market. Don’t break Charlie Munger’s first rule of compounding—“never interrupt it unnecessarily”—because of who is sitting in the White House.

I’m sure I’ll repeat that message many times this year. As the election approaches, I’ll dig into how stocks performed under different Presidents and parties—stay tuned.

On a related note, I’ve received a handful of questions recently about the deficit and national debt. You can read my thoughts on the deficit here.

My quick take is that while the national debt is a big issue, there is no magic number at which the economy starts to break. This doesn’t mean our debt burden won’t become an issue someday; it just means no one can say with any confidence when that day will come. Oh, and remember that both parties have contributed to the deficit for decades.

But, as I said, this isn’t a political newsletter. Turning to the markets, Tuesday was far from super in the stock market.

500 Index (VFIAX) fell 1.0% on the day. The worst-performing stock fund in Vanguard’s stable, Information Technology ETF (VGT), fell 2.4%. The best-performing stock fund, Energy ETF (VDE), gained 0.7%. The best-performing diversified stock fund in Vanguard’s stable was U.S. Value Factor ETF (VFVA), up 0.2%.

That was only one day in the market, so big tech stocks remain in the driver's seat. But we are getting glimpses of what might do (relatively) well—smaller stocks, value stocks—if (when) big tech stocks stumble.

Buckley’s Out

As I told Premium Members last week when the news broke, Vanguard’s Chairman and CEO, Tim Buckley, is retiring at the end of the year.

Yes. Buckley’s retirement is a surprise—he is only 54 years old, and this is his seventh year in the CEO seat. But if you consider that he’s been at the firm for over three decades, led the firm through COVID and has been pulling down tens of millions of dollars in compensation … well, who can blame him?

For the record, I don’t know the “real reason” behind his retirement, and I doubt we ever will.

I’m (still) scratching my head over why Vanguard announced the news now, considering they aren’t ready to name his successor. The end of the year is ten months off. Why not just wait three months, use the time to find Buckley’s replacement, and then make a comprehensive announcement?

My best guess is that Vanguard wants to control the narrative and avoid risking rumors or leaks while evaluating “both internal and external candidates.” But still, by only announcing Buckley’s retirement, Vanguard has cast us into a world of uncertainty.

We simply don’t know who will lead our $8 trillion asset manager (Vanguard) next year. That’s an unusual situation.

I would be surprised if this is the last we hear from Tim Buckley. Buckley’s predecessor, Bill McNabb, sits on the board of Vanilla—an estate planning software company that Vanguard recently partnered with—see here.

Also, Buckley's predecessor in the CIO role, Gus Sauter, was just appointed to Finra’s (the regulatory body) board of governors.

So, assuming no skeletons emerge from Buckley’s closet, I suspect we’ll hear from him again.

Our Portfolios

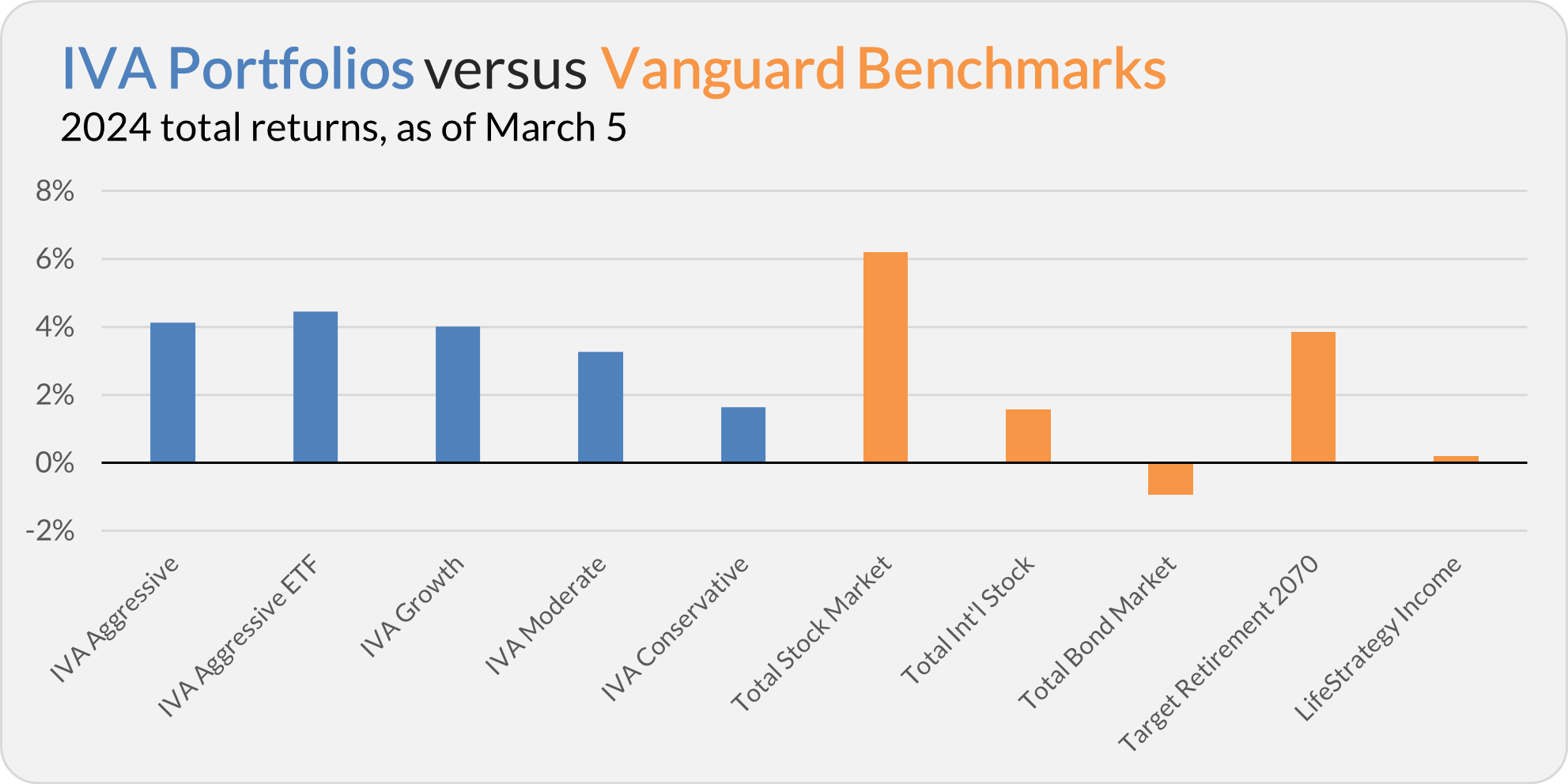

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 4.1%, the Aggressive ETF Portfolio is up 4.5%, the Growth Portfolio is up 4.0%, the Moderate Portfolio is up 3.3% and the Conservative Portfolio is up 1.6%.

This compares to a 6.2% return for Total Stock Market Index (VTSAX), a 1.6% gain for Total International Stock Index (VTIAX), and a 0.9% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.2%.

IVA Research

Yesterday, in Cash for the Long Run?, I analyzed data stretching back over 100 years to answer the question: Does cash belong in your investment portfolio?

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

UPDATE: I incorrectly identified Gus Satuer as McNabb's predecessor. Sauter was never Vanguard's CEO ... he preceded Buckley in the CIO role.