Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 27.

There are no changes recommended for any of our Portfolios.

Maybe it’s just because it's an election year, but I am reminded of this well-worn Wall Street quote:

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

The line is often attributed to Benjamin Graham, Warren Buffett’s mentor and author of one of the most widely read investment books, The Intelligent Investor. While Graham certainly laid out the framework for the quote, it’s debated whether he said it so succinctly. I pulled it from Buffett’s 1987 annual shareholder letter.

Whether Graham said it just that way or not doesn’t matter. What matters is how succinctly it defines the stock market and the stocks that make it up.

It’s a tidy way of saying that a stock can be “irrationally priced” on any given day as sentiment and expectations drive buying and selling. But it’s a company’s fundamentals (think earnings, profits, and dividends) that win out over the long haul.

I can think of no better contemporary example of the market acting as a voting machine right now than the stock of Trump Media & Technology Group (TM&TG, the parent company of Truth Social).

TM&TG was a private company until yesterday when it was acquired by Digital World Acquisition Corp—a SPAC. Without getting into the weeds; a SPAC is a blank check company with publicly-traded stock looking to buy a private company—it’s an alternative method for a private company to “go public” instead of doing an initial public offering (or IPO). While the original SPAC traded under the ticker DWAC, the combined entity now uses the ticker DJT, Donald Trump’s initials.

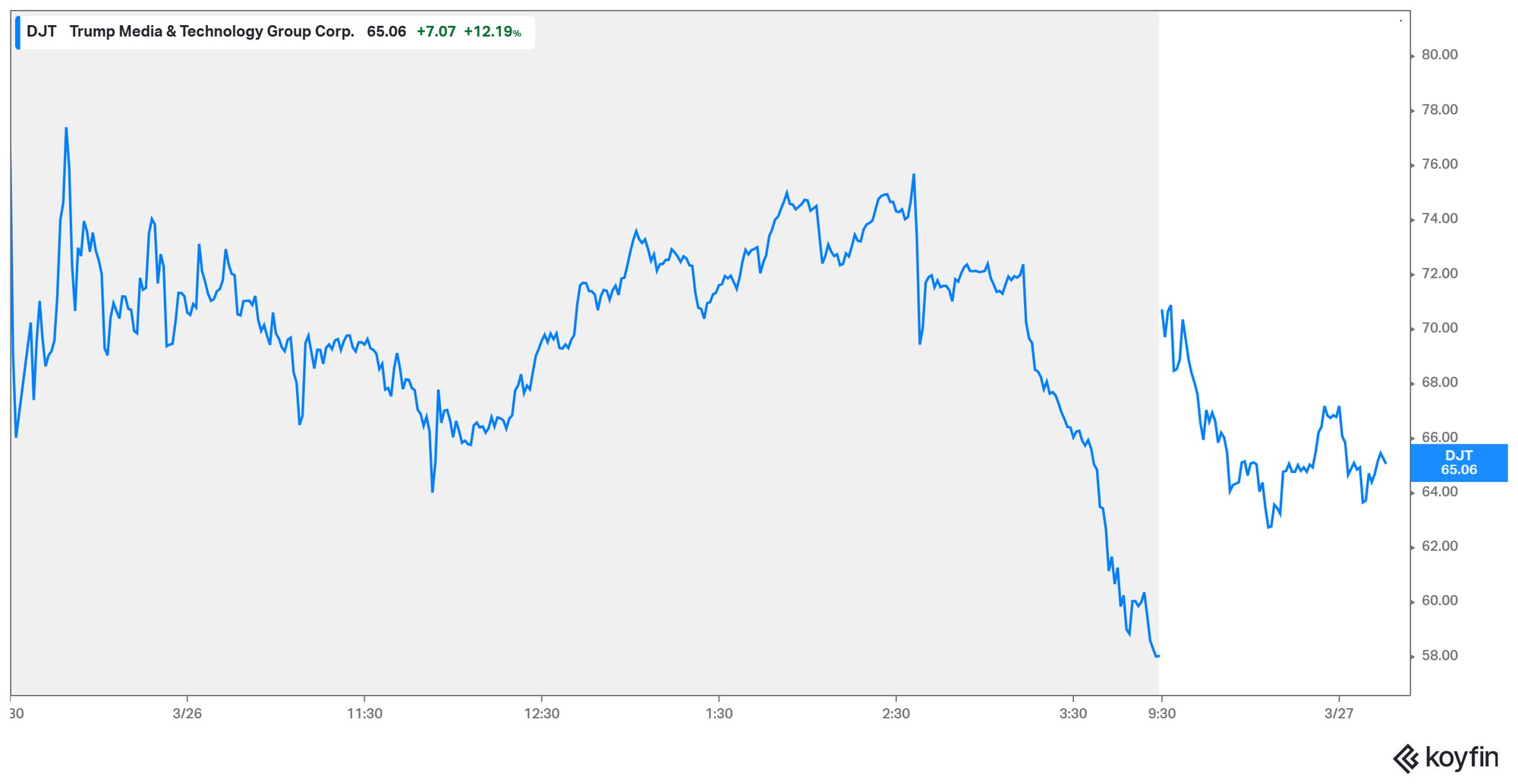

Just before the deal closed (on Monday), the SPAC’s stock was trading at $49.95 per share. On Tuesday, the stock opened 42% higher at $70.90. DJT traded as high as $79.38 before ending the day at $57.99 (or 16% higher than Monday’s closing price). On Wednesday morning (while I’m writing this), the stock traded between $71 and $62.

That’s what I would call severe volatility! It also means the company’s size (its market capitalization) is currently around $8 billion to $9.5 billion.

Consider that the company reportedly earned $3.4 million in revenue in the first nine months of 2023 while losing $49 million. So, a company that is running at about a $5 million per year run rate is being valued in the market at something north of $8 billion.

Consider that Twitter’s (now X’s) market capitalization toward the end of 2023 was in the $12 billion to $19 billion ballpark. (The X platform is no longer public, so it’s hard to pinpoint the company's exact market capitalization. A tip of my hat to Allan Sloan for his reporting on the topic.) To put the size of the Truth Social and X platforms into perspective, Trump has nearly 7 million followers on Truth Social but over 87 million followers on X. And, to bring it back to sales, X's revenues run in the billions, not millions.

One is a public company, and the other is private, so it's not exactly an apples-to-apples comparison. But still, something is not right. Either X is now worth a whole lot more than the $12—$19 billion ballpark, or DJT is a prime case of irrational exuberance.

I’ll be watching DJT with great fascination … from the sidelines. It’s always possible that Truth Social could grow to justify today’s lofty valuation. Time—and the weighing machine—will tell. But for now, the voting machine is up and running.

Municipal Money Market Yields Settle

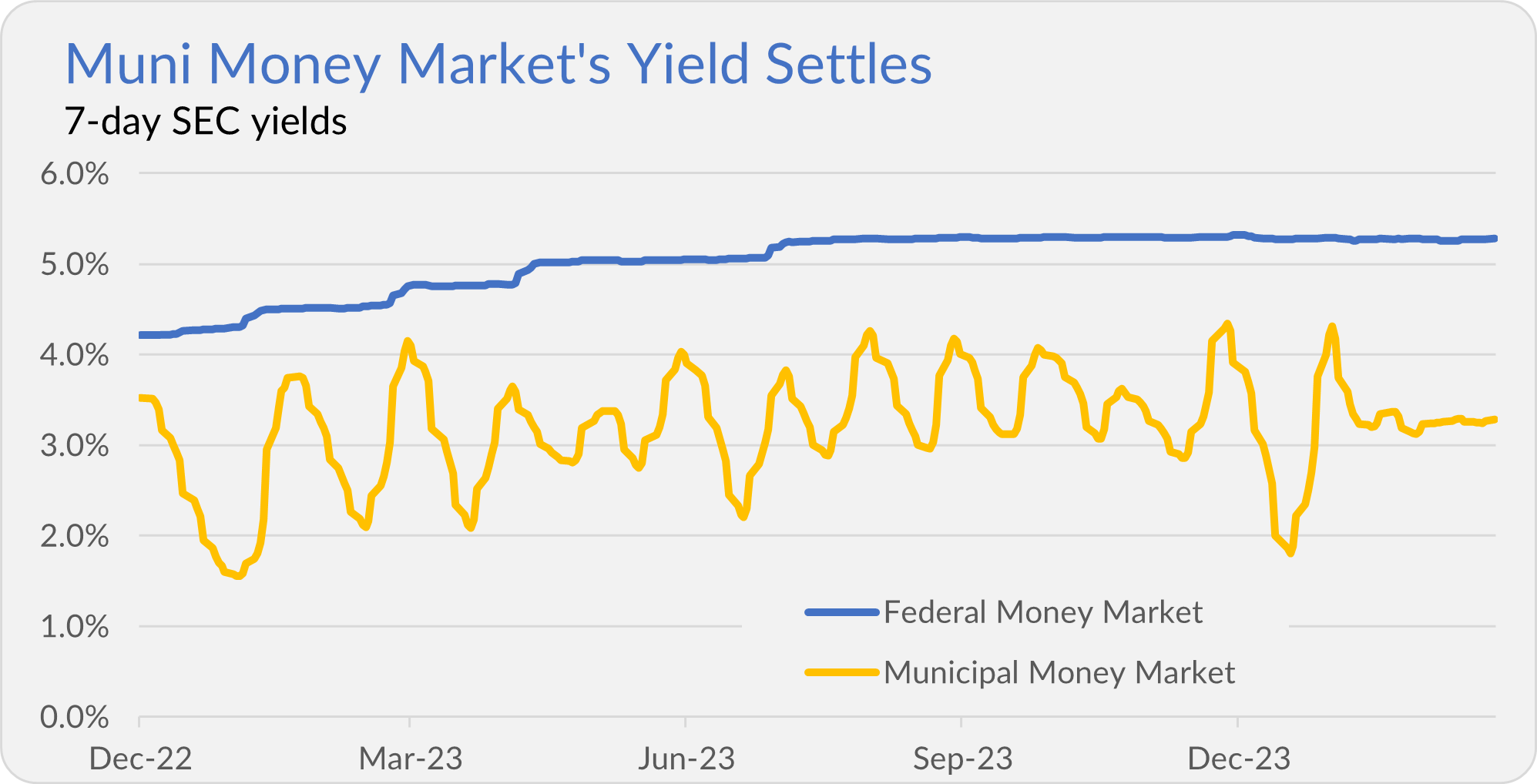

In January (here and here), I showed you how Municipal Money Market’s (VMSXX) yield had been on a rollercoaster ride. I cautioned against chasing those yields at the time, as I expected the ride to end. In particular, I said:

All things equal, given Federal Money Market’s 5.3% yield, I’d expect Municipal Money Market to yield around 3.4%.

I may have been a little too optimistic with that 3.4% prediction, but Municipal Money Market’s yield has settled down. In March, the tax-exempt money market’s yield ranged from 3.23% to 3.31%. As you can see in the chart, Municipal Money Market’s yield hasn’t been this stable for this long for more than a year.

The tax-exempt cash market looks attractive for investors in the top two tax brackets. For example, a yield of 3.25% for the municipal fund translates into a taxable yield of 5.49% for investors in the top tax bracket.

Given all the noise investors will have to contend with this year, removing some noise from Municipal Money Market’s yield is welcome.

IRA Reminder

With April 15 fast approaching, I have taxes on my mind. In the month ahead, I’ll share a series of articles analyzing the after-tax returns and tax efficiency of Vanguard’s funds with Premium Members. Stay tuned!

That said, I wanted to issue a reminder: If you haven’t maxed out your 2023 retirement contributions, you have until April 15 to do so. You can find the contribution limits for 2023 and 2024 here.

And if you have a teenager in your life who worked a summer job last year and whose income was reported to the IRS, you also have a few weeks remaining to fund a Roth IRA for them. See here.

IVA On Air

In case you missed my note on Friday, I was talking all things Vanguard with Sumit Roy and Jeff Benjamin on ETF.com's Exchange Traded Fridays podcast last week. You can find our 20-minute conversation about Vanguard’s future without Tim Buckley wherever you listen to podcasts. Or you can use the link below:

https://www.etf.com/sections/podcasts/whats-next-vanguard-after-buckleys-sudden-exit

Our Portfolios

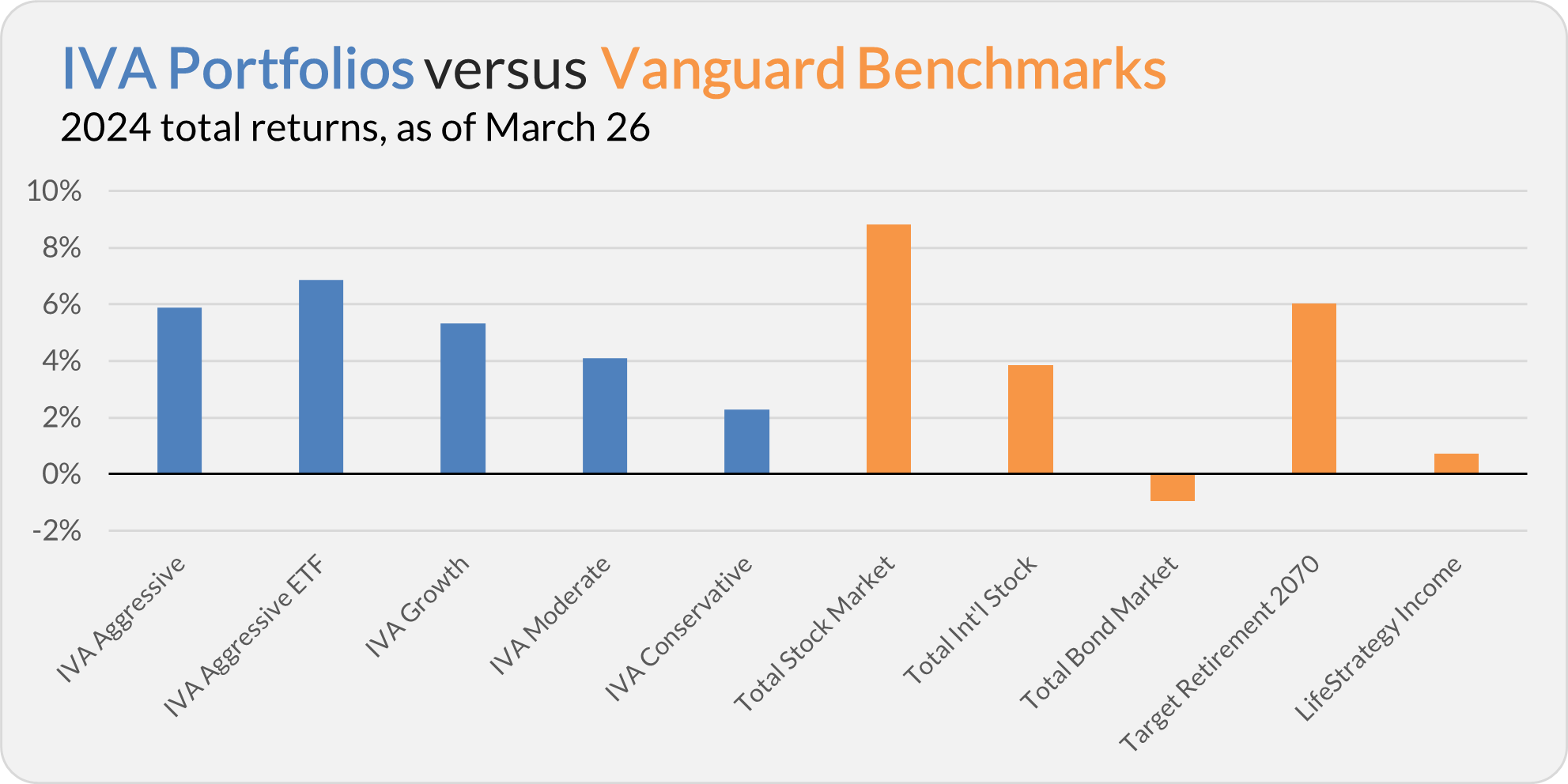

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.9%, the Aggressive ETF Portfolio is up 6.9%, the Growth Portfolio is up 5.3%, the Moderate Portfolio is up 4.1% and the Conservative Portfolio is up 2.3%.

This compares to an 8.8% gain for Total Stock Market Index (VTSAX), a 3.8% return for Total International Stock Index (VTIAX), and a 1.0% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.7%.

IVA Research

Yesterday, in Vanguard’s Toolkit for College Savers, I dug into The Vanguard 529 Plan. This was part two of my three-part series on 529 plans available for Premium Members. I covered the basics in part one. Next week, I’ll wrap things up by sharing my take on investing for college.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.