Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 19.

There are no changes recommended for any of our Portfolios.

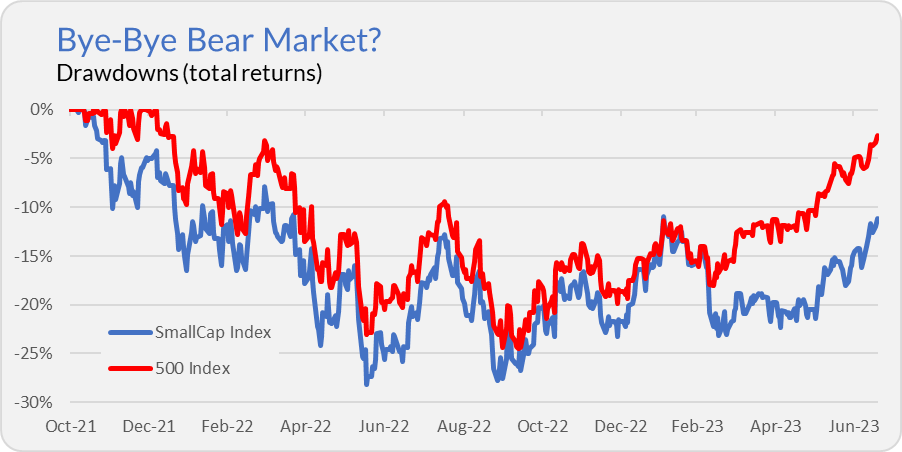

The bear market is almost over … or the S&P 500 index is approaching a record high. Smaller stocks still have some ground to cover to reach new highs.

The S&P 500 index, as of Tuesday night, was just 5.0% below its January 3, 2022 record high. But include dividends (which you really should), and 500 Index (VFIAX) was just 2.7% below its previous high.

Of course, there’s nothing exceptional about reaching a new high. In this case, investors will have recouped their losses from the recent bear market. But it doesn’t change the fact that the next day stocks can either go on to reach a new record or drop back below that high-water mark.

And, as I said, that’s the S&P 500—smaller stocks aren’t out of the woods yet. SmallCap Index (VSMAX) is still more than 10% below its record high set in October 2021.

Don't get caught up in the hype when the S&P 500 index hits a new record—which could be in the next few days or months. Not only are new highs a lousy reason to sell your stocks but there’s also more to the stock market than just the 500 stocks in S&P’s flagship index.

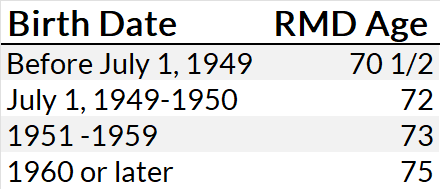

75 is the new 70

Yesterday, in Gifting Your Teen an IRA, I said you must take distributions out of traditional IRAs at age 70½. Thanks to the Secure Act 2.0, that’s not necessarily the case—when you begin taking required minimum distributions (RMDs) depends on when you were born. As you can see in the table below, today’s teens won’t be required to take a distribution until they turn 75.

The Secure Act 2.0 is a sprawling bill that tweaks many retirement savings rules. For another example, the regulations around catch-up contributions into 401(k) accounts are changing.

Catch-up contributions are extra dollars beyond the regular limits that savers over 50 can add to various retirement accounts—the catch-up limit for 401(k) accounts this year is $7,500. I wrote to Premium Members about the regular and catch-up contribution limits for 2023 in January—something I do every year.

Technically, due to a “drafting error,” the bill prohibits all catch-up contributions next year. But that was a mistake—one I expect lawmakers to correct. However, an intentional change to the catch-up rules is that starting in 2024, high earners (those with over $145,000 in income) will have to put their 401(k) catch-up contributions into Roth accounts.

Yes, if you’re a higher earner over 50 making catch-up contributions, you’ll be taxed on those contributions next year. The plus side is that you’ll be able to funnel a little more money into Roth accounts—. Also, to be clear, this only applies to 401(k) accounts, not IRAs.

Companies and 401(k) administrators are pushing back on the rule—seeking more time to adjust to the change. So, we’ll see where things stand come 2024. I’ll keep an eye out and update Premium Members early next year.

Not Just a Vanguard Issue

Last week, I wrote to you about receiving nearly 30 duplicate emails alerting me to the availability of the latest PRIMECAP Odysseysemiannual report. The issue was not with Vanguard, as several subscribers reported receiving duplicate emails from Fidelity.

So, the issue was either with PRIMECAP or somewhere else in the plumbing—not Vanguard. That’s a relief … but it doesn’t mean all is right with Vanguard’s tech and service.

For example, this week, I heard from a subscriber who had previously frozen their Vanguard accounts (to prevent unauthorized withdrawals). For the past two months, he’s been trying (unsuccessfully) to unfreeze the funds and access his money. The latest attempt involved a 30-minute phone call that disconnected … Vanguard didn’t call back.

Vanguard isn’t always at fault, but Vanguard can and should provide better service, as I said last week.

Our Portfolios

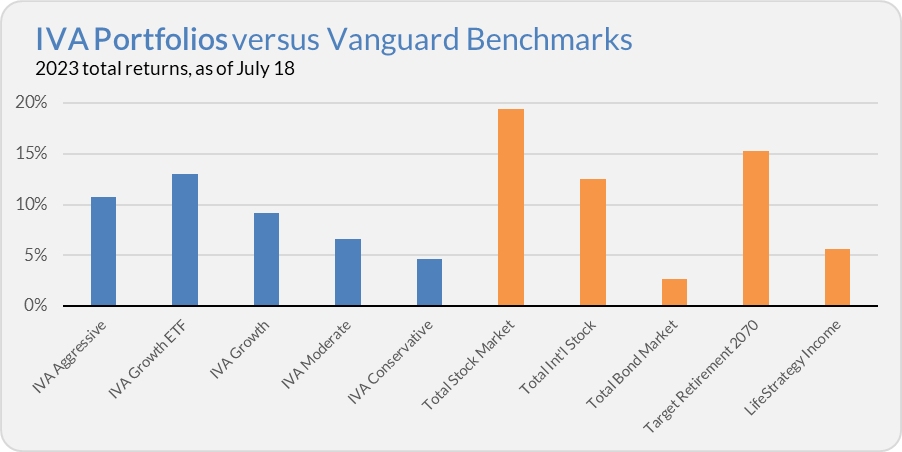

Our Portfolios are showing positive but lagging returns for the year through Tuesday. The Aggressive Portfolio is up 10.8%, the Growth ETF Portfolio is up 13.0%, the Growth Portfolio is up 9.2%, the Moderate Portfolio is up 6.6% and the Conservative Portfolio is up 4.7%.

This compares to a 19.4% return for Total Stock Market Index (VTSAX), a 12.5% gain for Total International Stock Index (VTIAX), and a 2.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.6% for the year.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.