Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, September 13.

There are no changes recommended for any of our Portfolios.

Is 4% the New Normal?

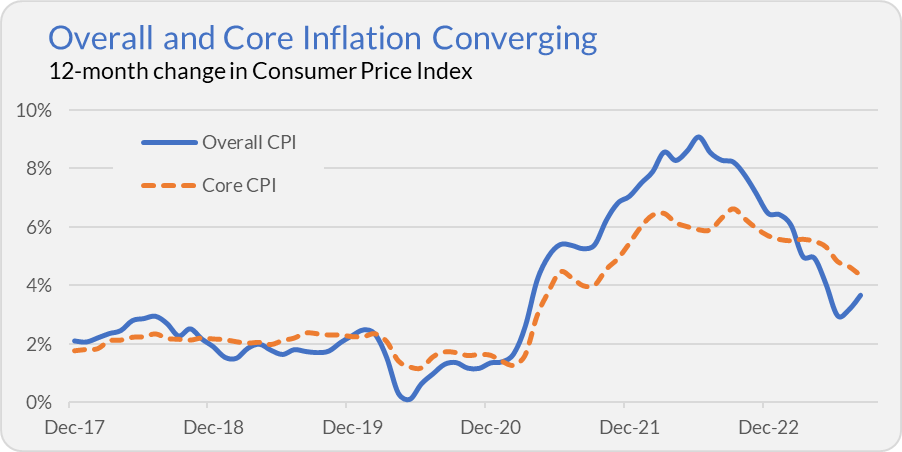

Inflation is blowing up again—at least in the media. Thanks to higher prices at the pump, the consumer price index (CPI) increased 0.6% in August—the biggest one-month jump in a year–putting prices up 3.7% overall over the past 12 months. If you strip out the particularly volatile food and energy costs (yielding what’s known as core inflation), prices rose 4.3%. This tells us that inflation trends are still relatively high.

As you can see in the chart below, overall inflation fell faster than core inflation between June 2022 and June 2023. Since then, overall inflation has ticked higher while core inflation continued to fall. They appear to be converging around the 4% level.

Federal Reserve Chair Jerome Powell and his colleagues say they want 2% inflation over time. The question is: How hard will they push to get from 4% to 2%?

My best guess is that Fed policymakers sit tight for the time being. As I’ve shown you, the Fed hasn’t been this aggressive in fighting inflation in three decades. Since it takes a while for monetary policy to have an impact, it is time to sit and watch what happens. With a soft landing in the cards, I expect Powell and company to tread lightly.

What does this mean for money market and bond funds? In short, it means the big rise in yields (and big drop in prices) is likely behind us. I showed you a few weeks ago how investors are earning a 2% real yield (after inflation) with Inflation-Protected Securities (VIPSX) for the first time in over a decade. But it’s not just inflation bonds that offer a more compelling yield today.

Federal Money Market (VMFXX), Vanguard’s default settlement fund, yields 5.27%. Short-Term Investment-Grade (VFSTX) and Intermediate-Term Investment-Grade (VFICX), the two bond funds I currently utilize in the Portfolios, yield 5.34% and 5.41%, respectively.

As I’ve said before, it’s been difficult getting to this point, but now that we are here—finally earning a decent yield—well, now isn’t the time to give up on bonds.

Pausing Operations

Congress returned to Washington after the Labor Day weekend, but will they go to work?

They have just ten working days to pass the dozen bills needed to fund the government. If they don’t pass those bills (or a stop-gap “continuing resolution”), the federal government will shut down—pause—certain operations. (I can hear you sighing and asking why this has to keep happening. I hear you. Too bad Congress doesn’t.)

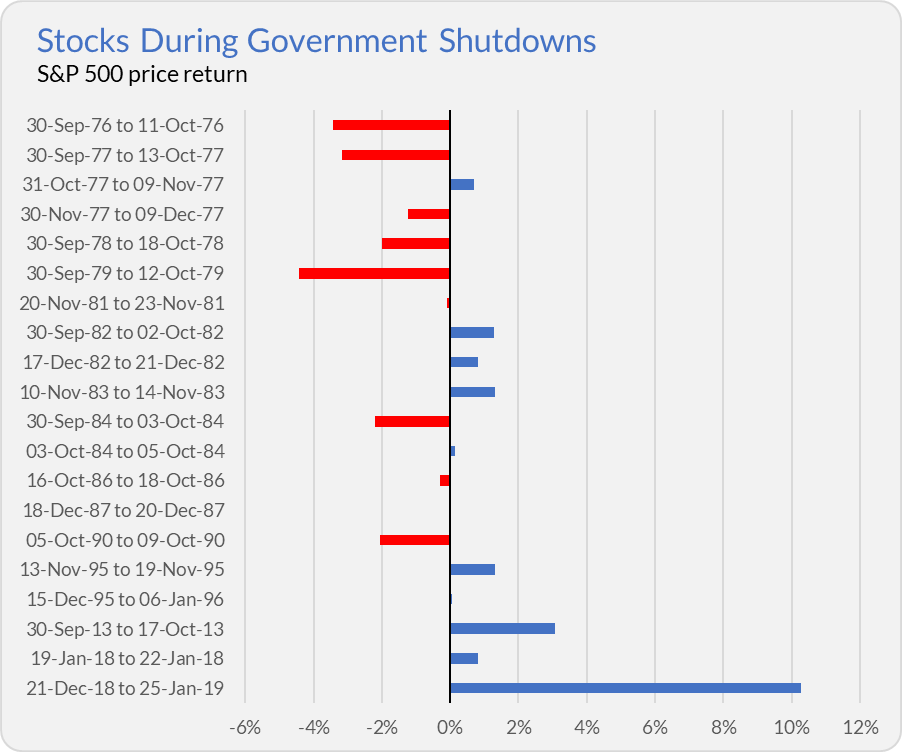

A government shutdown sounds like bad news—and you can bet the fear-mongers will be out in force warning of an impending disaster. While I wouldn’t say a shutdown is “good,” recognize that we’ve survived multiple shutdowns. And, for investors, a government shutdown has been more or less a non-event.

The government has shut down 20 times since the mid-1970s. During those closures, the S&P 500’s return was microscopically positive, gaining 0.04% on average. If we exclude one outlier—the big 10% return during the 2018-2019 shutdown—the index fell 0.5% on average. However you wish to parse the numbers, the bottom line is that the stock market hasn’t cratered during government shutdowns. In fact, stocks gained ground half of the time.

Stay invested, think long-term, and if the news makes you anxious, turn it off and go for a walk.

Our Portfolios

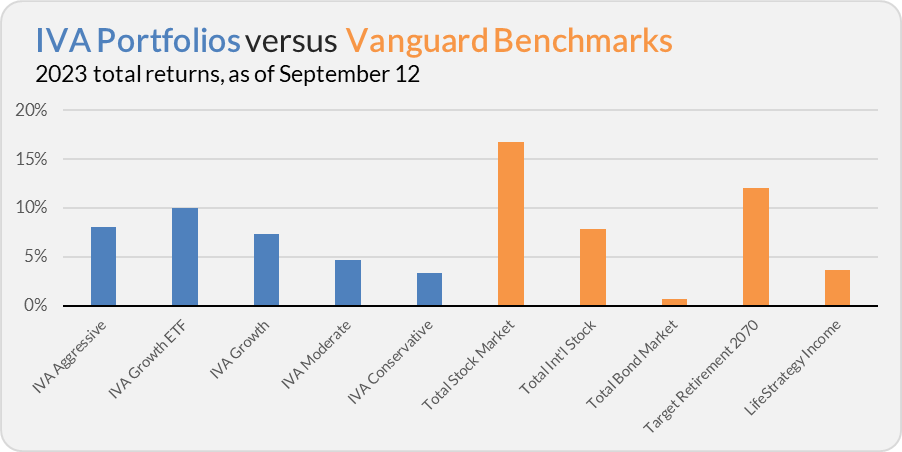

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 8.1%, the Growth ETF Portfolio is up 10.0%, the Growth Portfolio is up 7.3%, the Moderate Portfolio is up 4.7% and the Conservative Portfolio is 3.4%.

This compares to a 16.8% return for Total Stock Market Index (VTSAX), a 7.9% gain for Total International Stock Index (VTIAX), and a 0.7% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 12.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.7% for the year.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.