Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 22.

There are no changes recommended for any of our Portfolios.

And have no fear; if there’s any breaking Vanguard news, I’ll do my best to share it and provide my Quick Take on what it means for you and me as promptly as possible. (I may take a vacation, but I never sleep when it comes to helping you make the most of your Vanguard investments.)

Now, back to our regularly scheduled update …

The stock bull market lives. Last week, the S&P 500 index set a new record—meaning the April pullback of 5.5% (at its worst) was just a bump in the bull market’s road. As I often suggest, it pays to remember that stock markets don’t go up in a straight line. Any time the indexes hit a record, the next day’s moves will result in another record or a “loss” from the high. This is just the natural course of events when it comes to the investment markets.

On Friday, the Dow Jones Industrial Average closed above 40000 for the first time. I don’t mean to be a killjoy, but I note, rather than celebrate, these market milestones. As I told you in February when the S&P 500 index first closed above 5000, big round numbers make for nice headlines but are more a distraction than a relevant measure of value.

The Dow, in particular, is an imperfect index. It’s a relic, made up of just 30 stocks weighted by their price—not their market capitalization (or size). It was developed when doing complex mathematical calculations was, well, too complex for most of the folks on Wall Street. Plus, that 40000 milestone doesn’t include dividends. Add dividends to the mix, and the Dow’s total return index (which only started counting dividends in 1987) crossed 40000 in 2016.

But let’s put those quirks aside. How about the Dow 100,000? Or 1 million?

If the Dow grows at 7% per year—its annual pace of growth since the end of 1945—we’ll see the Dow index break six figures by 2040. If the Dow continues to grow at a 7% annual pace, I’ll see the Dow hit 1,000,000 before my 90th birthday (50 years from now).

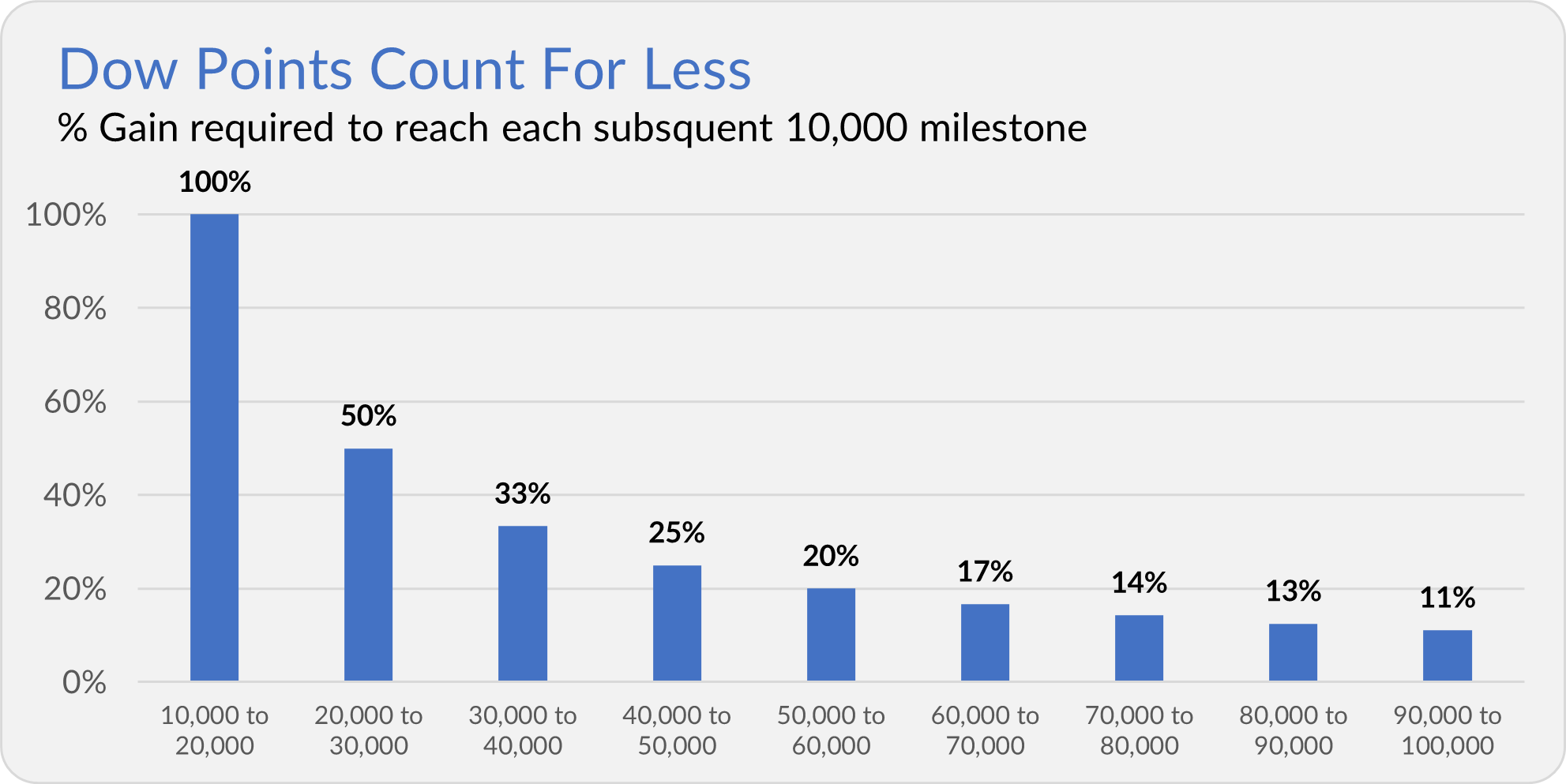

This points up a simple truth that a Dow point just doesn’t count for as much as it used to. The Dow needed a 33% gain to go from 30000 to 40000. It’ll only take a 25% gain for the Dow to reach 50000 from here. 20% on top of that will get us to 60000. And so on.

Index milestones are nice and give headline writers something to play with, but they are pretty much irrelevant to your and my investment success.

Vanguard Is A Target

Willie Sutton, the acclaimed bank robber (and jail escapee), reportedly said that he robbed banks because “that’s where the money is.” Well, scammers and fraudsters increasingly target Vanguard and its customers for the exact same reason.

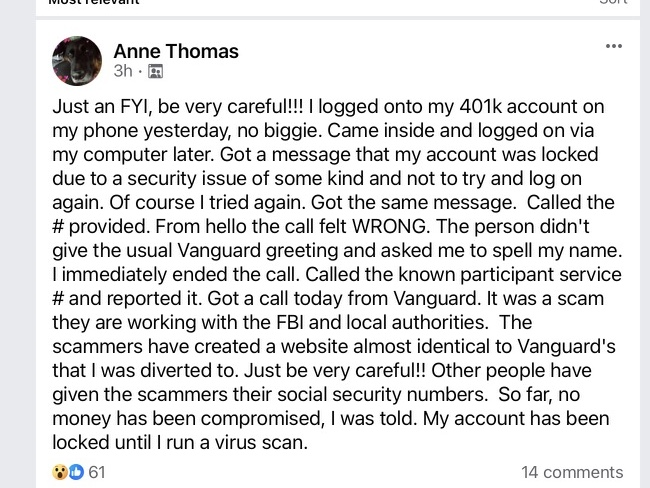

Last week, scammers set up a look-a-like Vanguard website with a bogus 888 phone number. Here is how one member of the Vanguard Crew Past and Present Private Facebook Group described her experience:

Credit Anne for quickly hanging up the phone when something didn’t seem quite right.

Vanguard worked with the authorities to shut down the scam. The phony phone number (888-643-0531) has reportedly been cut off.

To be clear, I think our money is safe at Vanguard.

However, I’m sharing this experience to, well, scare you a little bit. Unfortunately, there are a lot of bad actors out there, and their ruses have become more sophisticated over the years. This isn’t the first time someone has impersonated Vanguard (see here or here or here, for example). It won’t be the last.

So, we need to be on alert. My antennae are always on the lookout for scams when I’m on the web. This is why I initially thought Many Happy Returns was a scam, not an activist campaign.

My advice for keeping your Vanguard account secure is pretty generic:

- Double-check that the URL (the website’s address) looks correct.

- Use strong passwords and consider a password manager.

- Don’t reuse passwords. (That means creating a unique password for every website.)

- Use two-factor authentication.

- Freeze your credit score.

- Keep an eye on your accounts, and if you see any unexpected activity, act quickly.

Oh. And be like Anne. If something (a phone call, website, email) seems off, don’t stick around, don’t click buttons, or share your information. Log off.

I’d rather risk being rude to a Vanguard phone rep (sorry) than share my personal details with a scammer. You can always call Vanguard back and apologize!

Be safe out there.

Better Search

A quick housekeeping note: I’ve launched a new and improved search tool on the IVA website this week. The new search is more comprehensive and will help you find topics and funds we’ve covered more quickly than before.

Please feel free to email my team at support@independentvanguardadviser.com with any feedback about the search, website and newsletter. We are always looking to improve The IVA.

Our Portfolios

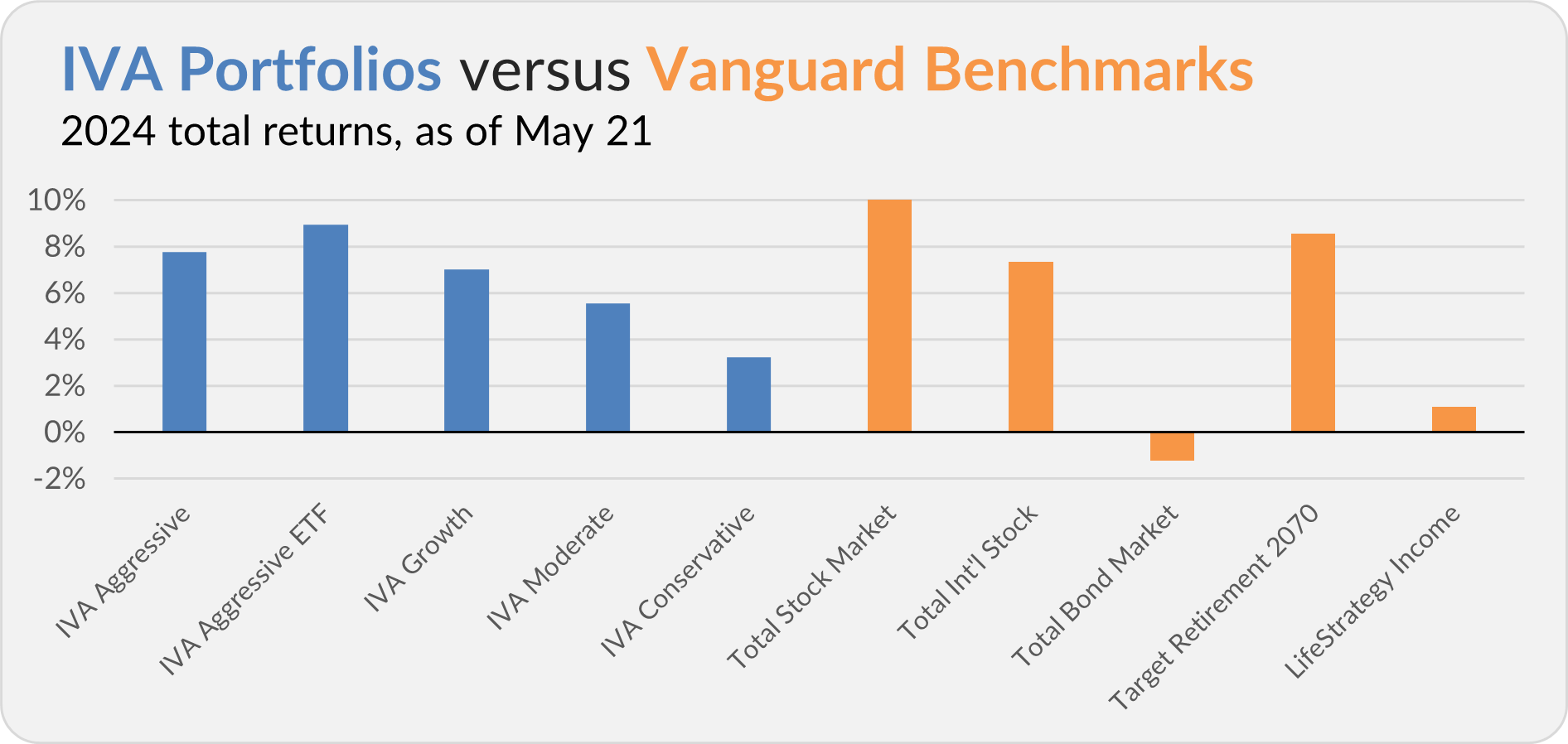

Our Portfolios are showing decent absolute but lagging total returns for the year through Tuesday. The Aggressive Portfolio is up 7.8%, the Aggressive ETF Portfolio is up 8.9%, the Growth Portfolio is up 7.0%, the Moderate Portfolio is up 5.6% and the Conservative Portfolio is up 3.2%.

This compares to an 11.2% gain for Total Stock Market Index (VTSAX), a 7.3% return for Total International Stock Index (VTIAX), and a 1.2% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 8.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.1%.

IVA Research

Yesterday, in Complex Doesn’t Mean Better, I shared my analysis of Market Neutral (VMNFX) and Commodity Strategy (VCMDX) with Premium Members.

As I mentioned, there won’t be an IVA Weekly Brief next week. However, I’ll try to answer the question of when you should take your RMD for Premium Members. I’ll be back the following week with a full schedule: Monthly Recap (June 3), IVA Research (June 4) and IVA Weekly Brief (June 5).

Until then, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.